By Catherine Austin Fitts

My “go to” website for technical analysis of precious metals, the US dollar & the US stock market is Rambus Chartology, where Rambus (that’s his handle – he’s the founding technical analyst) leads a discussion with extensive charts of what the markets are saying.

In January 2016, Rambus launched his quarterly Solari Report with a Blockbuster Chartology. You can find links to the entire series of quarterly and annual Blockbuster Chartologies at the end of this latest piece.

One of the reasons that Rambus is so good at his craft is that he focuses on “staying on the right side of the major trend.” The challenge of doing so at this time is that it is tempting to look for bottoms or to assume that the trend upwards in the US dollar or stock market may be over. However, Rambus consistently brings us back to the discipline of the Chartology. What does price tell us? As he describes so aptly, we are dealing with psychological warfare.

Sitting back once each quarter to get this perspective offers invaluable insight. So, here we go for the 3rd Quarter 2022 Wrap Up Blockbuster Chartology!

Blockbuster Chartology Quarterly Report

By Rambus

~ 3rd Quarter 2022 Wrap Up ~

PM Complex

US and World Stock Markets

Interest Rates

SPX Bull Market Update

PM Complex

My job is to give you the best unbiased opinion of the markets to the best of my ability. That means my opinion is my opinion and not someone else’s. Opinions are a dime a dozen when it comes to the markets including mine. There are some good analysts and some not so good market analyst which can become very confusing when one tries to read every stock market timer on the planet.

Most investor will gravitate to someone that says what they want to hear to reenforce what they think the markets should be doing. Keeping an open mind can be very hard when so much information is bombarding us each and everyday of our life especially in this day and age. Information overload can cause mental paralysis which can lead to unwanted mistakes.

The most important thing to have when trading the markets, which is the toughest game on the planet to win, is to have a game plan and the discipline to execute it. It all sounds so easy on paper, but in reality it is much harder to do because we are human beings who have survived by following the herd.

The markets are like a casino in Las Vegas, sometimes you win and sometimes you lose, but in the end they will end up with most of your money. In the markets you may get some good trades off, but eventually you will give your profits back and then some until you realize this game we choose to play is much harder than we thought. I’ve said this many times in the past, “we are going up against the greatest traders and trading systems in the world that want every penny you have and won’t feel bad if it is your “LAST PENNY.”

I’m going to focus exclusively on the PM complex tonight and lay out the groundwork for what is possible if one can keep an open mind. There are never any 100% guarantees when it comes to the markets, but if we can get the odds in our favor we have a fighting chance to be successful. When looking at the charts below please keep an open mind.

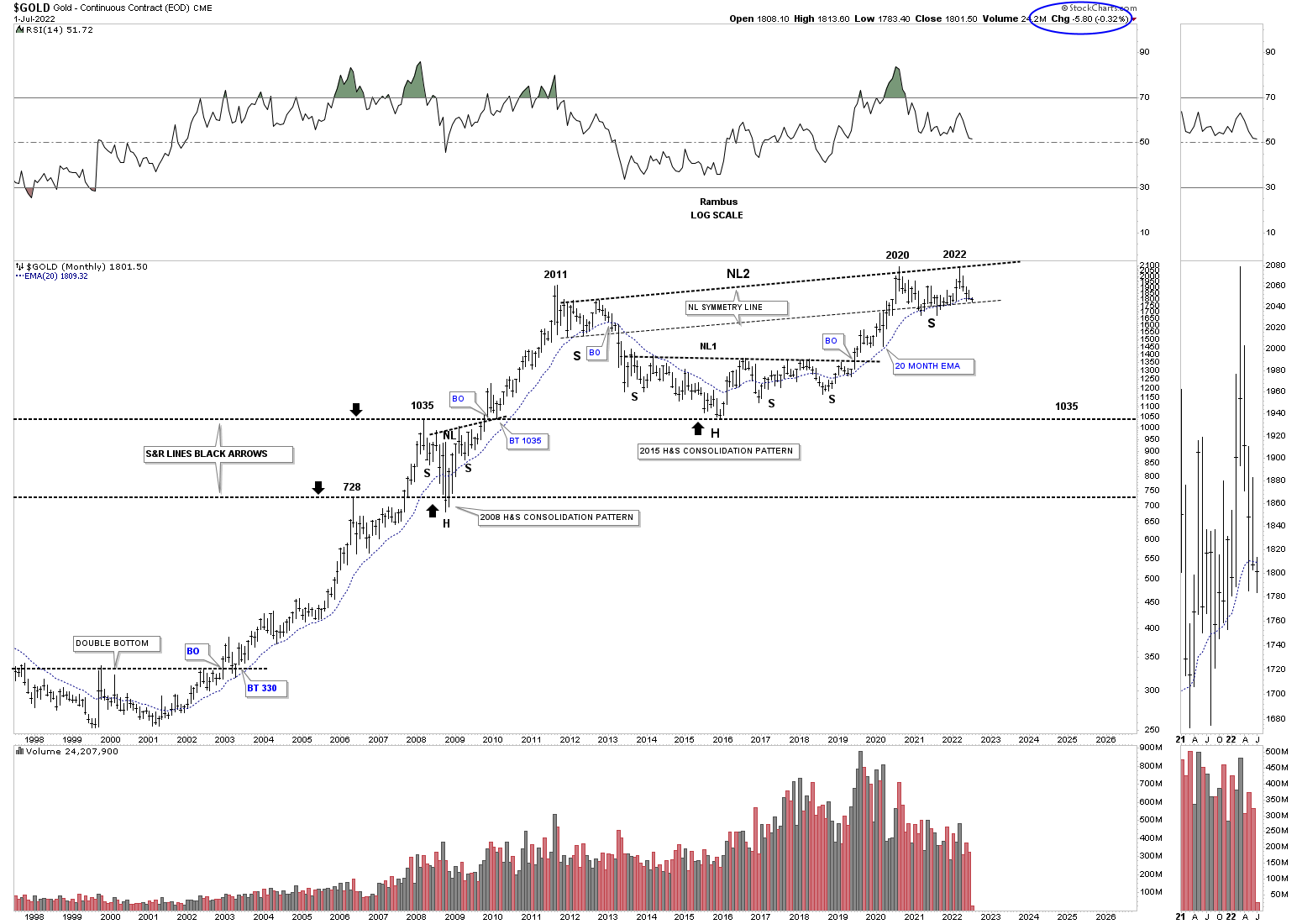

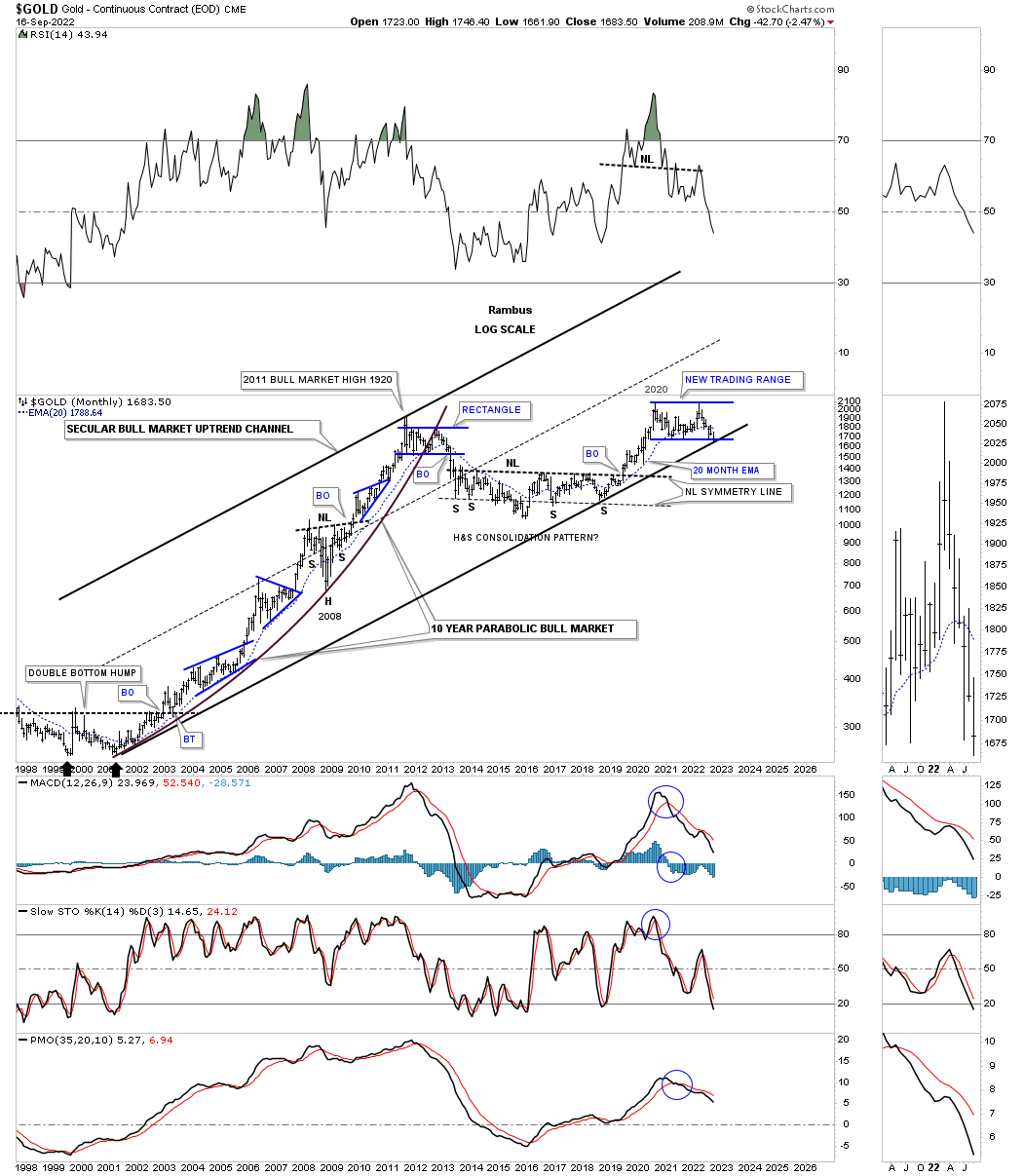

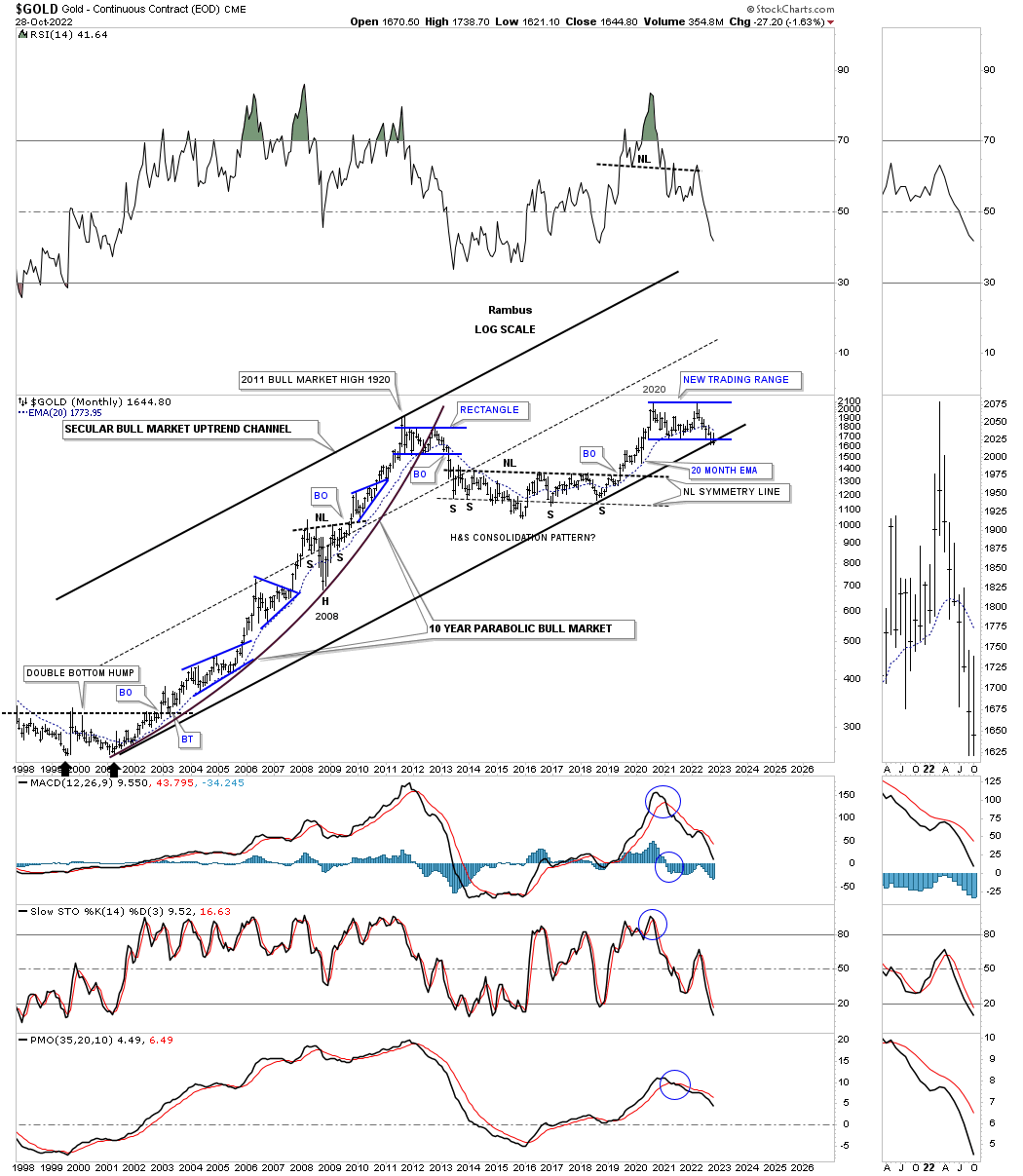

Many of the charts you will see were down loaded last Thursday which was the end of the month and end of the quarter with a few downloaded this weekend. Lets start with the long term monthly chart for Gold which shows the possible double H&S bottom with the right shoulder still under construction. If you look at the thumbnail on the right sidebar you will see that Gold closed the month of June just below the 20 month ema for the first time since neckline1 gave way. It was only by a small margin which doesn’t look that significant, but it was the first time in a couple of years.

The best way to understand the importance of the 20 month ema is to start at the beginning of the bull market back in 2000 by following the price action and the 20 month ema together. The only time that Gold closed below the 20 month ema was during the 2008 crash which ended up being the head of the H&S consolidation pattern and only lasted one month. The very next month Gold closed back above the 20 month ema and stayed above the 20 month ema until the top completed at the 2011 high. It is all about where Gold closes at the end of the month and not what it does during the month. For now this is a warning sign.

Gold July 4th.

September 18th:

Gold is clearly trading below the 10 and 20 month ema’s and is trading below its neckline symmetry line.

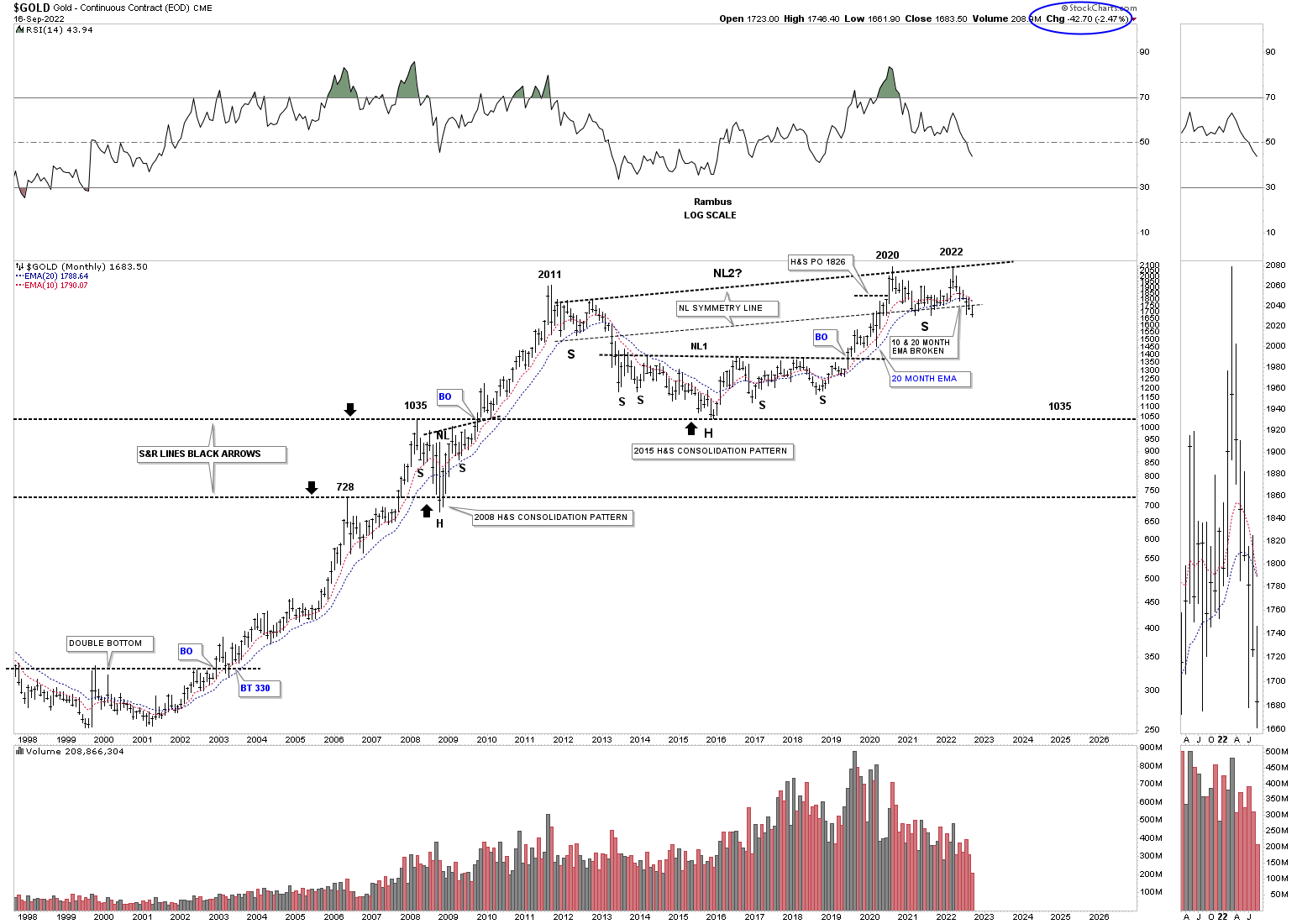

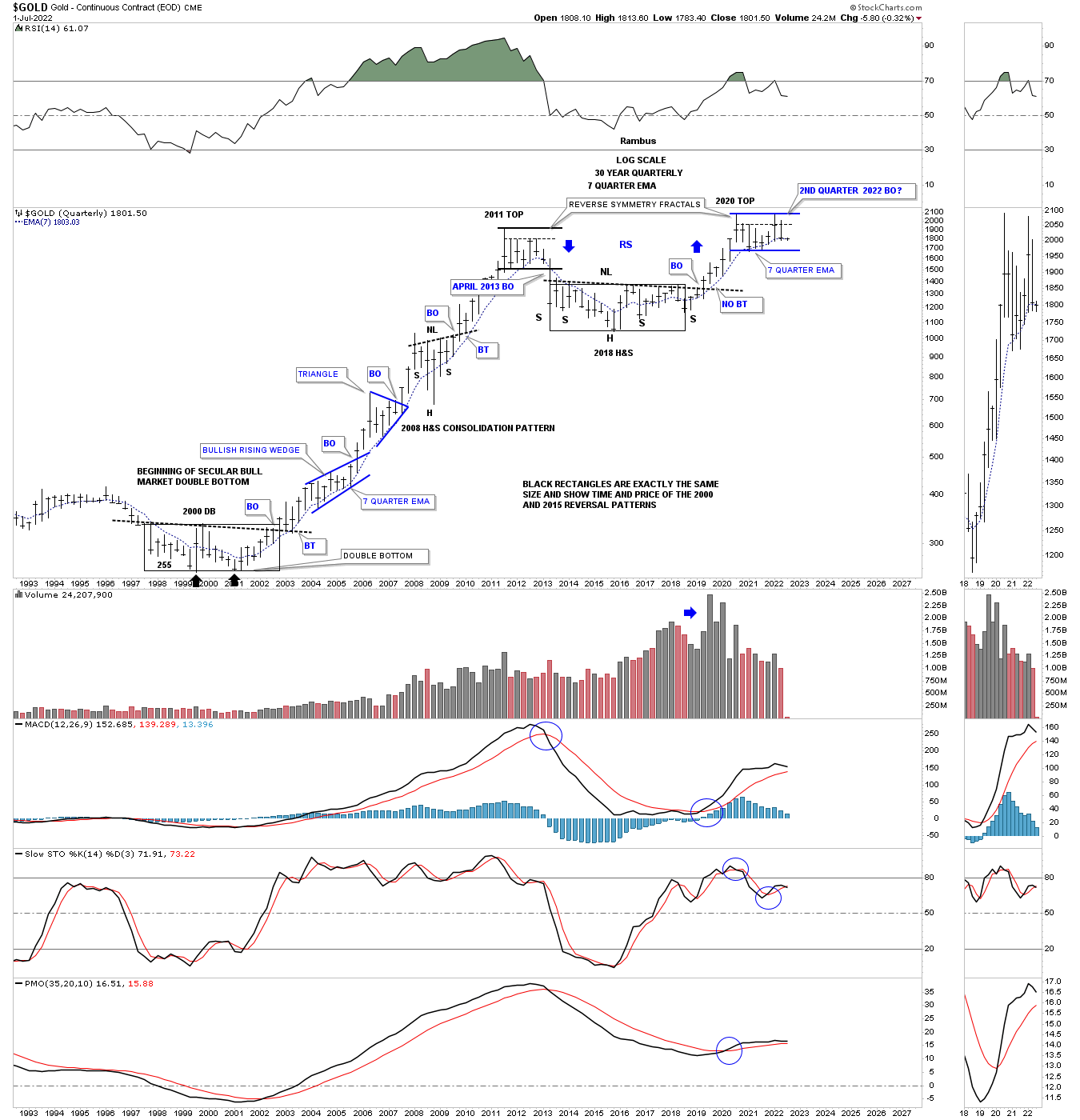

July 4th:

Next is the Gold fractal chart which shows the 2011 and 2020 trading ranges which are very similar in time and price. It is not the end of the world, but Gold was supposed to breakout one way or the other at the end of June and didn’t, calling the fractal into question. Again, it is not the end of the world just a warning sign.

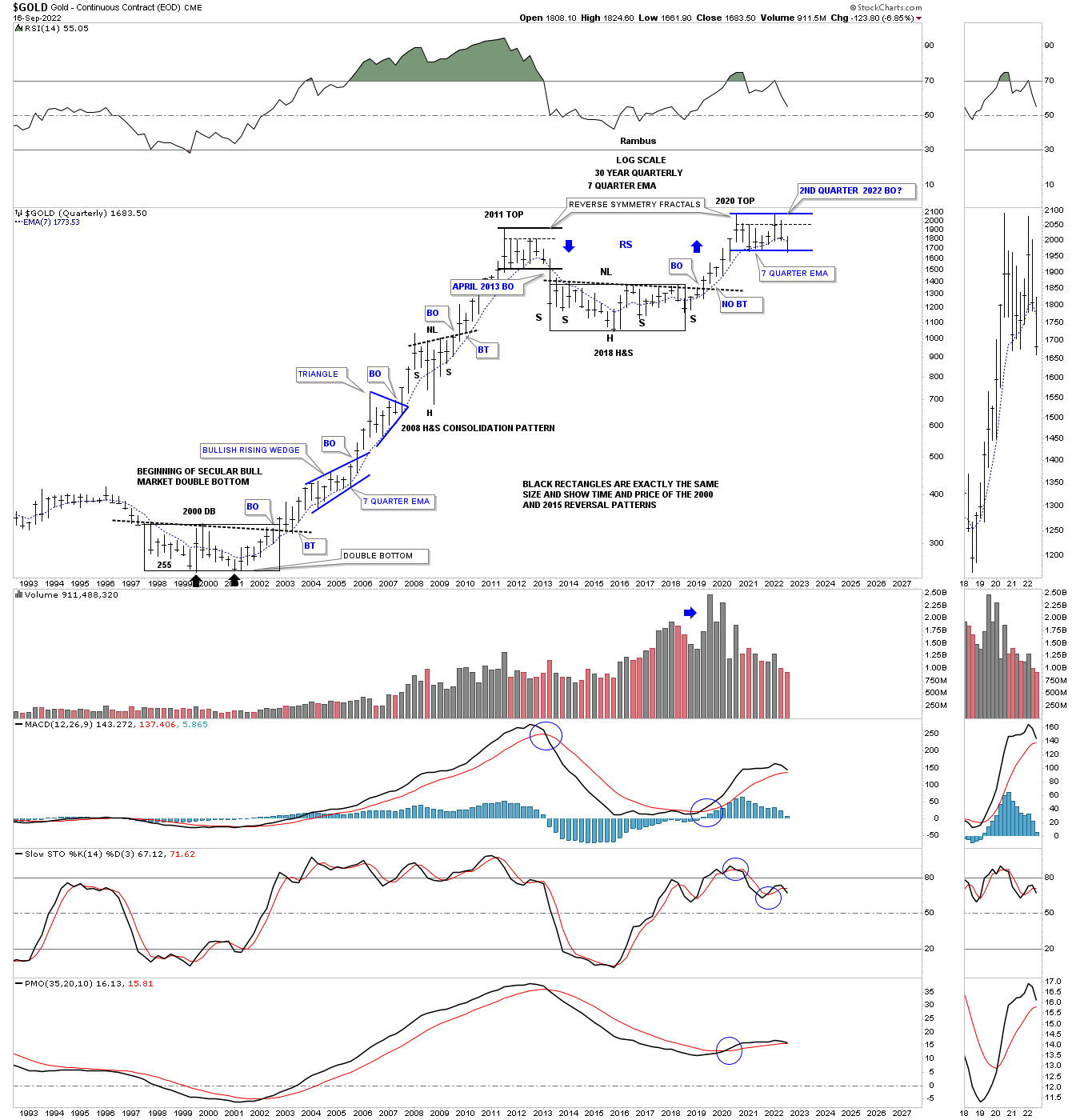

September 18th:

Gold is now testing the bottom rail of its 2020 trading range and is trading below the 7 quarter ema.

July 4th:

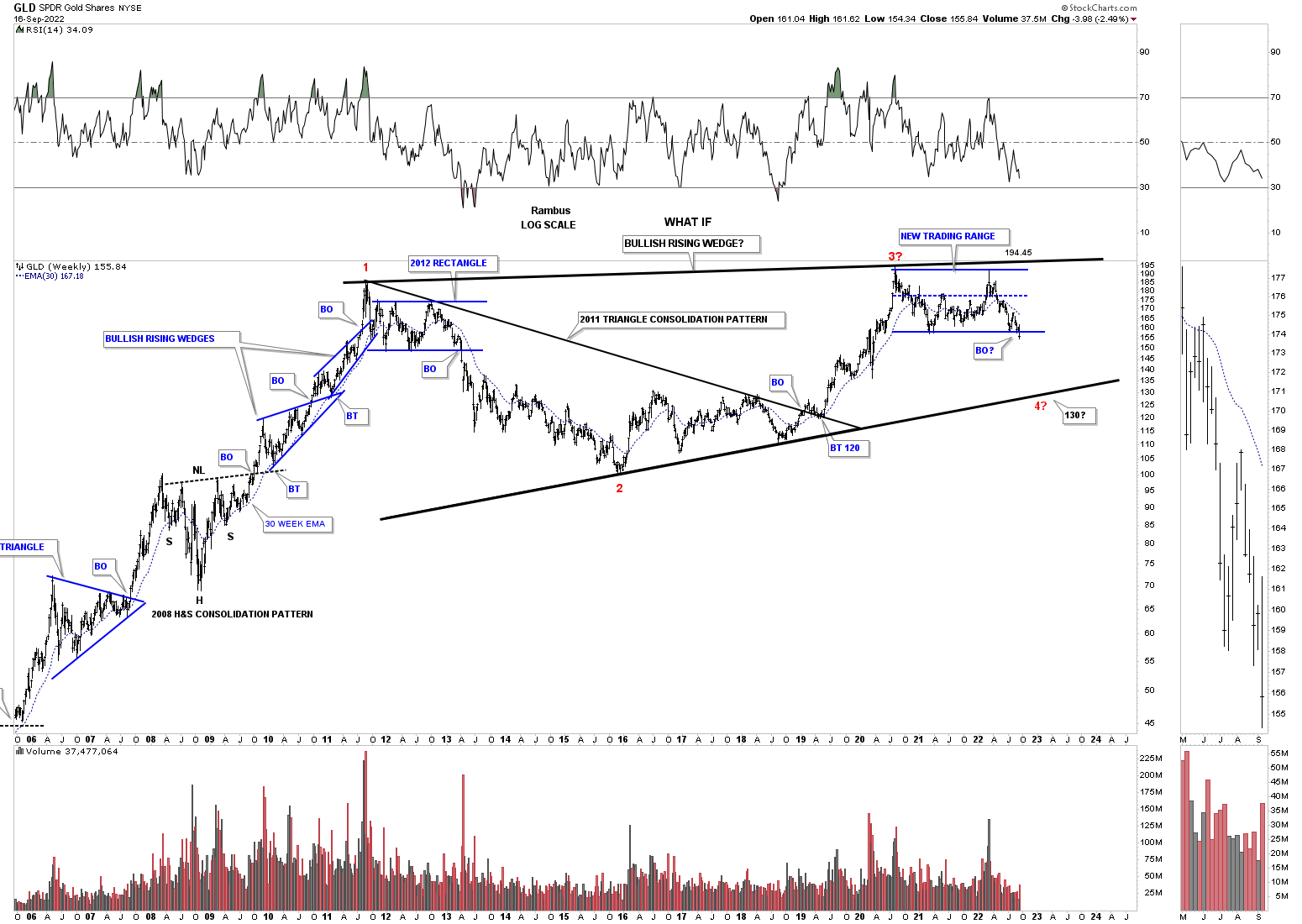

Keeping an open mind this weekly chart shows how Gold could still be in a bull market, but could have one more leg down to the bottom rail of a very large rising wedge formation that began forming at the 2011 high. Currently Gold is in no mans land offering no low risk entry point from this long term perspective.

September 18th:

GLD is now strongly testing the bottom rail of its 2020 trading range.

July 4th:

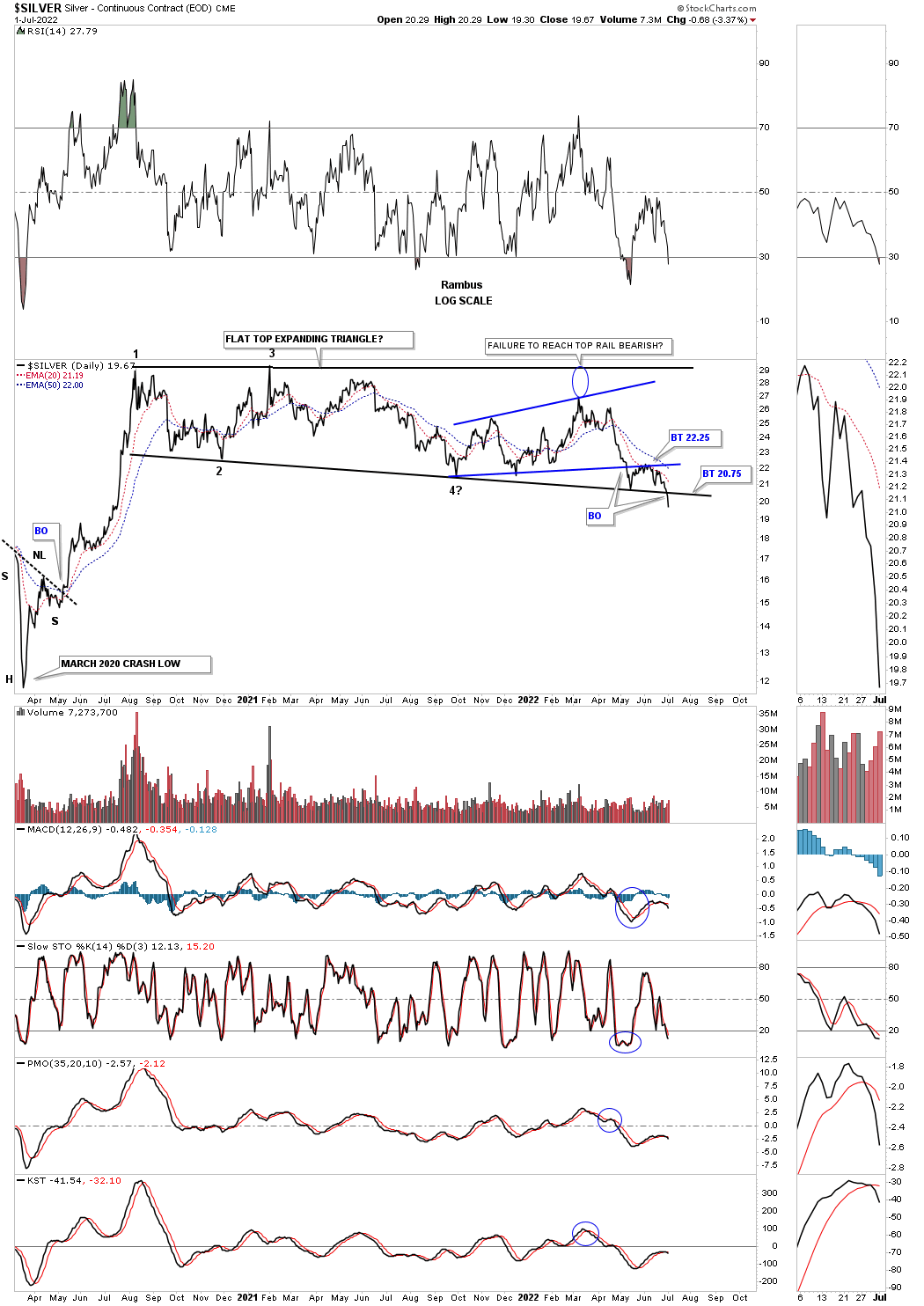

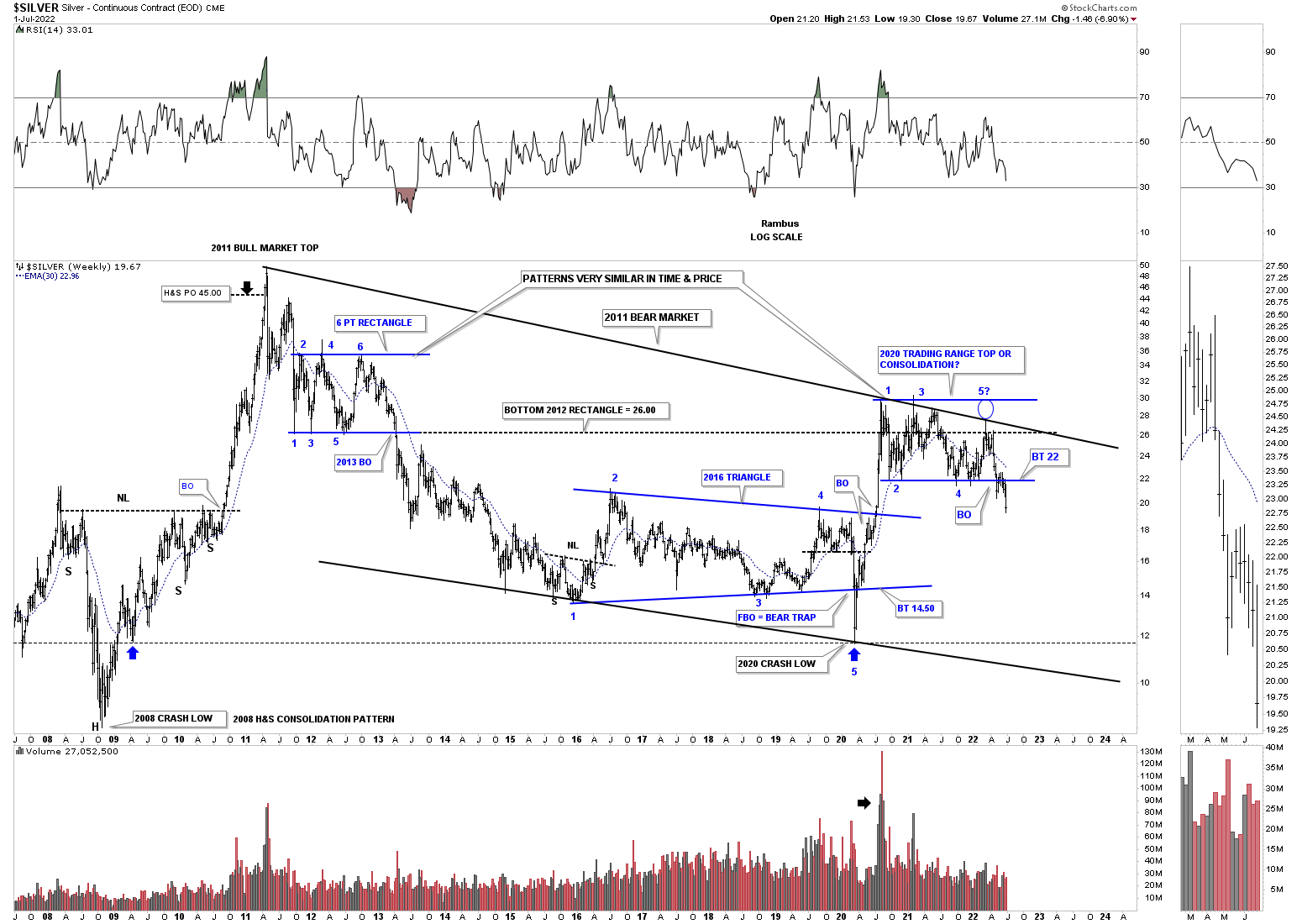

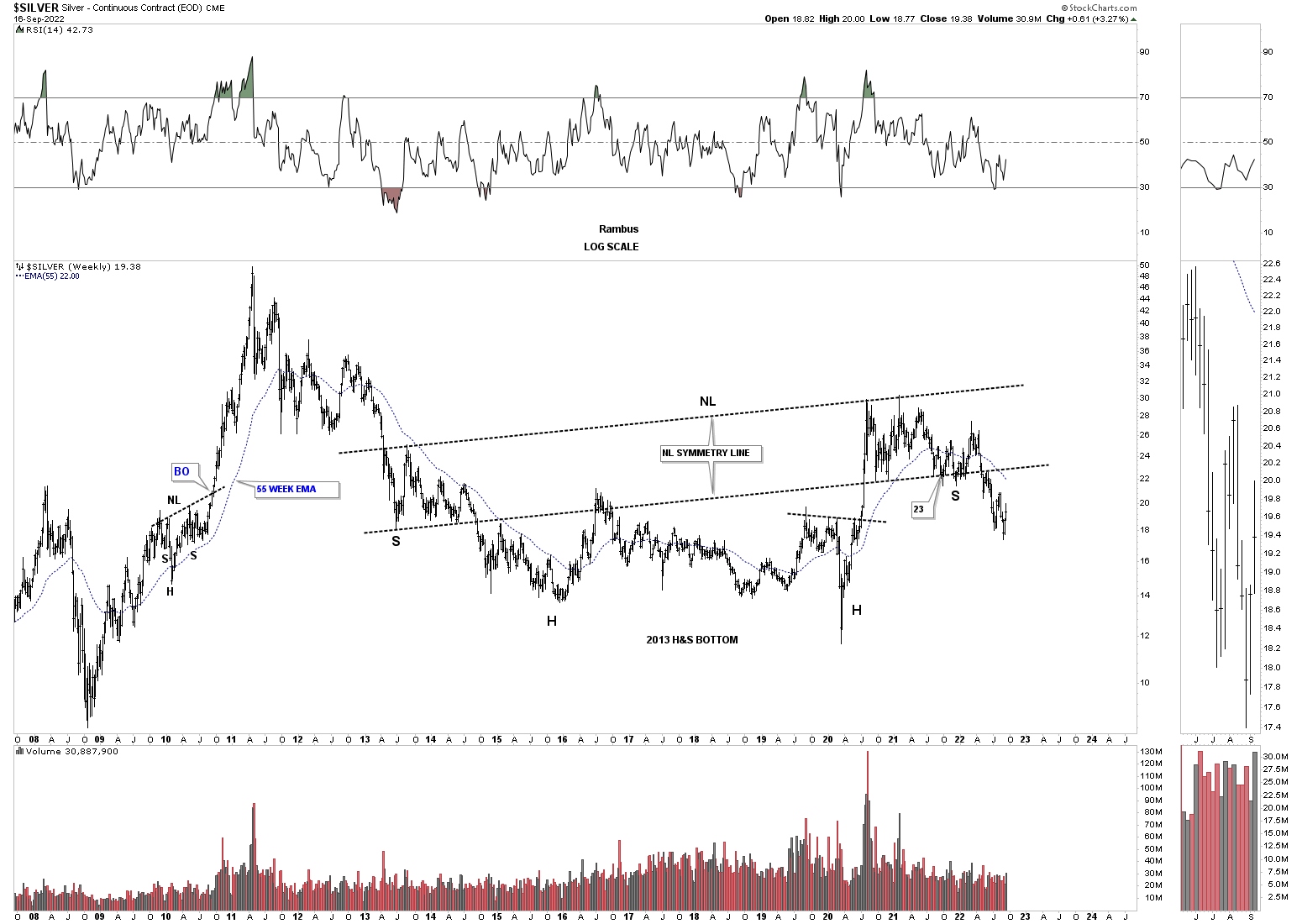

Lets move on to Silver which we know has been one of the laggards in the PM complex. After topping out in 2020 like everything else in the PM complex Silver has formed a flat top expanding triangle which gave way to the downside last week. Before breaking the bottom rail of the flat top expanding triangle, Silver put in the blue bearish expanding rising wedge which experienced a breakout and backtest to the bottom rail which strongly suggested the bottom rail of the 2020 trading range was going to give way. The blue circle shows weakness when Silver couldn’t rally all the way back to the top rail. We shouldn’t be surprised to see a backtest to the bottom rail of the flat top expanding triangle before the impulse move really takes hold to the downside.

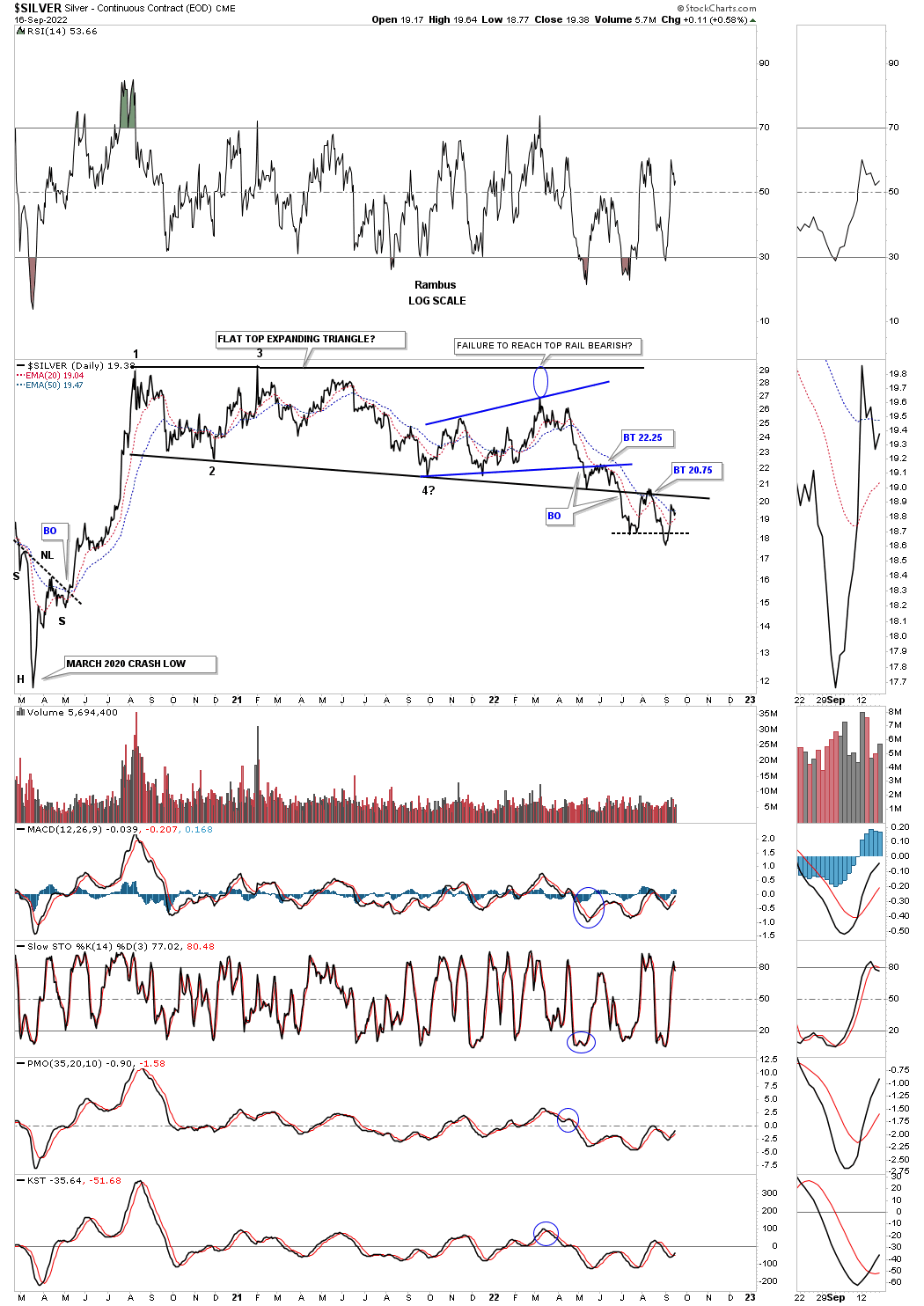

September 18th:

The bottom rail has held on one backtest so far with a possible 2nd backtest underway. A break above the bottom trendline would be a step in the right direction for the bulls showing a possible double bottom.

July 4th:

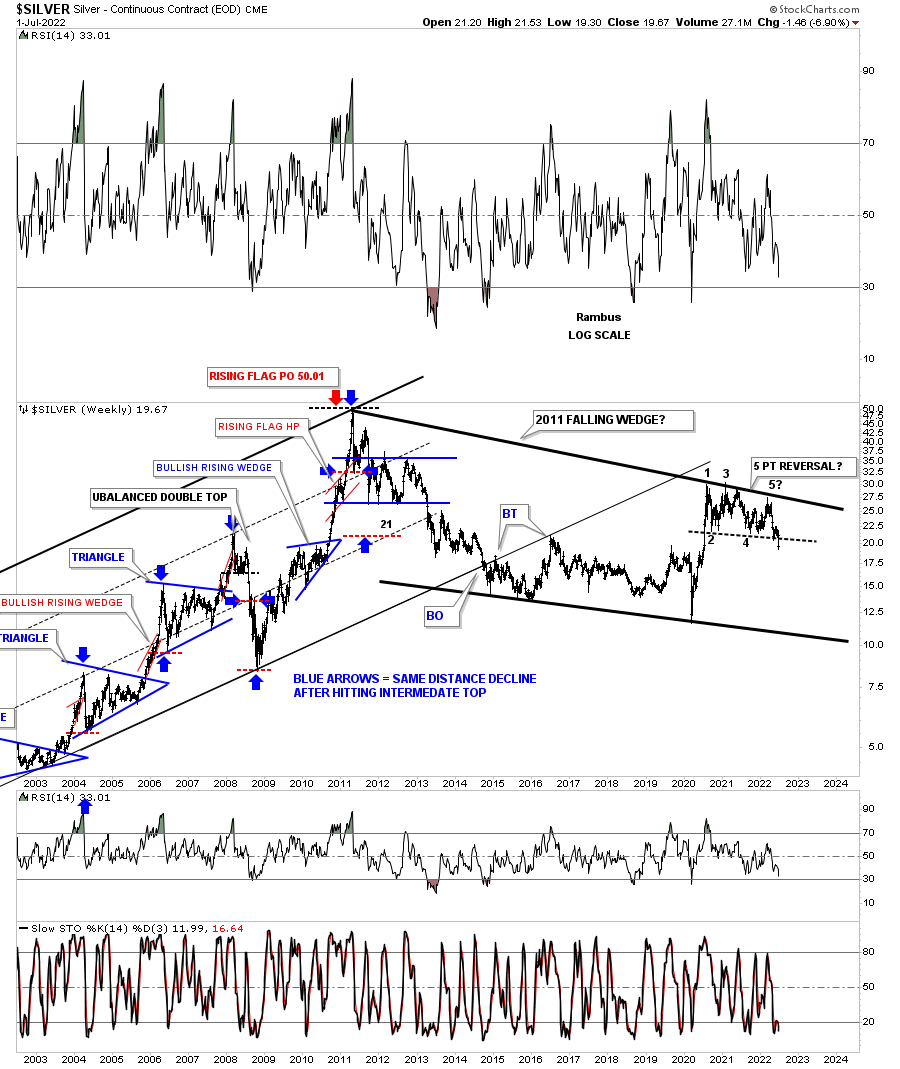

This next chart is an old chart I used during the bull market years charting the bull market in Silver. It is hard to see now but during each impulse move the price action would form a small red bullish rising wedge between each consolidation pattern.

Now look at the top rail of the 2011 falling wedge and how nicely the 2020 trading range, on the daily chart above, interacts with it. As you can see there is no gap at the 5th reversal point as the angle of the top rail takes care of it now. You can see last weeks bar traded the entire week below the bottom rail. Again, we should expect to see a backtest.

September 18th:

Silver is still in backtest mode.

July 4th:

This slightly different version of the chart above shows the 2013 rectangle which was the first consolidation pattern in the 2011 bear market. Now look at the 2020 trading range and the similarity to the 2011 trading range. From strictly a support and resistance perspective you can see how the 2020 trading range has ran into resistance at the bottom of the 2013 trading range with just a bit of overlap. You can also see how the top of the 2016 trading range has been holding support. With Silver breaking below the bottom of its 2020 trading range the odds favor Silver moving lower leaving the 2020 trading range as a distribution pattern.

September 18th:

Silver still trading below the top rail of the 2011 downtrend channel and the bottom of the 2020 trading range.

July 4th:

I realize that few can grasp what this big picture of Silver is strongly suggesting, but when the bottom rail of the 2020 trading range gave way the odds went way up that the top rail of the 2011 bear market downtrend channel is still hot and to be respected. The bulls had every chance in the world to hold support at the bottom blue rail, but they told us they are weaker than many think is possible.

September 18th:

Still trading below the 2020 trading range in backtest mode.

July 4th:

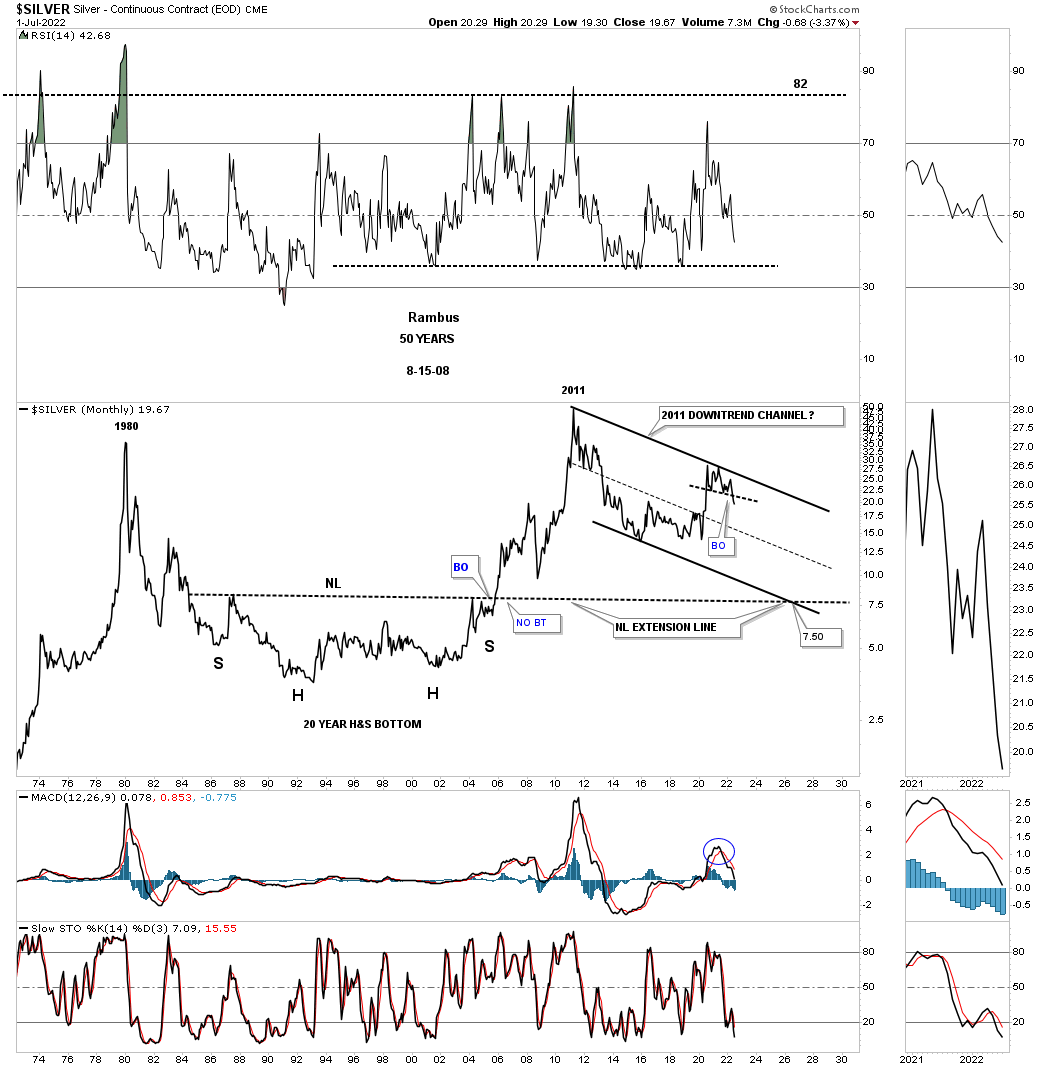

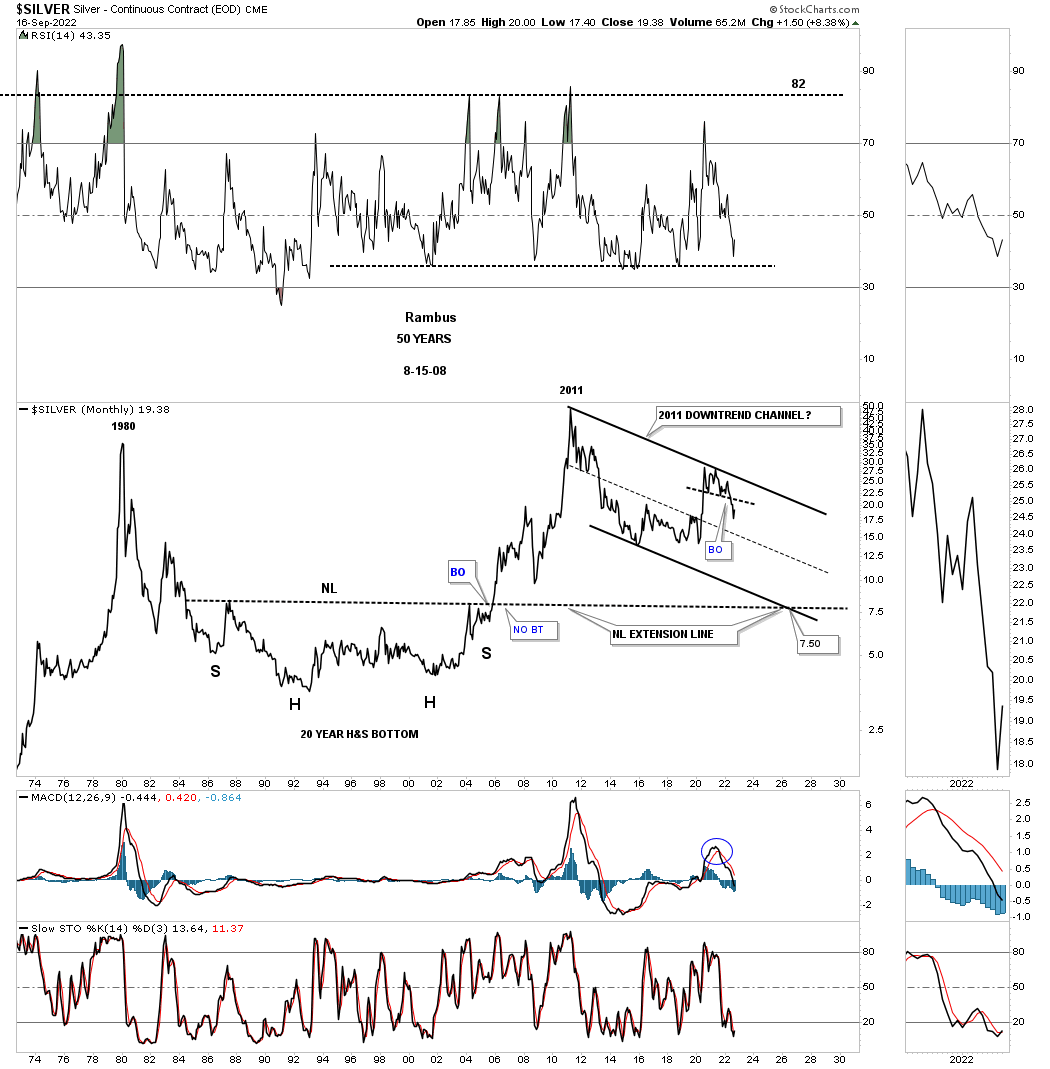

This 50 year monthly chart for Silver puts the 2011 downtrend channel in perspective. I know it seems impossible at this time, but the bulls are doing nothing to change this possible scenario. Until they do, it is what it is until it isn’t.

September 18th:

Still trading below the S&R line.

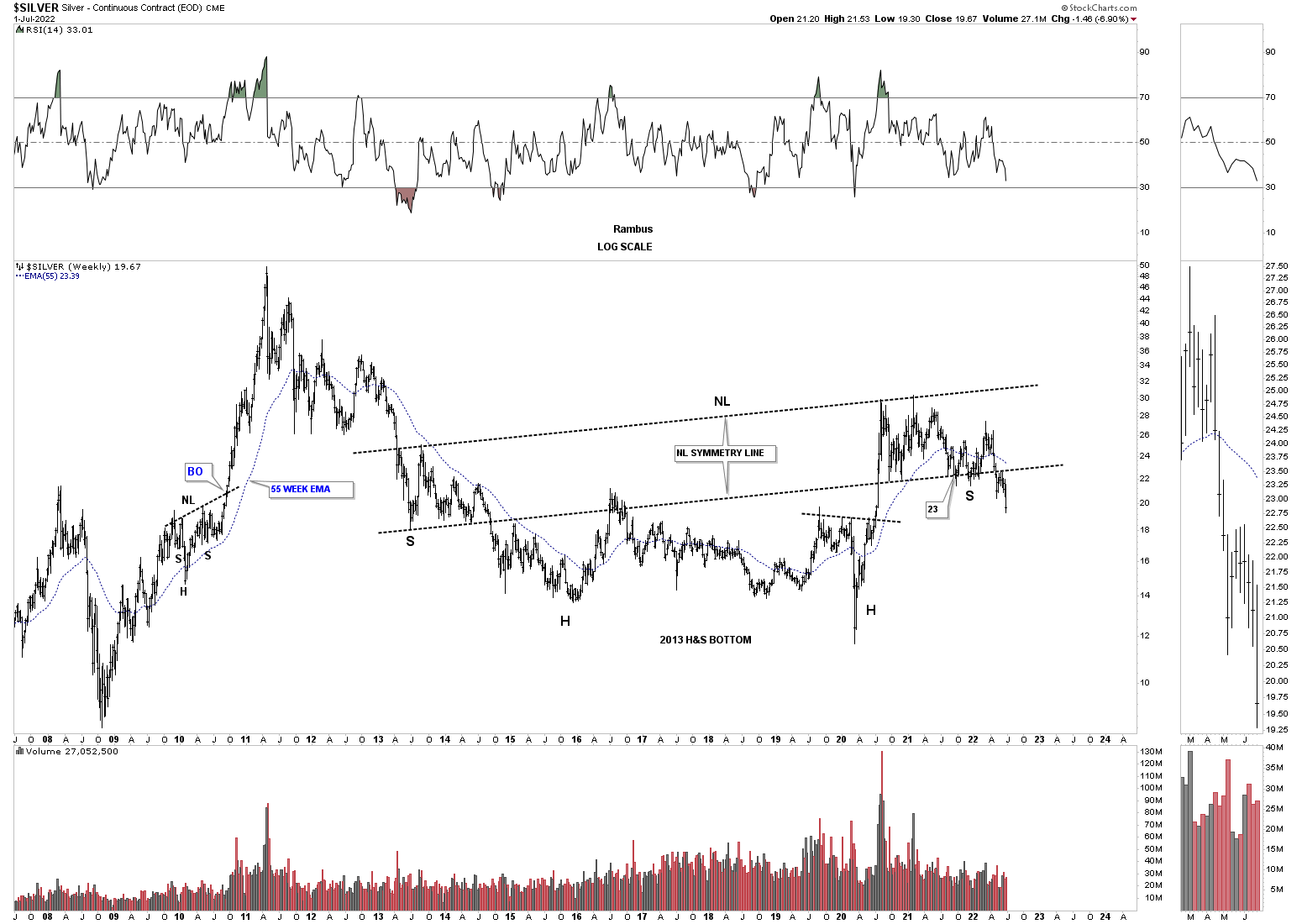

July 4th:

About ten months or so ago I showed this chart for Silver and the rest of the PM complex which were forming a possible massive H&S base with the neckline symmetry line holding support for the low of the right shoulder. As you can see that possible H&S bottom is fading fast as the price action is now trading below the neckline symmetry line which isn’t the end of the world of the possible H&S bottom, but it now puts it in question. It is not pretty and symmetrical anymore.

September 18th:

The right shoulder is still in play, but it looks pretty ugly at the moment.

July 4th:

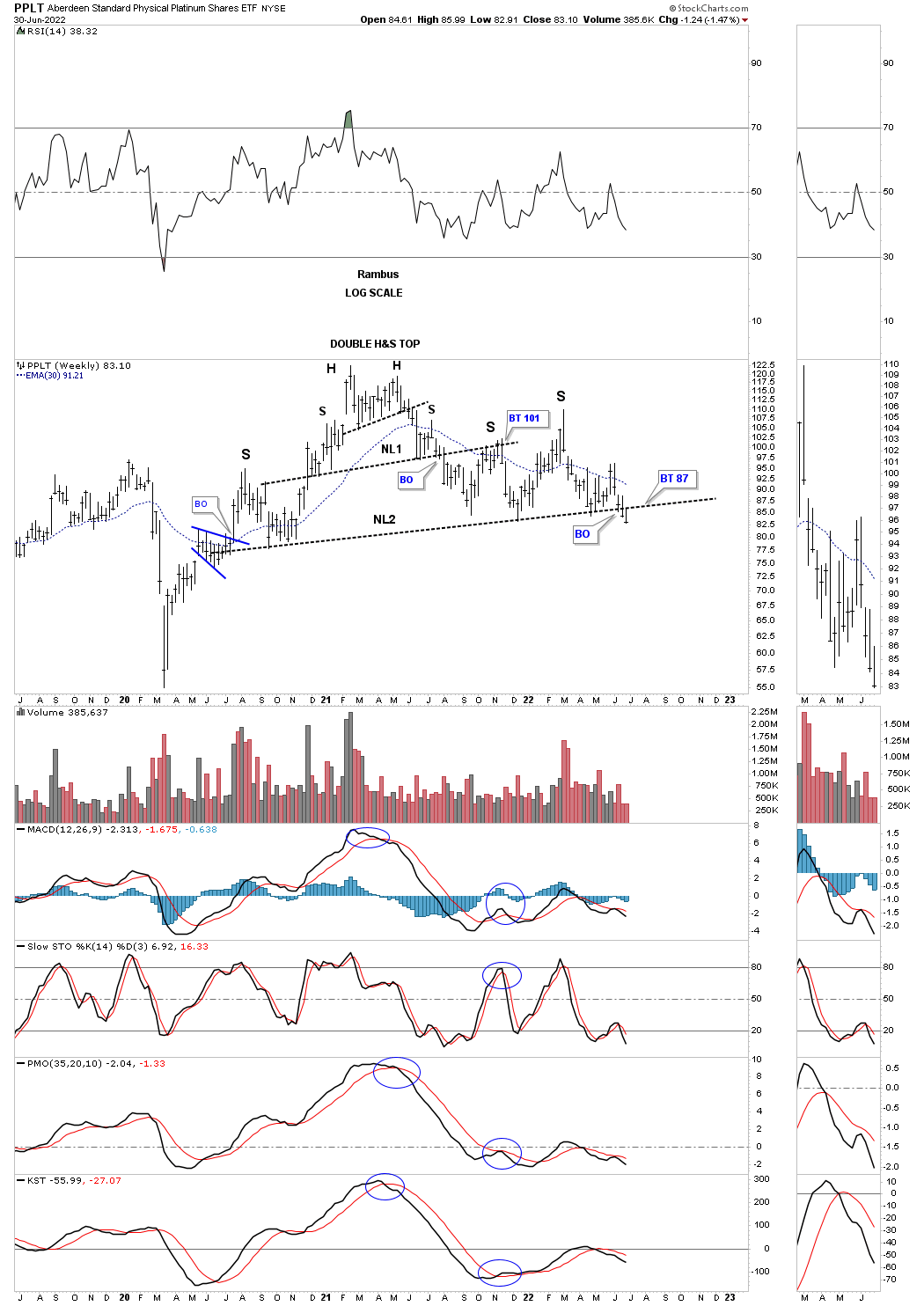

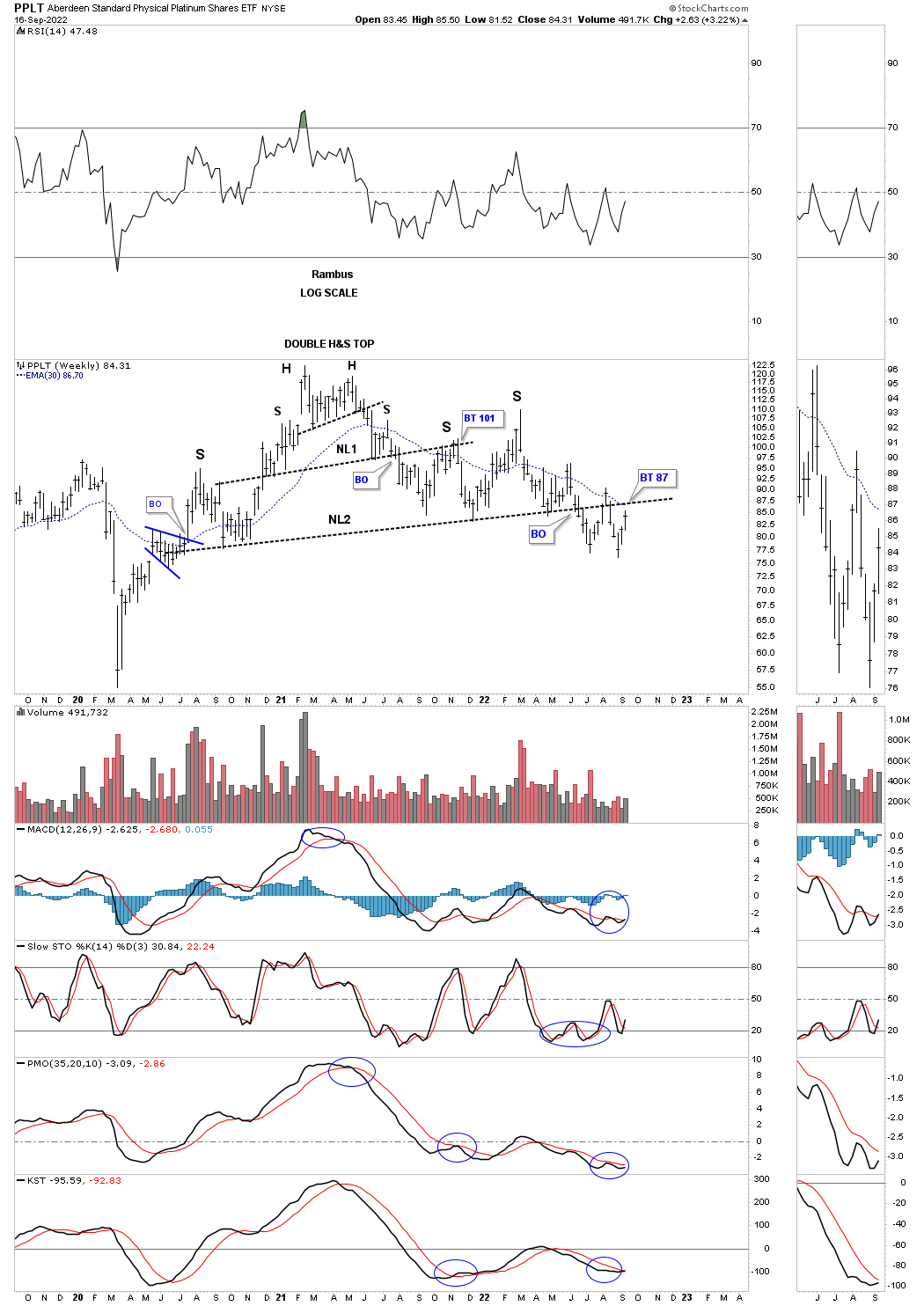

PPLT: Platinum has now traded two weeks below its possible very large H&S top neckline. Now we’ll watch the neckline for a backtest to see what happens.

September 18th:

Still in backtest mode.

July 4th:

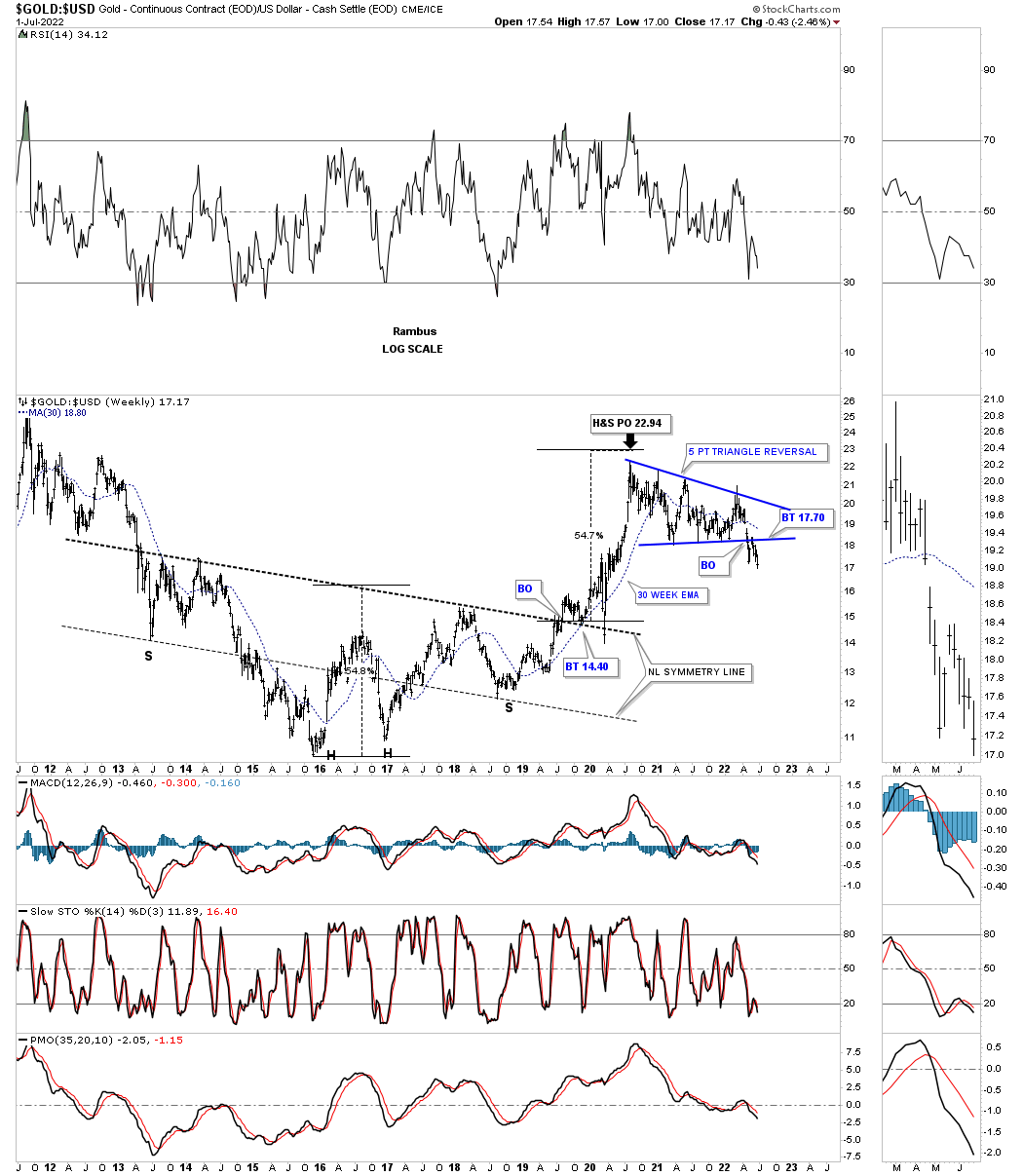

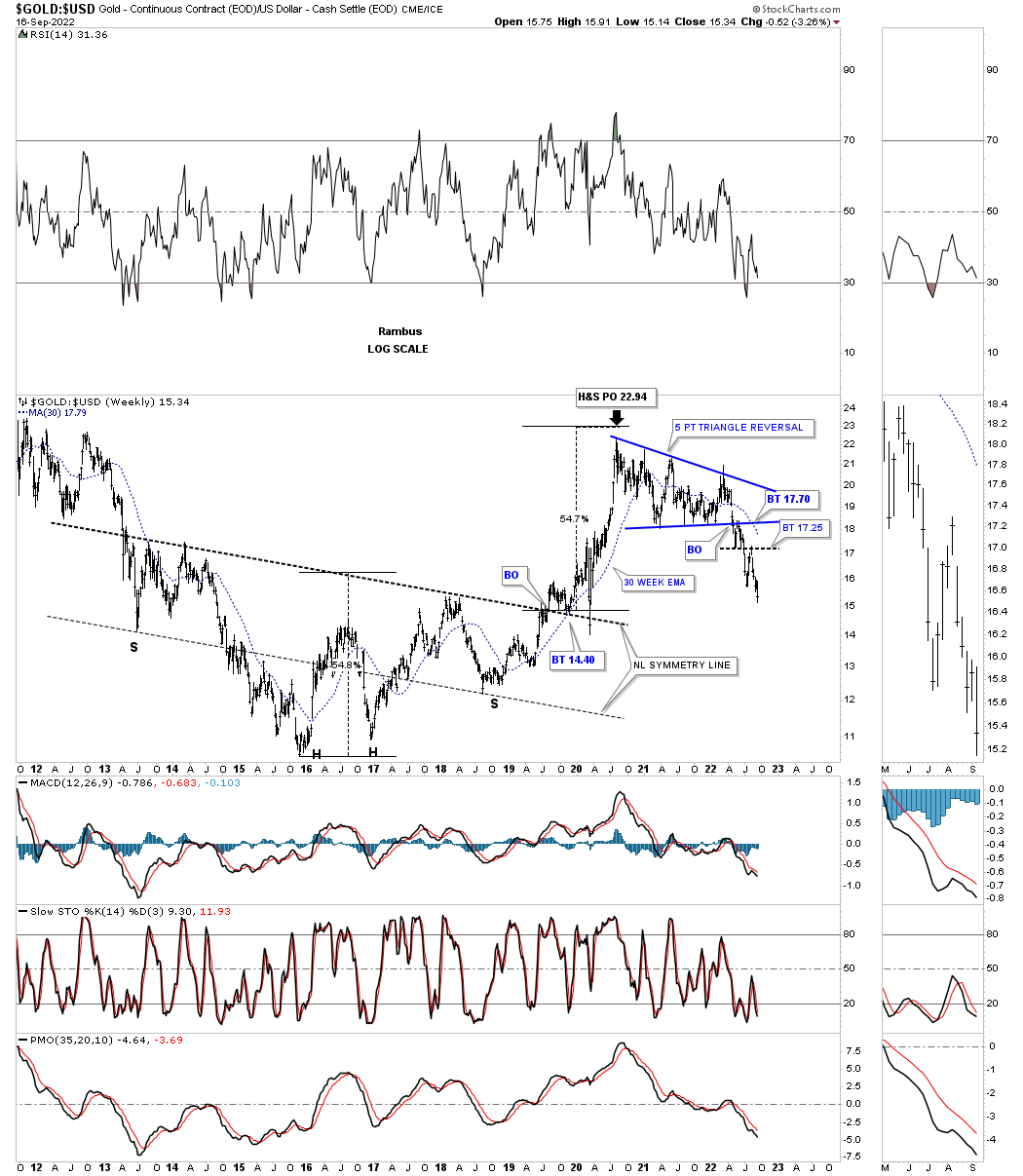

Now lets look at a couple of ratio charts to see if they can help us in determining the next important move in the PM complex. This first ratio chart compares Gold to the US dollar which shows the ratio built out a very large H&S bottom, meaning Gold was outperforming the US dollar into the 2020 high. As you can see the price action fell just shy of reaching the minimum price objective for the H&S bottom.

Since the high made in 2020 the ratio formed the five point blue triangle reversal pattern that shows a breakout and backtest that may be complete. I don’t want to sound like a broken record, but if the Gold bulls were in charge the triangle should have broken to the upside and not the downside.

September 18th:

The ratio made a new lower low last week.

July 4th:

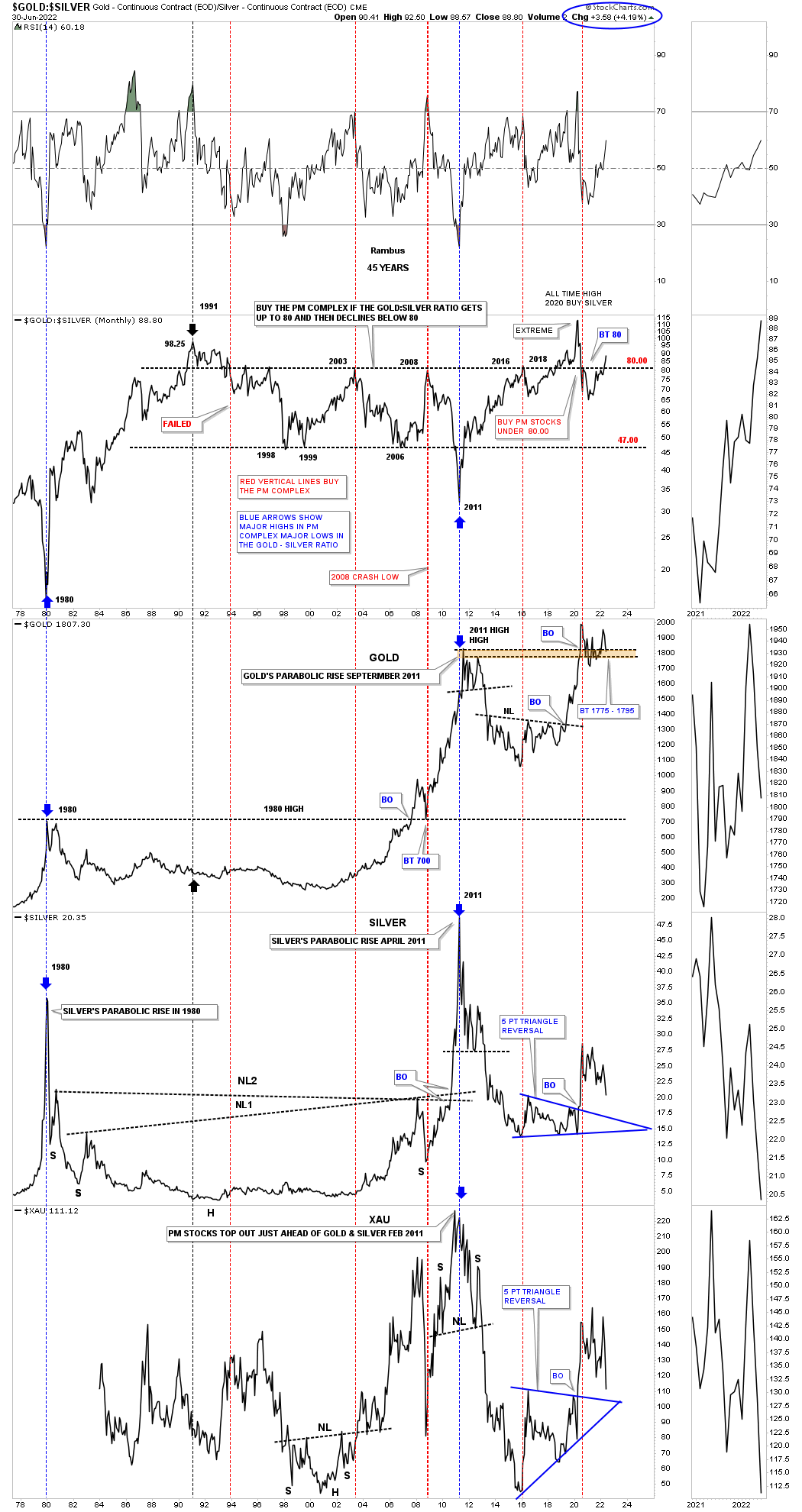

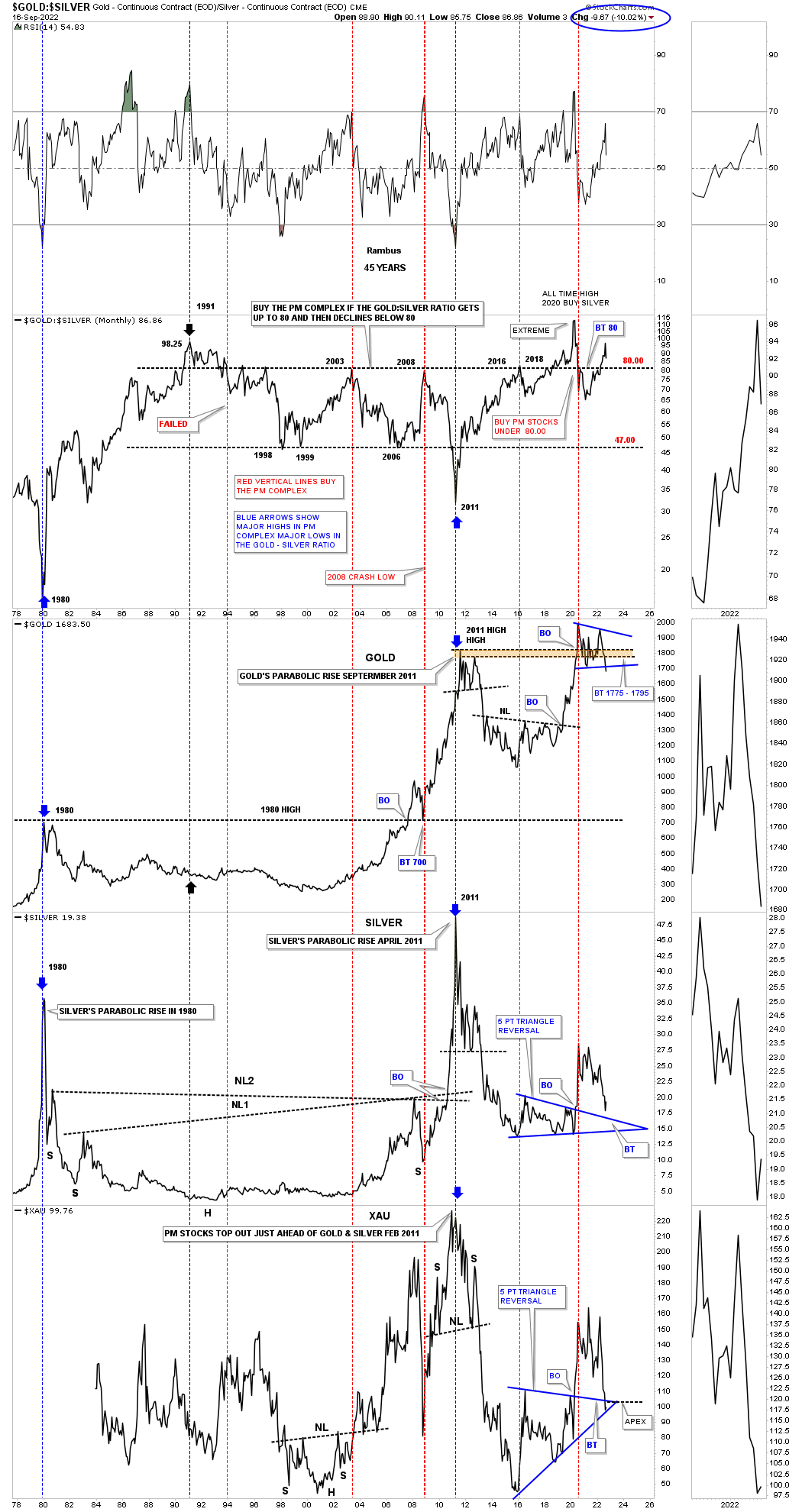

Everyone who follows the Gold:Silver ratio has their own interpretation of what it means. For me when the ratio is rising that is generally, but not always, not a good time to be in PM stocks. Since the 2020 low in the ratio and the high in the PM complex the ratio has broken back above 80 which is not a bullish sign if one is long the PM complex. Again, it is not the end of the world, but a huge warning sign to stay vigilant if one is thinking about entering the PM complex.

September 18th:

If the ratio can move below 80 that would be a bullish sign for the PM complex.

July 4th:

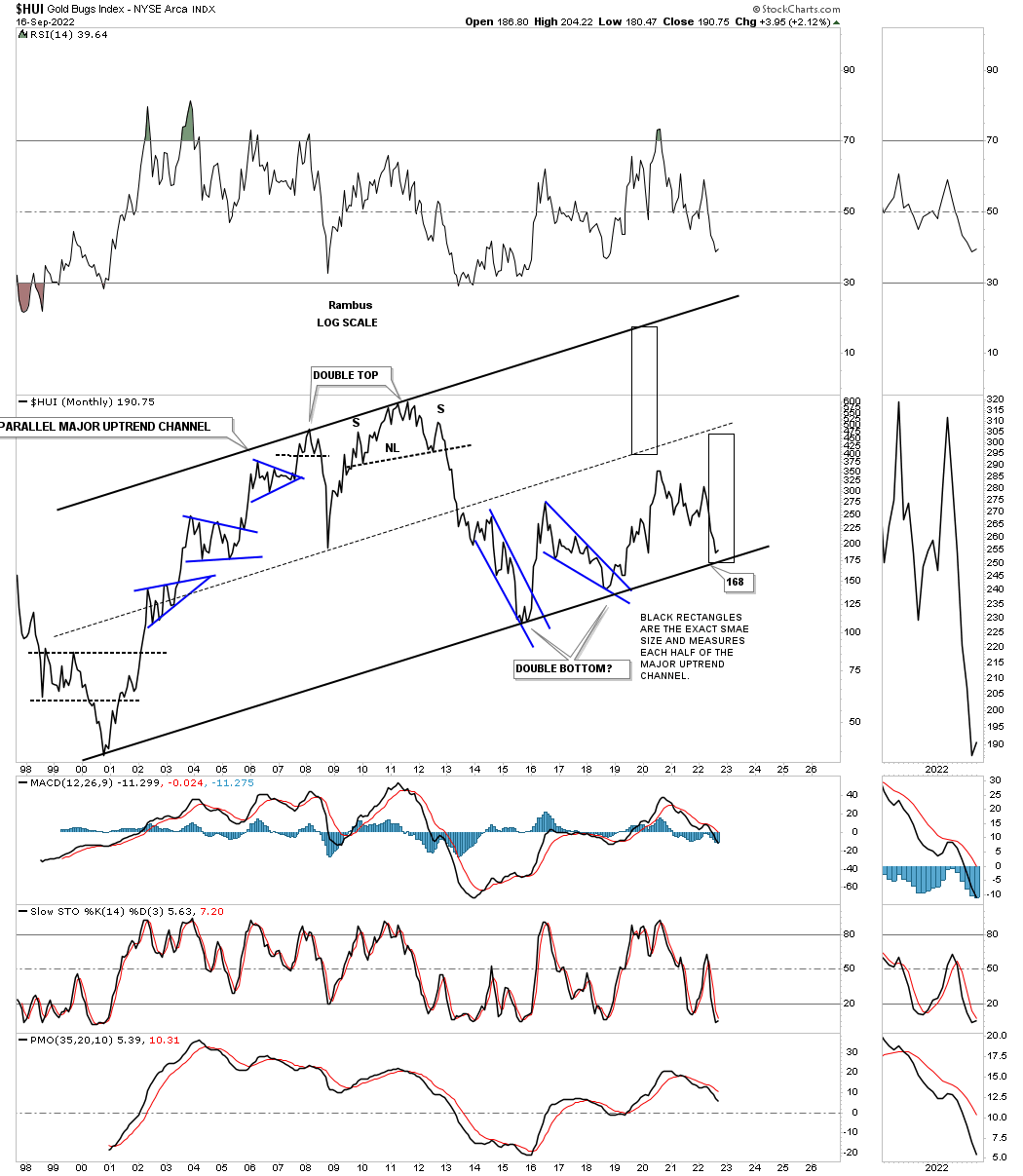

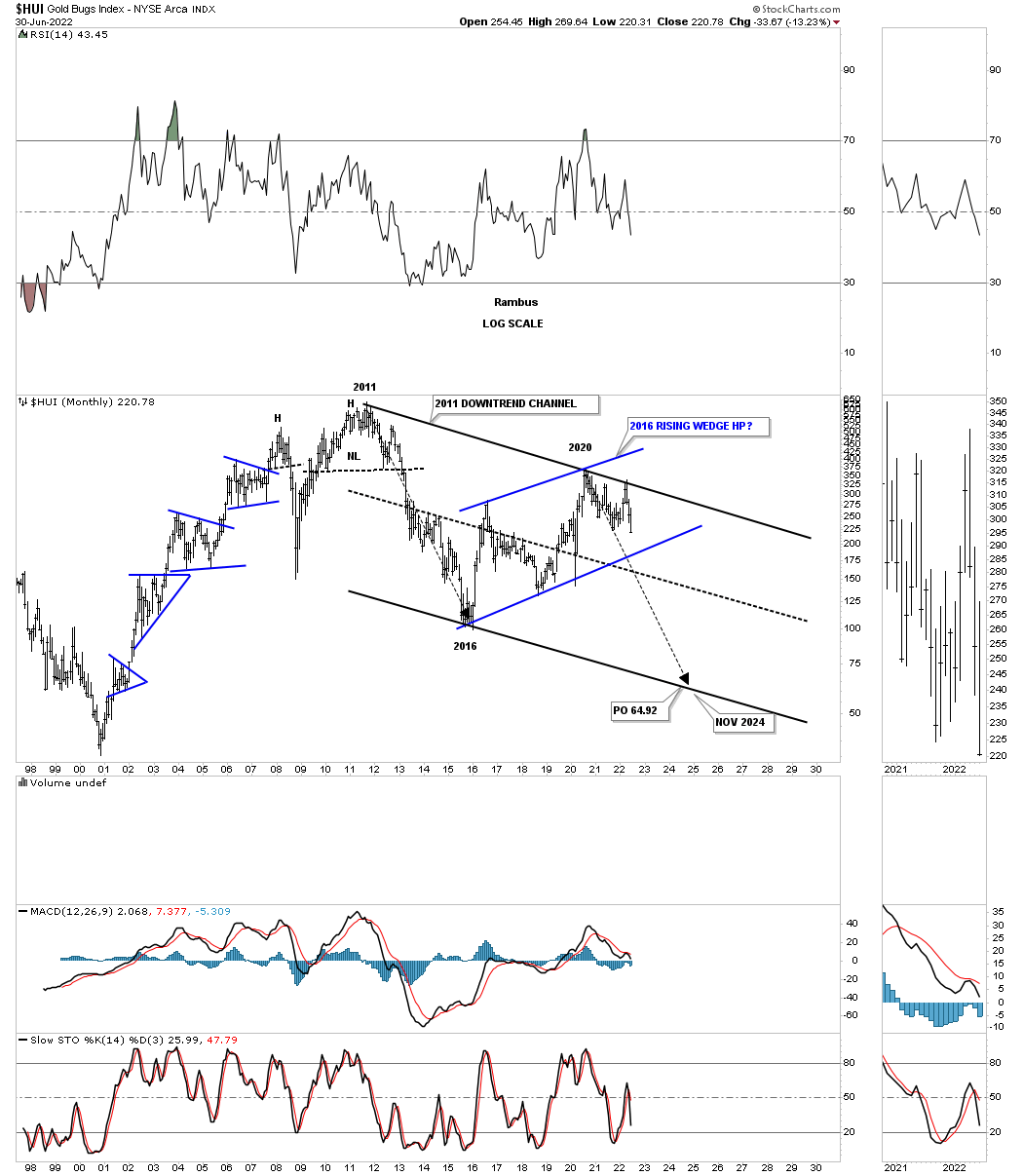

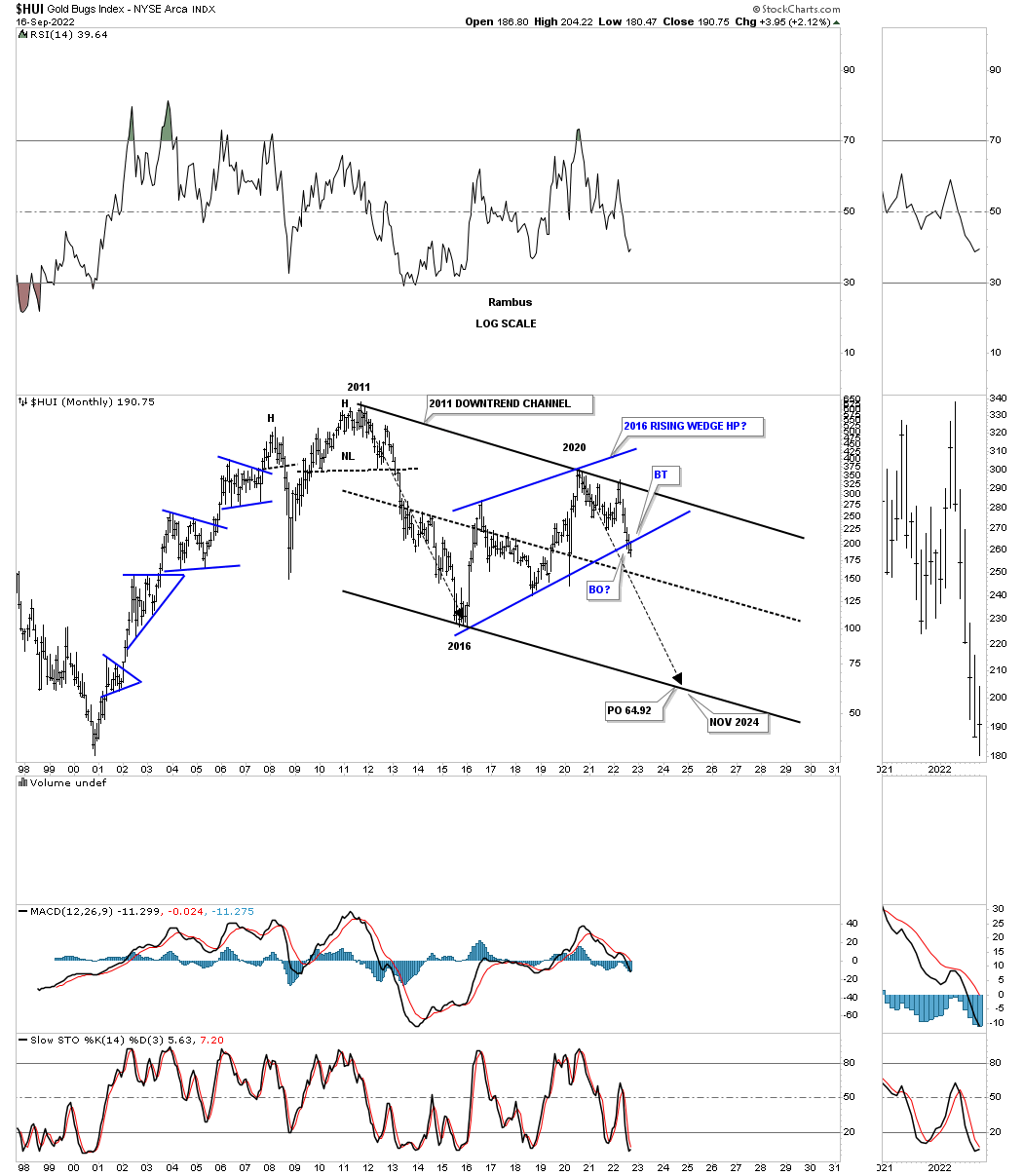

Lets look at a few PM stock indexes to see if they can give us any good clues on the next important direction for the PM stocks. Lets start with the long term monthly chart for the HUI which shows its 2000 bull market uptrend channel. The two black rectangles measure each half of the uptrend channel. The HUI could decline down to the bottom rail and the bull market would still be intact with no damage done, frustrating the bulls.

September 18th:

The HUI is now very close to testing the bottom rail of its 2000 bull market uptrend channel.

July 4th:

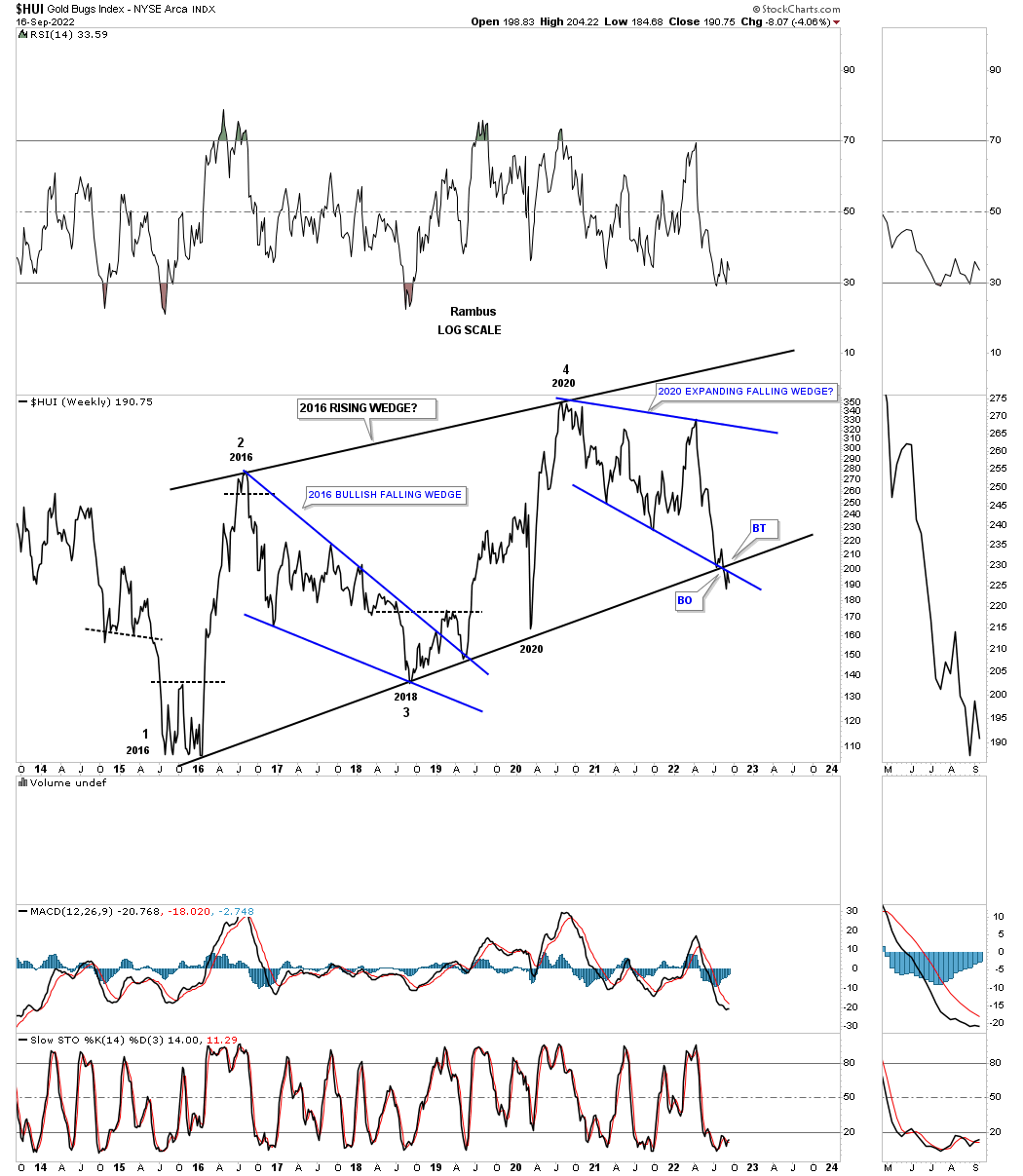

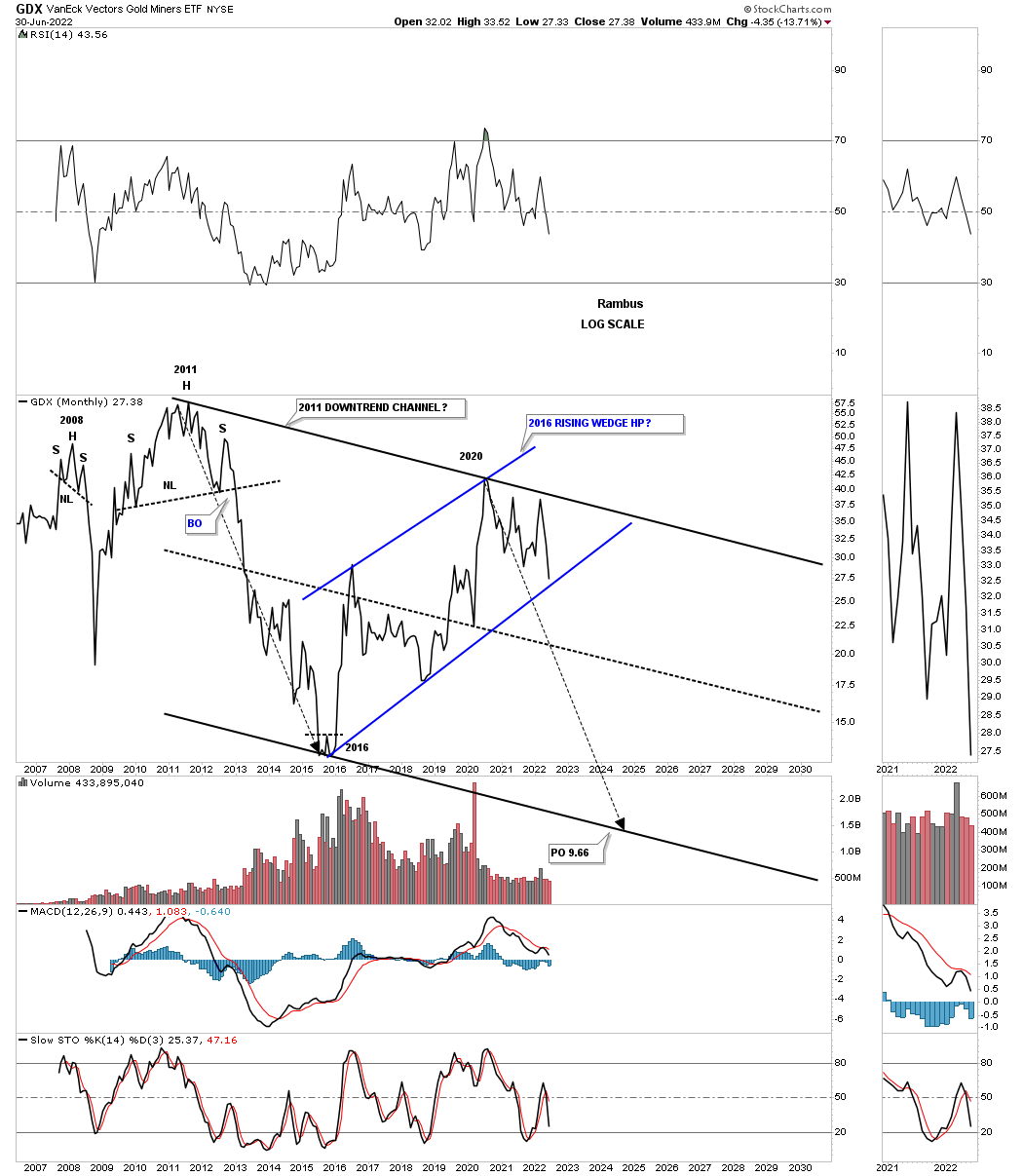

And then there is another possibility that few are even aware of which is the possible 2016 rising wedge formation. As you can see each important reversal point comes at an important top or bottom in the past five years or so. A touch of the bottom rail will complete the all important 4th reversal point in the rising wedge and is where the bulls need to step up and hold support. If they fail to do so the rising wedge will then be a consolidation pattern to the downside.

September 18th:

Is the HUI in breakout and backtest mode?

July 4th:

This longer term bar chart for the HUI shows how the 2016 rising wedge would look as a halfway pattern if the bottom blue trendline is broken to the downside.

September 18th:

The HUI has broken below the bottom trendline with an inter month backtest.

July 4th:

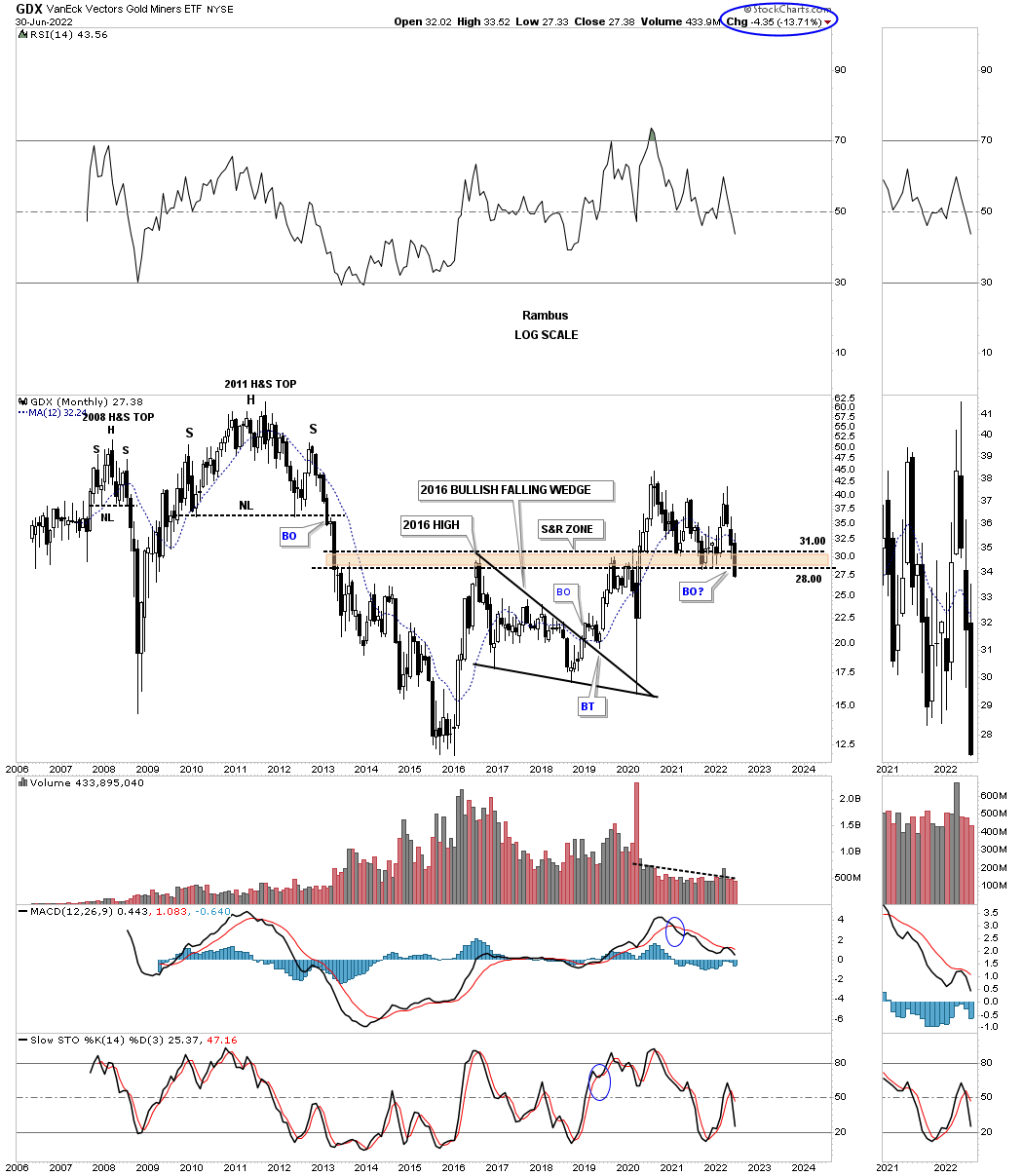

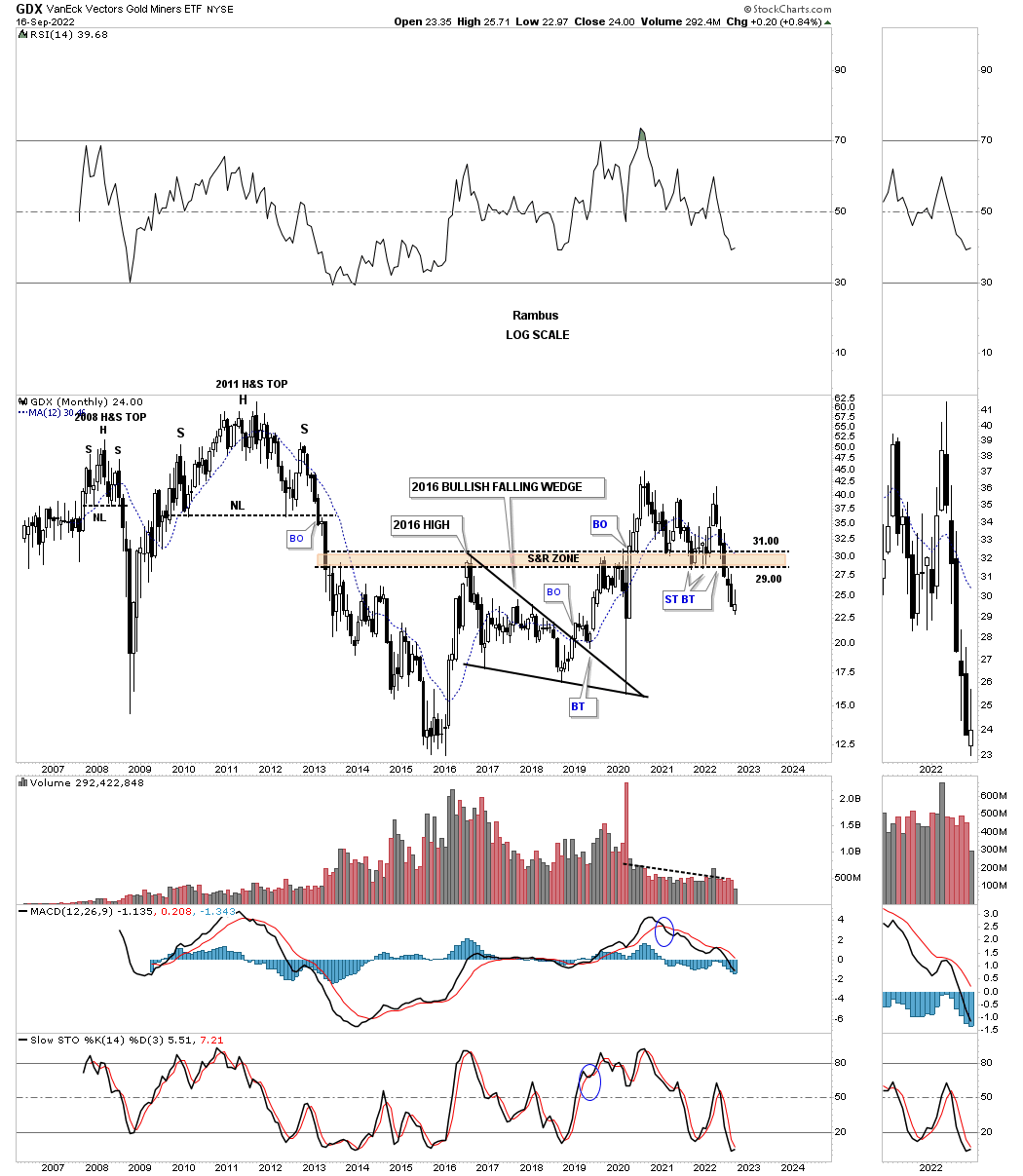

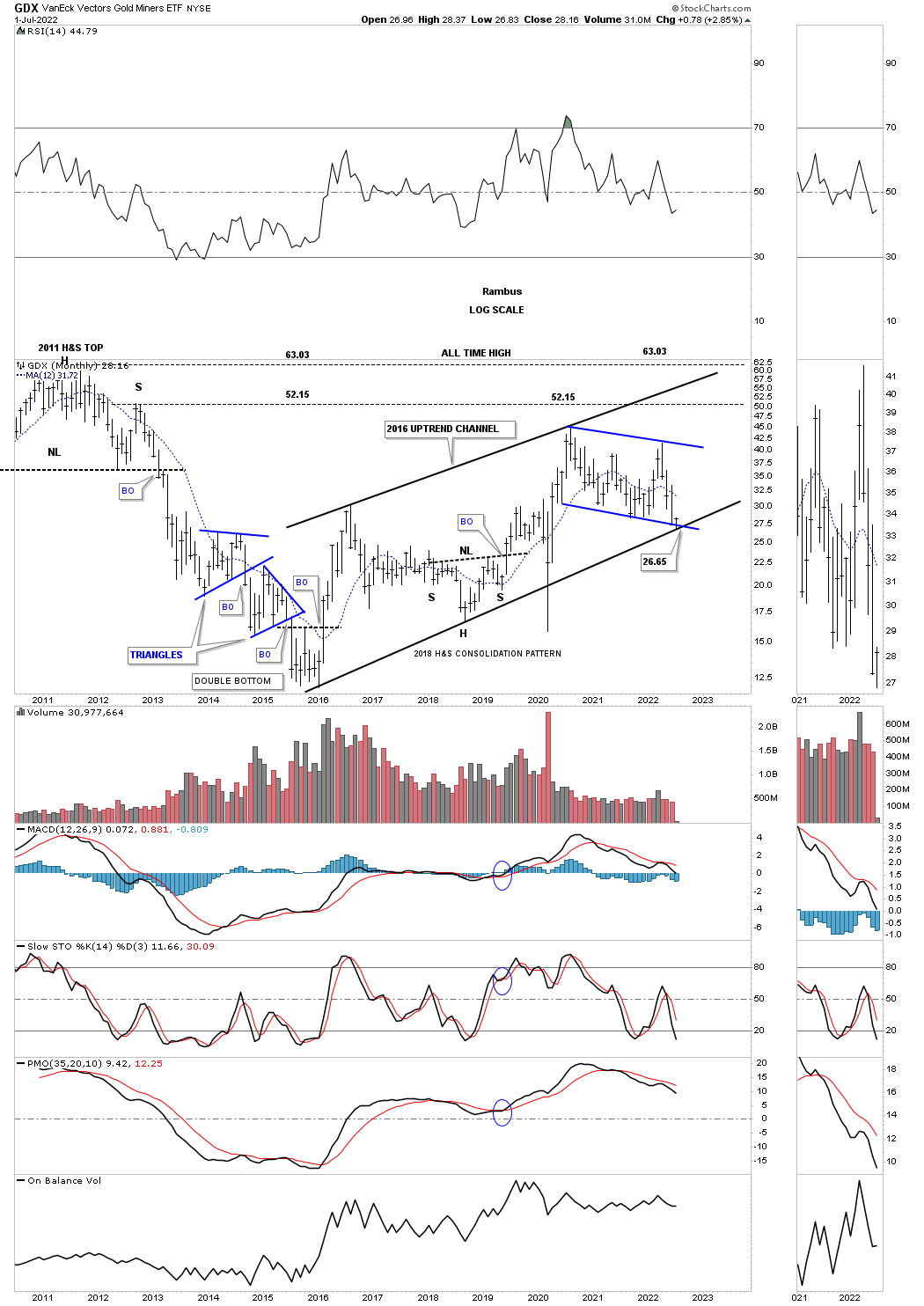

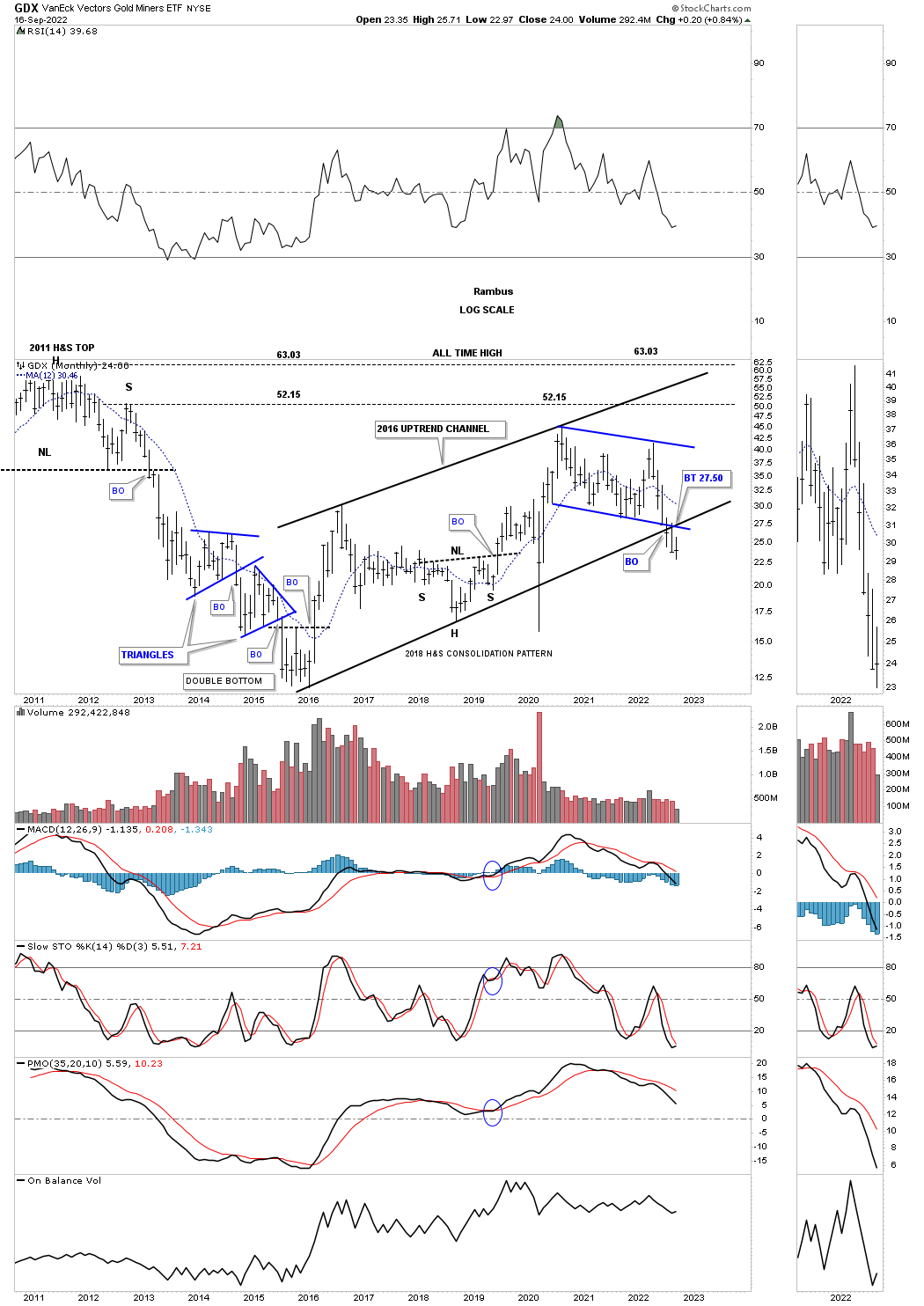

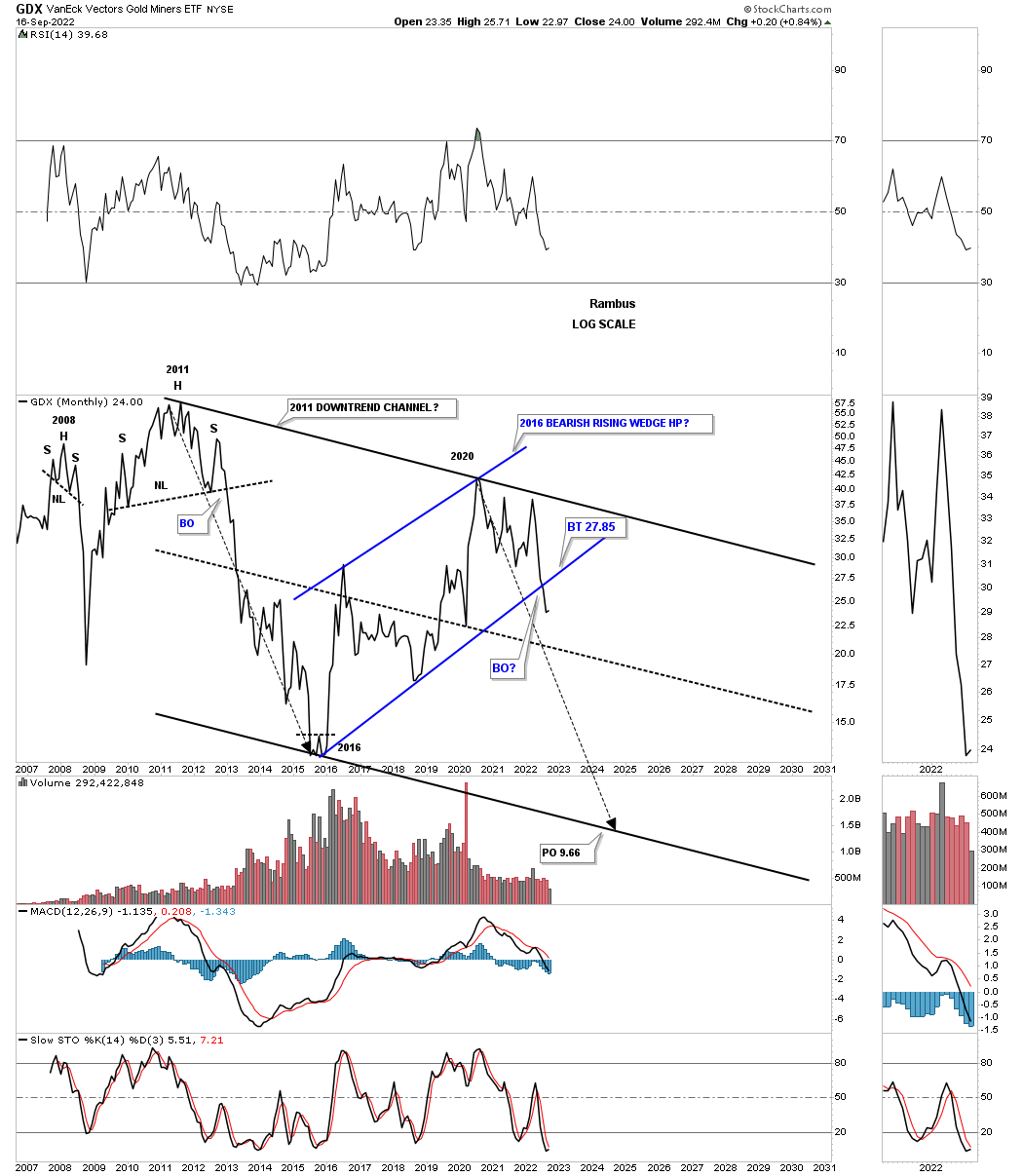

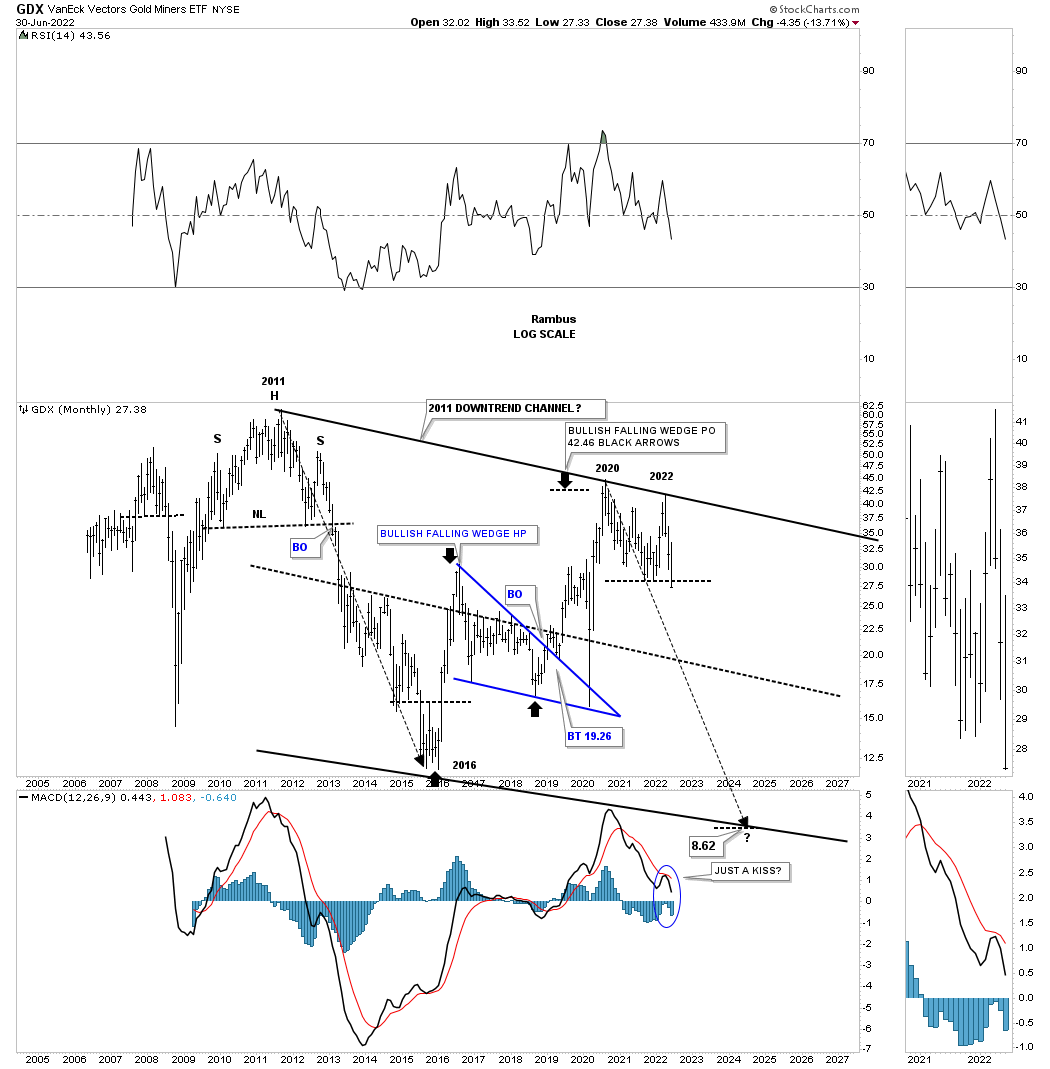

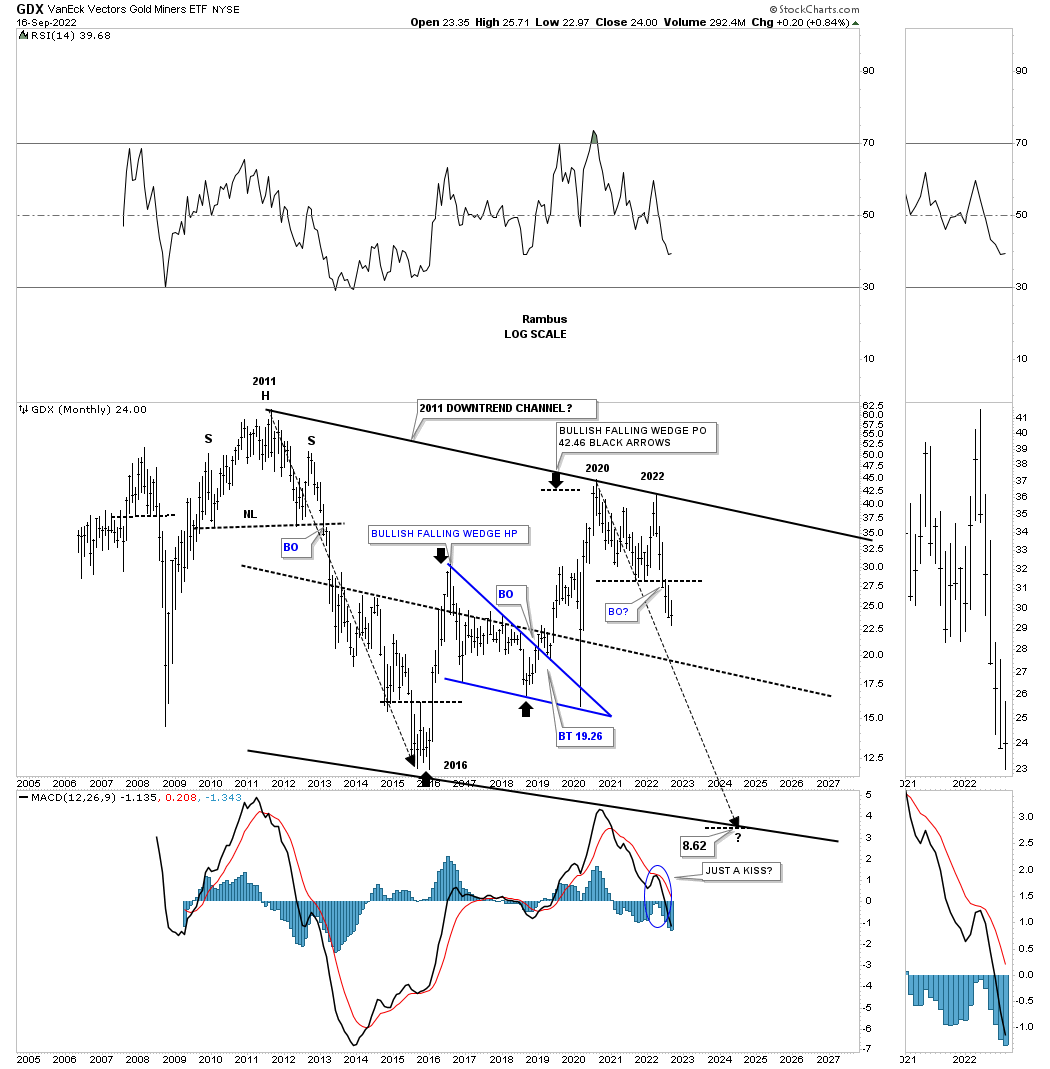

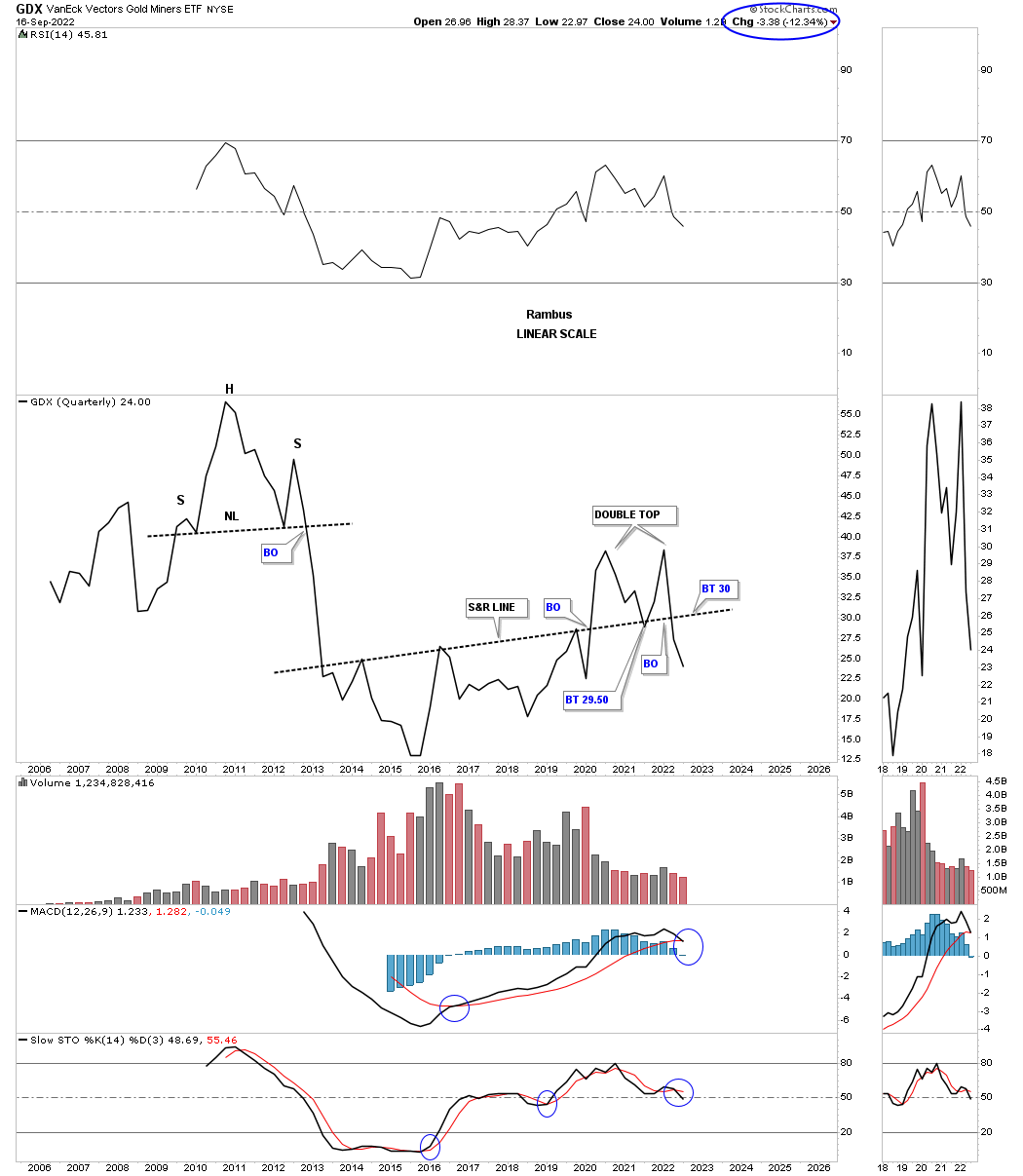

This monthly chart for the GDX shows the 2013 brown shaded S&R zone, which has been holding support since the 2020 high, with the price action closing last week below it. During a strong impulse move down you will generally see a string of black candlesticks all in a row, with the end of June showing the third. Just the opposite in a strong impulse move up where you will see a string of white candlesticks.

September 18th:

Above the browns shaded S&R zone is bullish and below is bearish.

July 4th:

This next monthly chart for the GDX shows the price action hitting critical support last week where the bottom rail of the 2016 uptrend channel and the bottom rail of the possible blue bull flag intersect. The possible blue flag won’t be complete until the top rail is broken to the upside leaving the bulls with a lot of work on their hands if the 2016 trading range is going to be bullish. On the other hand if the bottom rail of the 2016 uptrend channel and the bottom rail of the possible blue bull flag give way then we’ll be left with a bearish rising channel.

September 18th:

GDX broke below the bottom rail of the 2016 uptrend channel.

July 4th:

This monthly line chart shows how the blue rising channel would look in the 2011 downtrend channel as a possible halfway pattern to the downside.

September 18th:

GDX has broken below the bottom rail of the 2016 rising wedge.

July 4th:

The monthly bar chart for the GDX.

September 18th:

The GDX is trading well below the horizontal S&R line. Note the blue circle made I put on the GDX chart above asking the question, was the MACD just kissing?

July 4th:

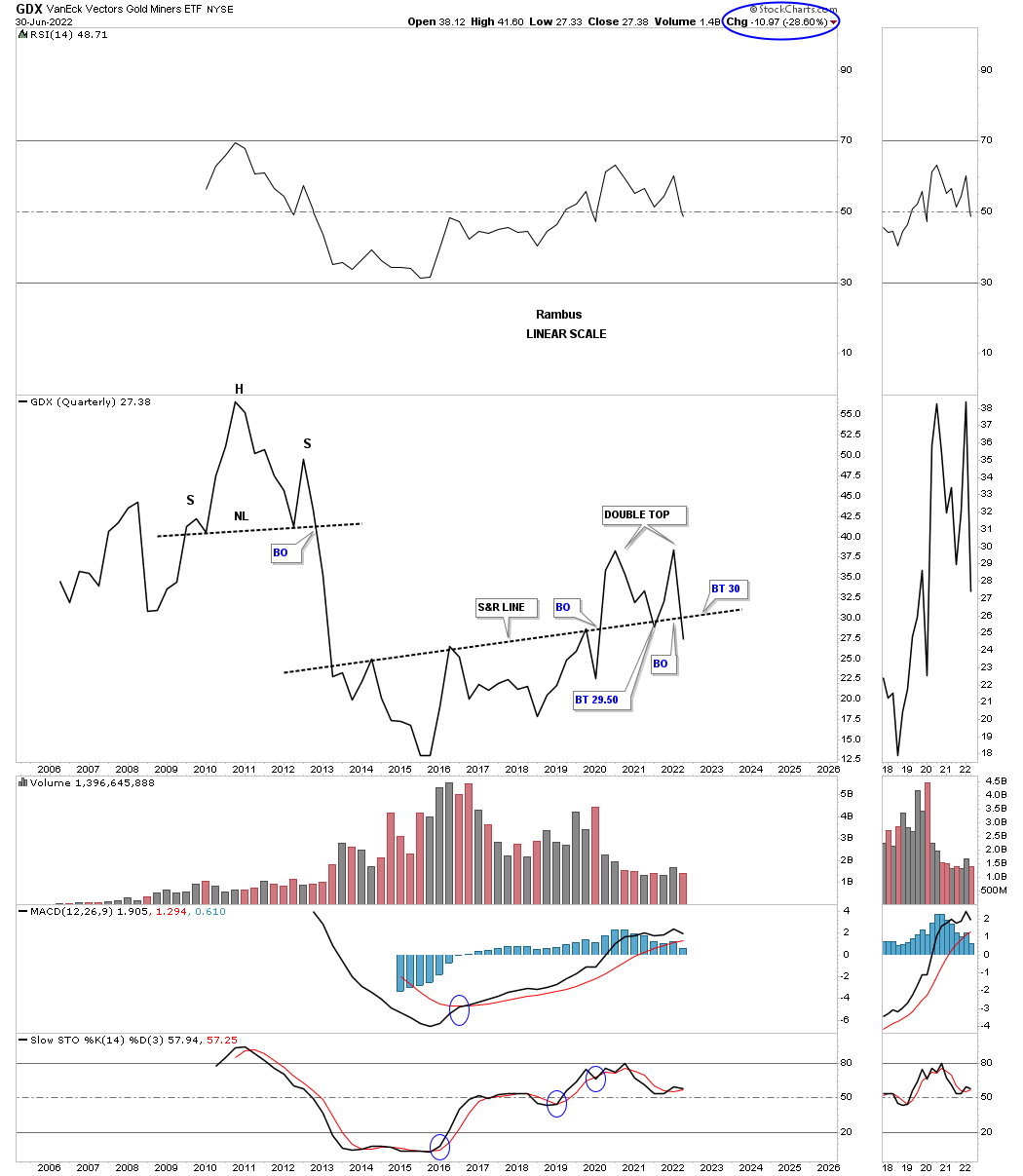

Something happened this quarter that I wasn’t excepting when the 2nd quarter began. This quarterly line chart for the GDX shows the price action closing the quarter below the S&R line going all the way back to 2013. I’ve been following that S&R line for many years and to see it give way like that was very interesting. As you can see I’ve labeled the price action above it as a double top reversal pattern which I have to admit I wasn’t expecting when the quarter began three months ago.

September 18th:

Down another 12% so far for the third quarter with two weeks to go.

July 4th:

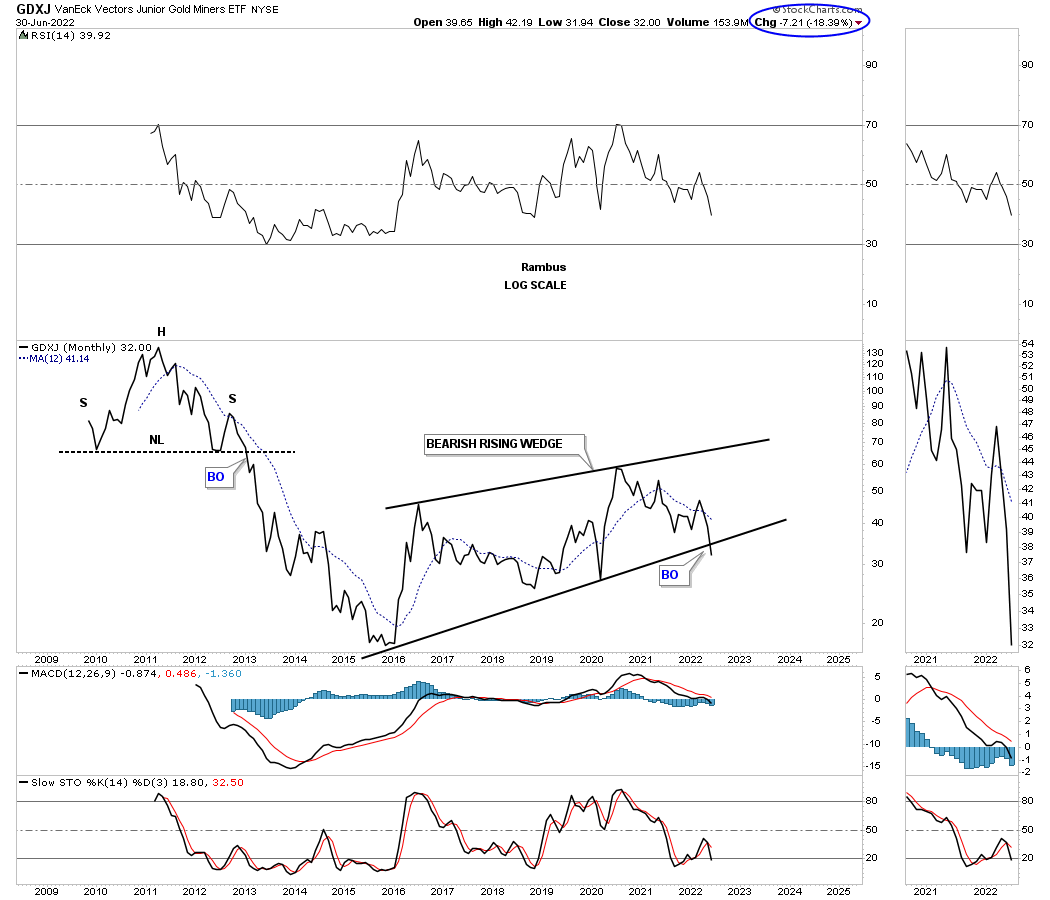

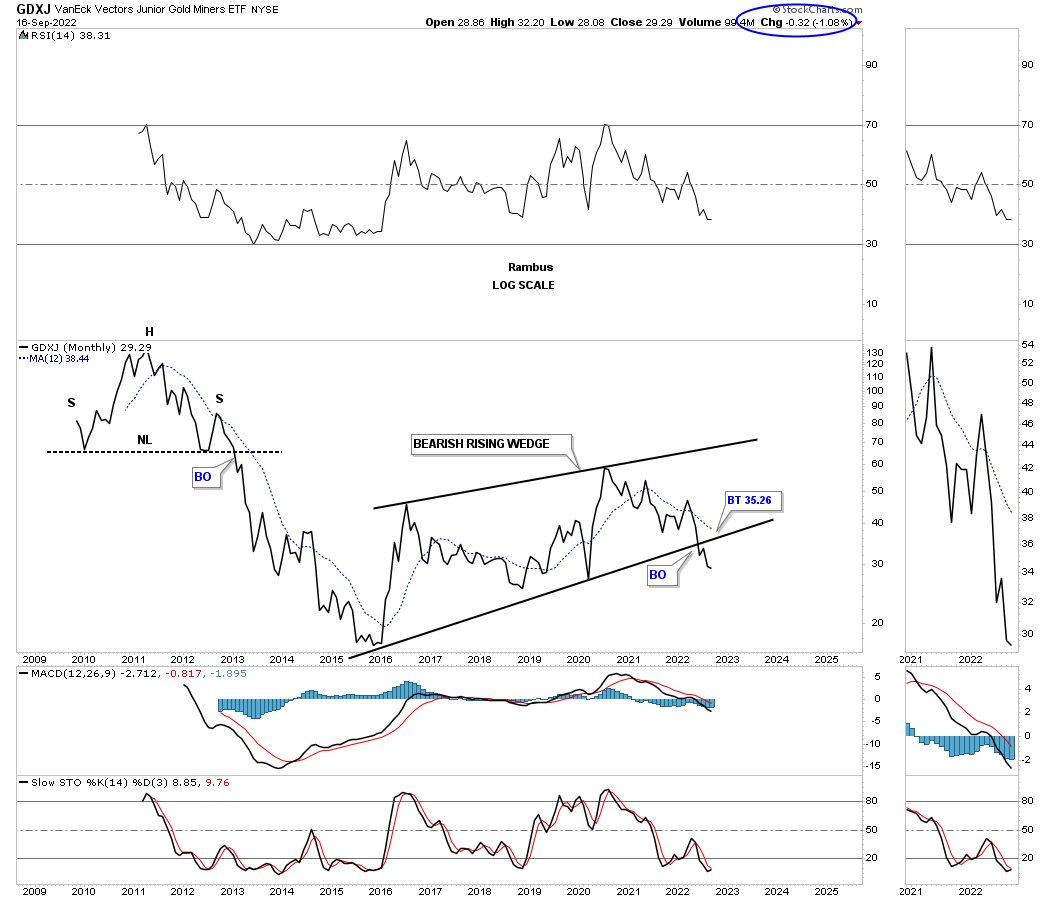

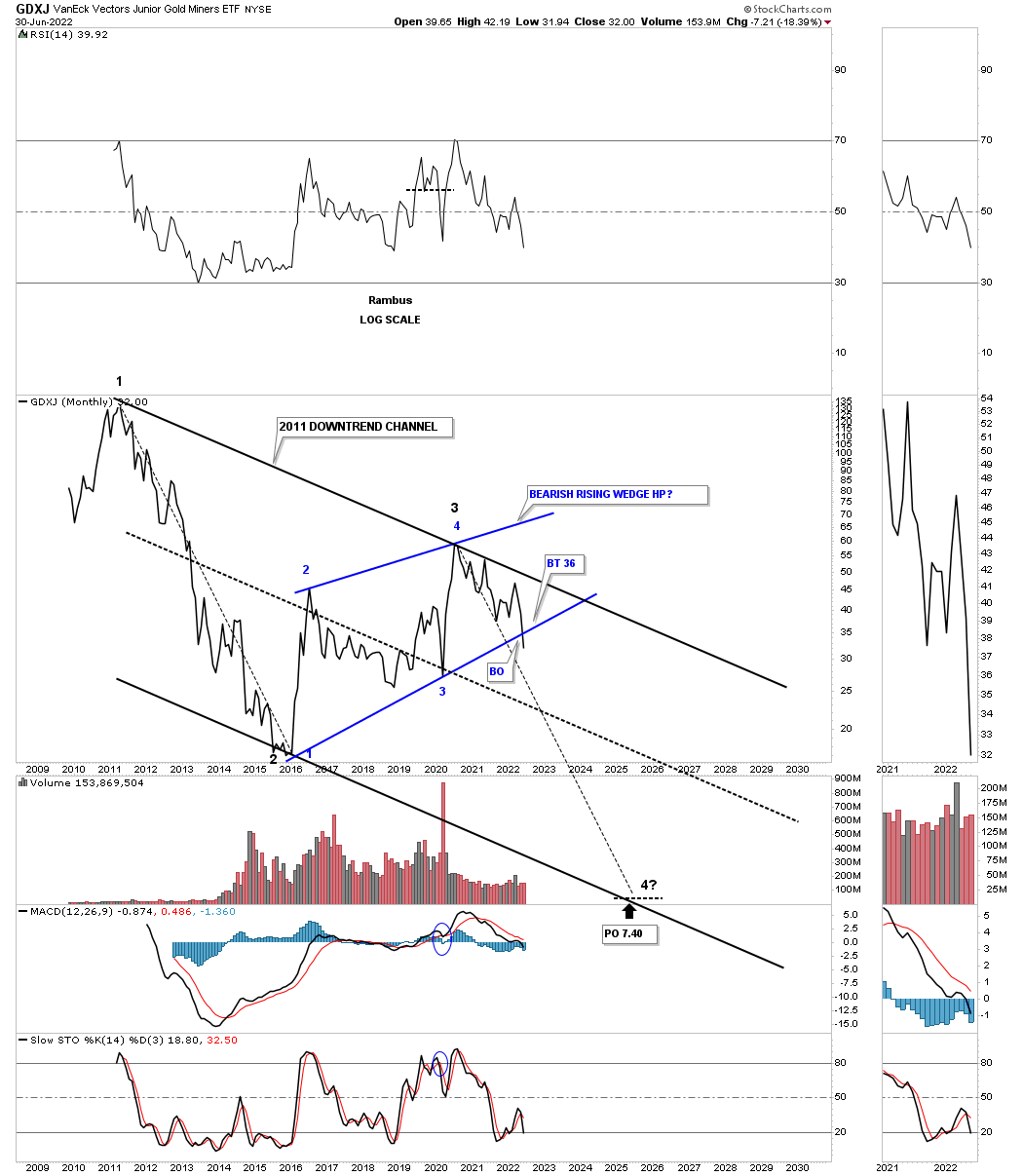

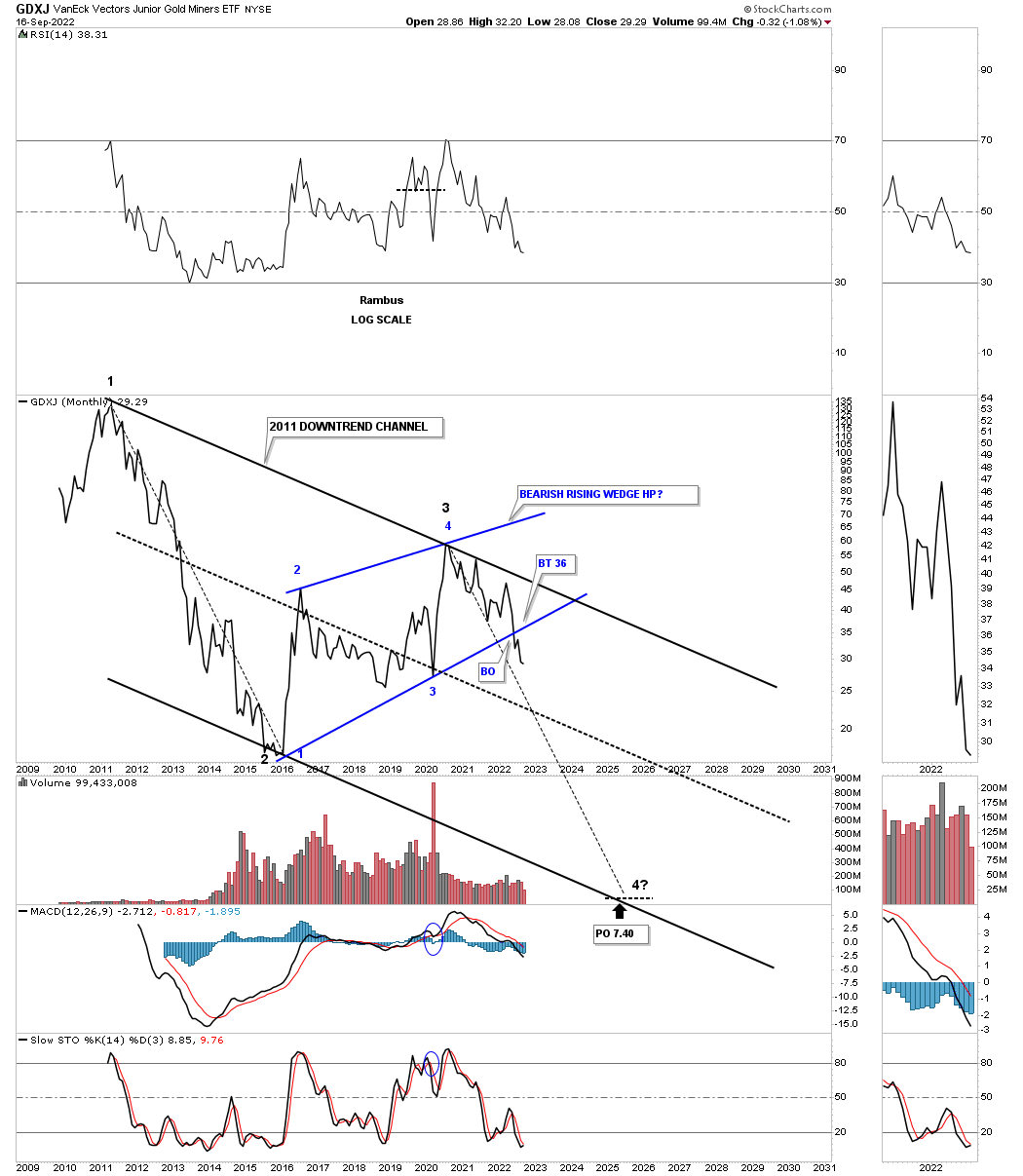

I’ve been mentioning for quite sometime that Silver and the GDXJ have been the weakest areas in the PM complex. This monthly line chart for the GDXJ, junior miners, closed the month of June below the bottom rail of its 2016 rising wedge formation. Now we’ll see if the bottom rail can hold resistance on the backtest.

September 18th:

There was a backtest to the bottom trendline and now a lower low.

July 4th:

This history chart for the GDXJ shows how the 2016 rising wedge fits into the very big picture. Again, now we’ll see if the backtest can hold resistance.

September 18th:

The angle of the decline from the 2020 high appears to be in sync with the 2011 bear market decline so far and the backtest has held.

July 4th:

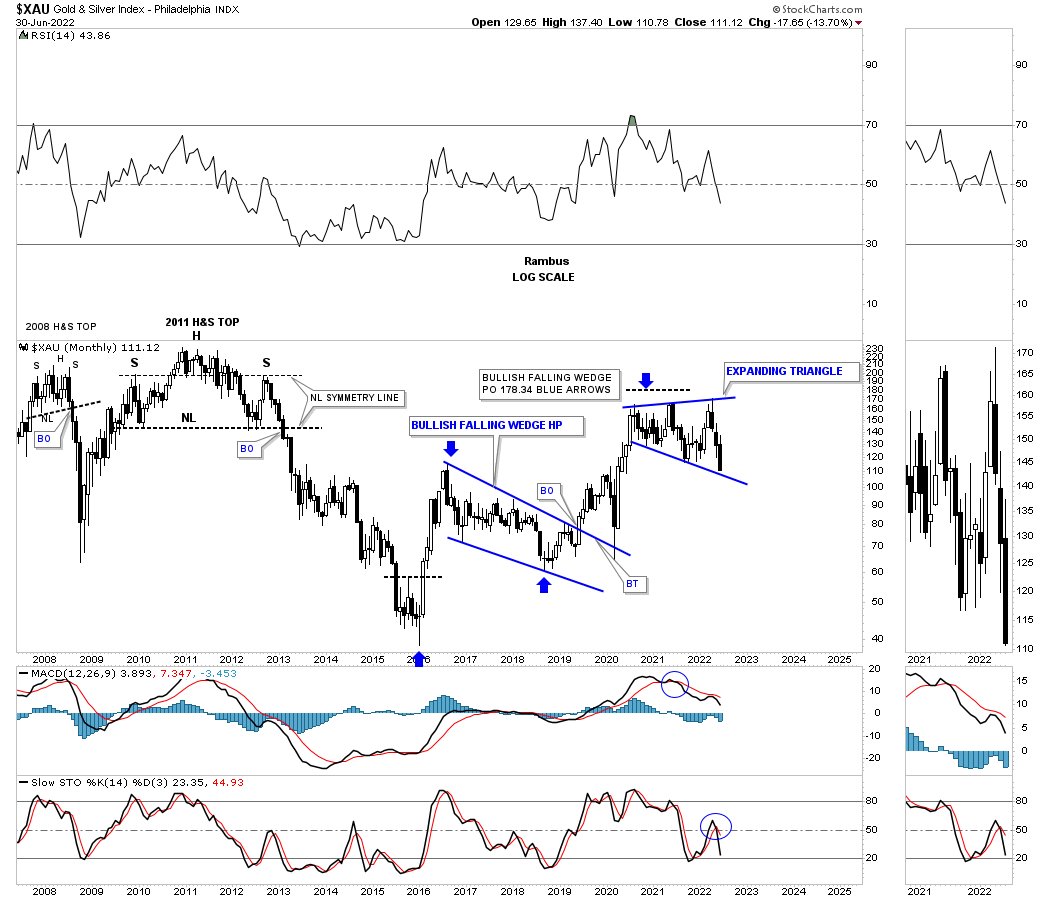

The XAU is one of the older PM stock indexes and is still finding support on the bottom rail of its 2020 expanding triangle, which has completed five reversal points putting it into the reversal pattern to the downside category if the bottom rail fails to hold support. So again, it is time for the bulls to hold support and show they are strong and mean business.

September 18th:

The XAU is now trading below the bottom rail of the blue 5 point expanding triangle reversal pattern.

When we saw the initial reaction off of the 2020 high I mentioned that it would not be surprising to see a sideways trading range that could last until the intersection of the bottom rail of the blue trading range and the bottom trendline of the 2000 secular bull market uptrend channel. As you can see Gold is just about there.

I’m using Gold a as proxy for the rest of the PM complex. How Gold goes so does the rest of the PM complex. Last Thursday GLD broke below the bottom of the 2020 trading range which could be the beginning of another leg down after a possible backtest. On the other hand if Gold can trade back above the bottom rail of the 2020 trading range then we could be seeing a bear trap before prices move higher. Gold has finally reached it most important inflection point in a long time. Keeping an open mind. All the best…Rambus

US and World Stock Markets

Before for we look at the US and world stock markets tonight there is one sector that I would like to show you first because of its possible implications going forward.

For those that have been with us through the years know that I was a staunch bull for the US stock markets since our inception back in October of 2011. The 2009 crash low was already two years old and the stock markets looked extremely bullish based on the long term quarterly charts.

There were several sectors, technology TQQQ, semiconductors SOXL and the biotechs LABU that did very well for us during the bull market years. I was pretty much alone with the bullish thesis which was fine because the PM complex began its bear market in 2011.

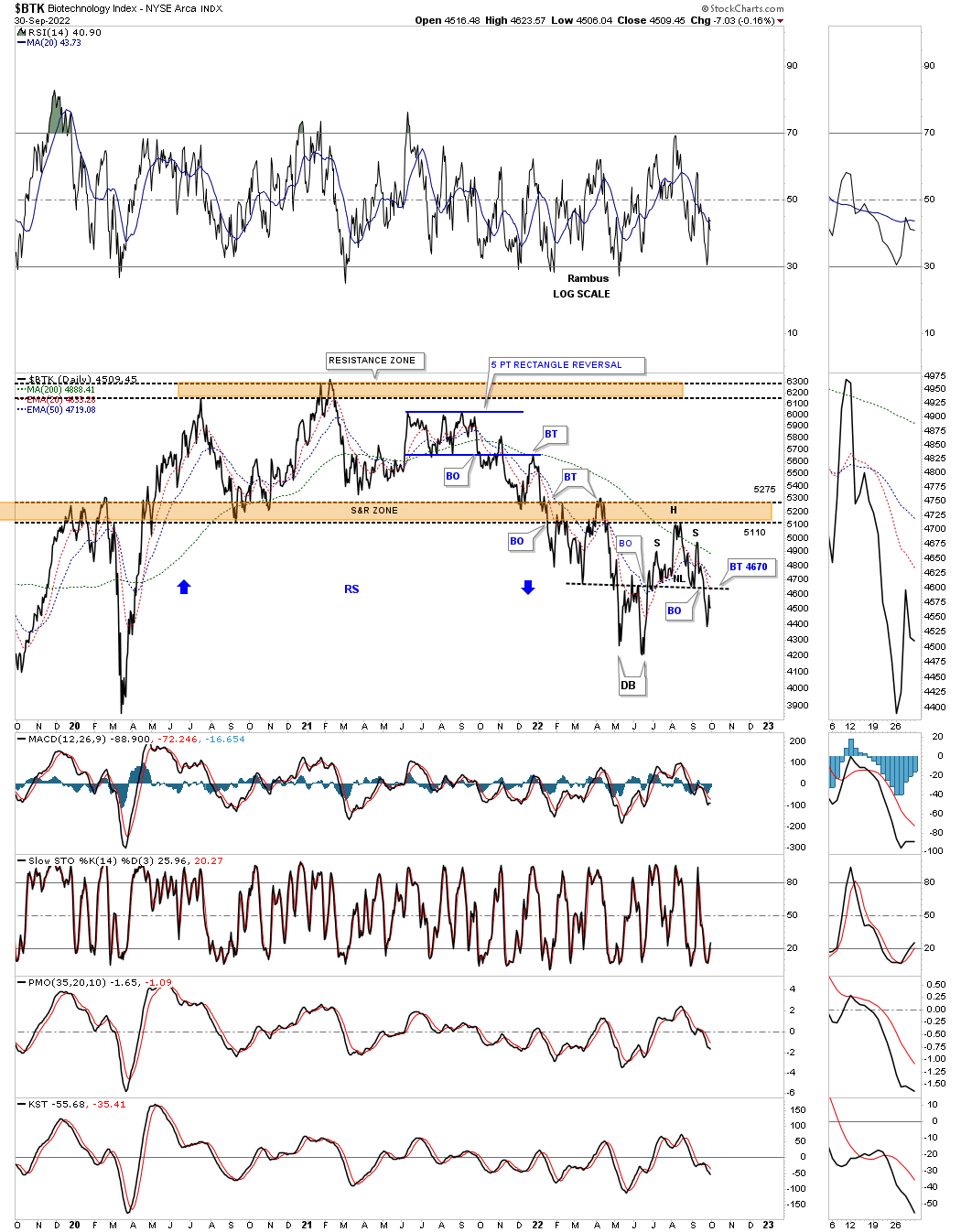

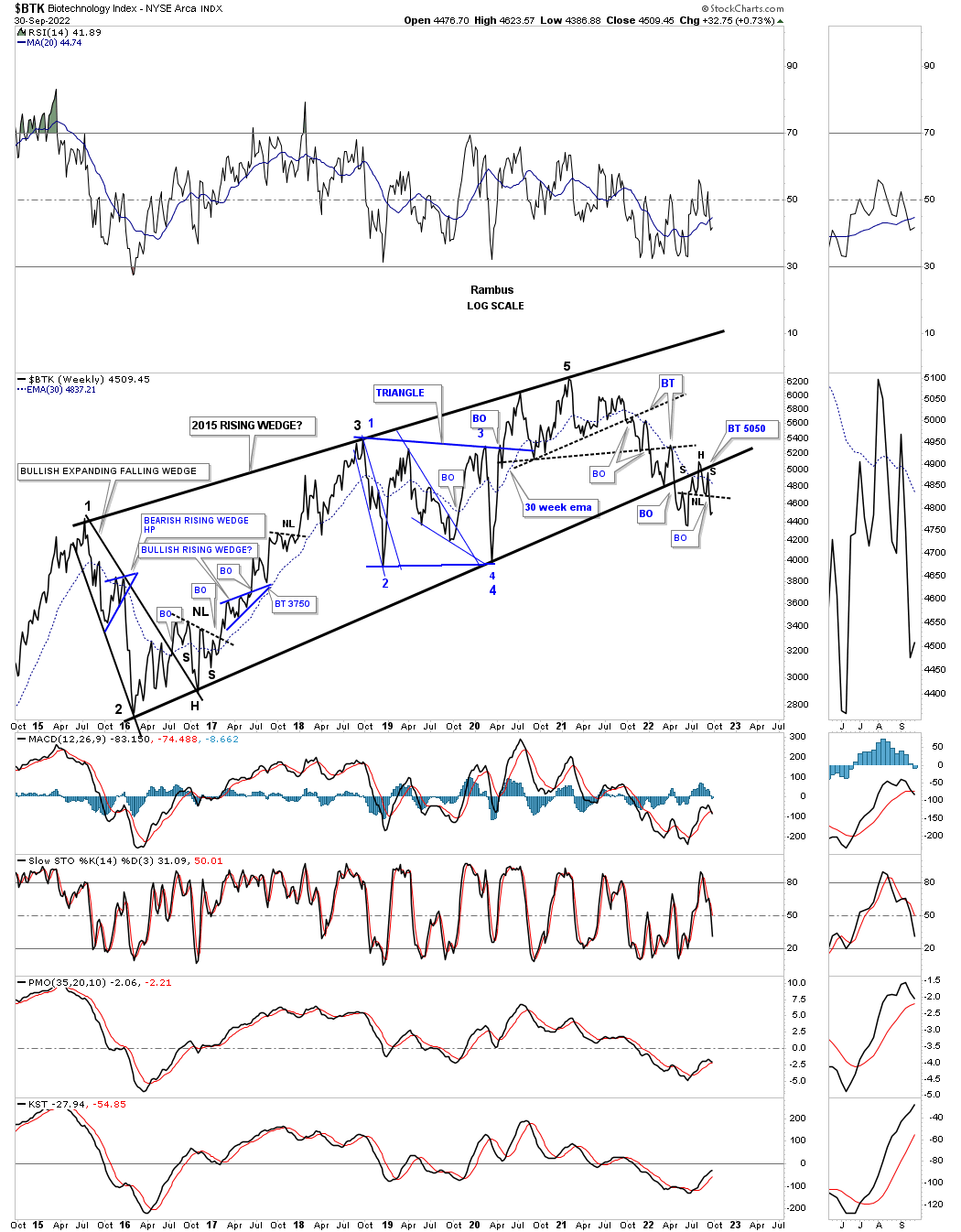

What I want to show you tonight are three charts for the BTK, biotechnology sector, which is showing me something I refused to believe until a year or so ago. Even after taking the biggest loss since the founding of Rambus Chartology, it was hard for me to grasp the consequences of what was truly happening in this sector that I had been following when it was born in the 1990’s. I knew this sector inside and out and it never let me down.

Earlier this year I finally began to realize that something was amiss with the biotech sector which may have long term implications for the rest of the stock markets. Keep in mind this sector had been by far the strongest sector in the markets for well over 20 years. Even during the 2009 crash it held up extremely well unlike the rest of the sectors.

Lets start with the daily line chart for the BTX which shows the upper and lower brown shaded support and resistance zones. As you can see in January of this year the price action broke below the lower S&R zone and then had two separate backtest from below. Back in the summer the BTK put in a double bottom which looked promising and the price objective was reached at the bottom of the S&R zone which I believe is the head of a H&S top now. Recently the price action broke below the neckline with a backtest the week before and is rolling over again.

Now lets look at the long term weekly chart which I’ve been following everyday for years which shows the internal structure of the 2015 rising wedge formation. If the secular bull market was going to continue this sector would be the leader as it always had been. Note the breakout below the bottom rail of the 2015 rising wedge formation which shows the backtest to the underside being that H&S top on the daily line chart above.

This long term monthly chart shows its rally into the 2000 bull market high which took place shortly after its inception. It was a sight to behold if you were trading in the markets back then. Just like all the stock markets around the world the BTK also experienced a long drawn out sideways trading range that took close to ten years to complete. That ten year triangle consolidation pattern is a bit deceiving because the distance between the third and fourth reversal points is very small compared to most of the other sectors. It was also the first one out of the gate after the 2009 crash low was completed.

Then came the first real correction that began at the 2015 high which was the beginning of the now seven year rising wedge formation with the weekly chart above showing you the internal structure. I intentionally left the bottom rail lite so you can see the breaking out and backtesting process that has been ongoing since the first of the year.

What the BTK is strongly suggesting to me is the secular bull market that I was so fond of since its beginning at the 2009 crash low is most likely over now. When you see the most bullish sector breaking below a seven year trendline that is not going to bode well for the rest of the sectors. You can see the 2015 rising wedge has now completed five reversal points which puts the rising wedge into the bearish rising wedge reversal category. Unless something changes drastically the BTK is going to show us the way lower. Remember big patterns lead to big moves just like the 2000 ten year triangle led to a very big move higher.

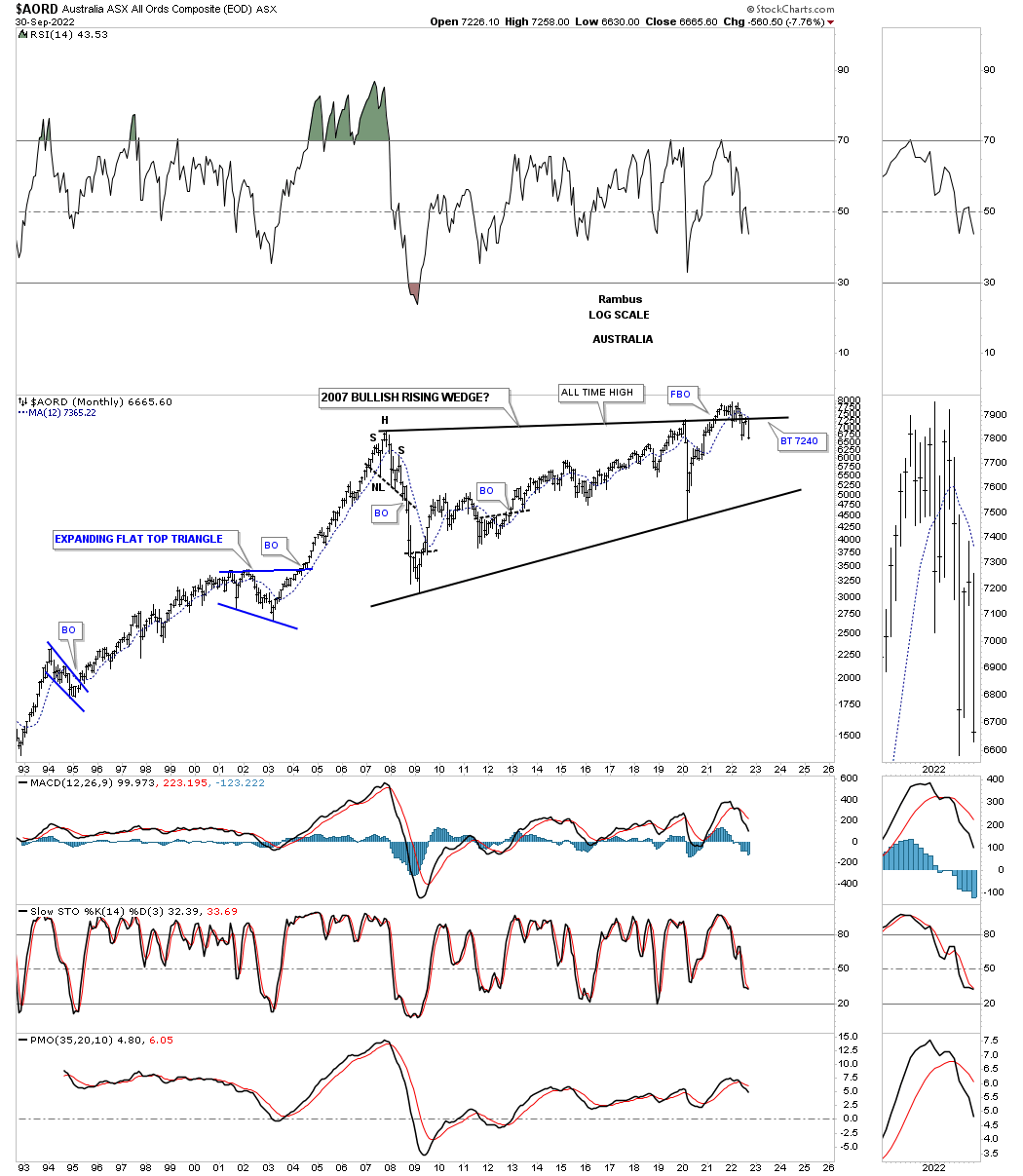

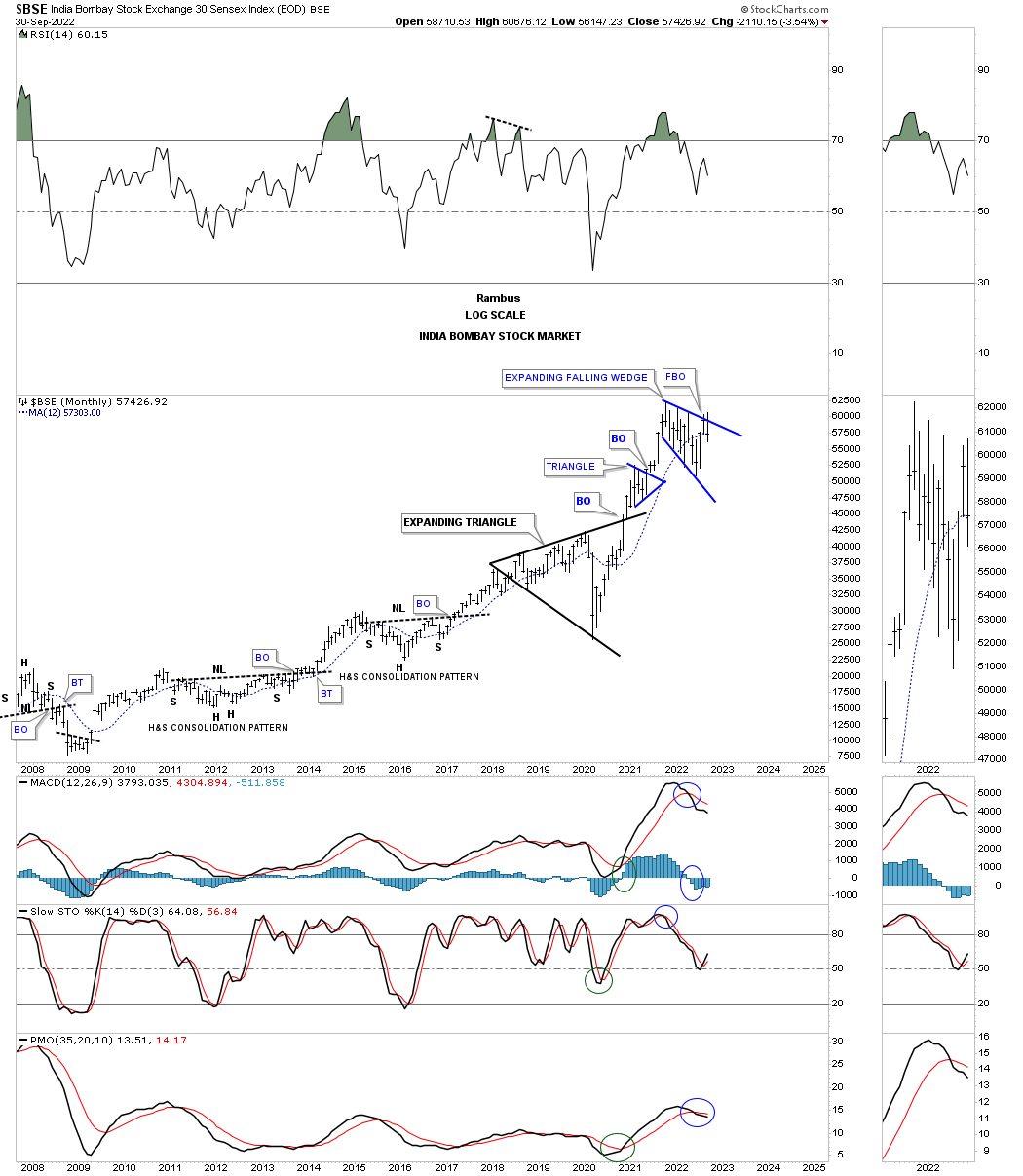

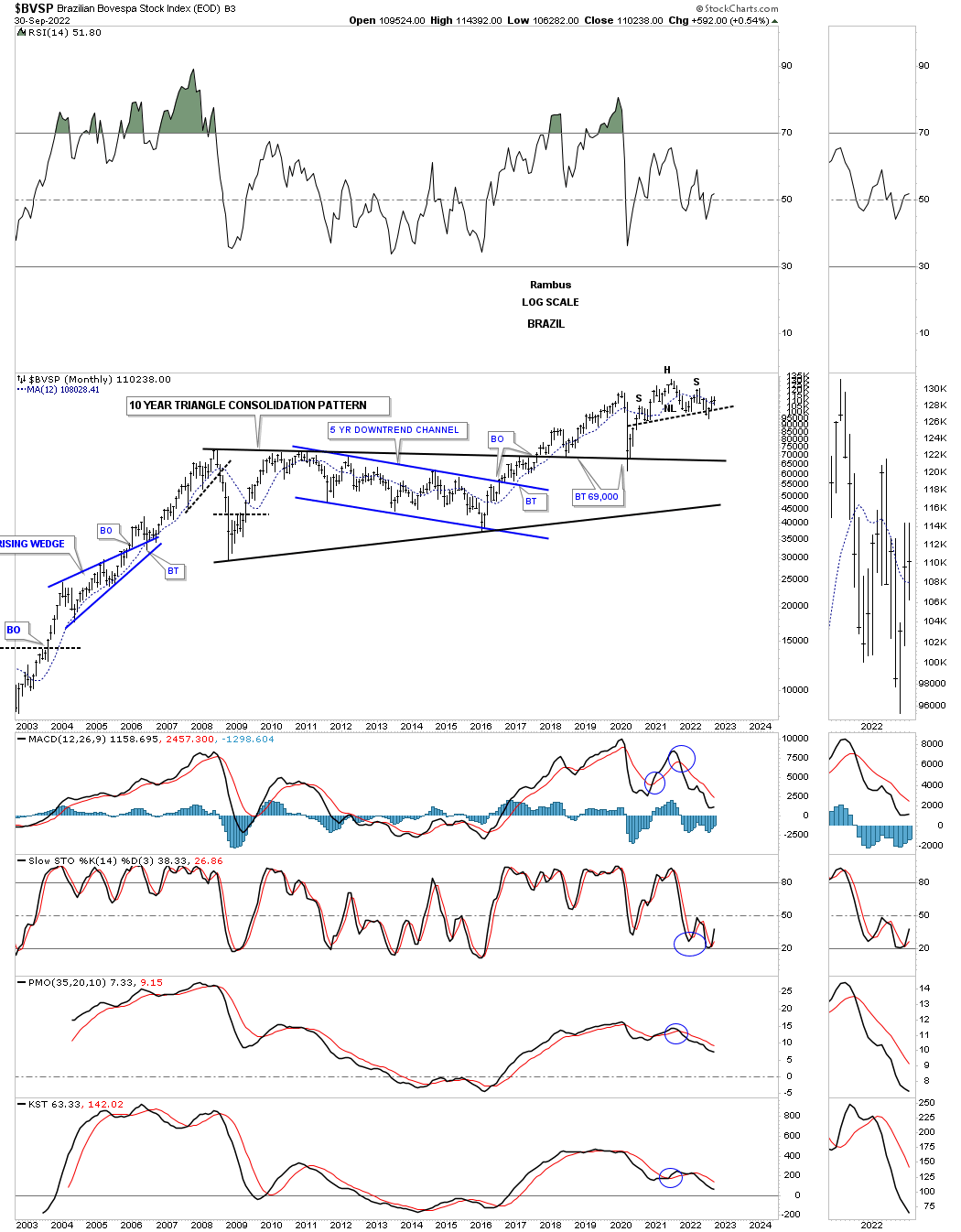

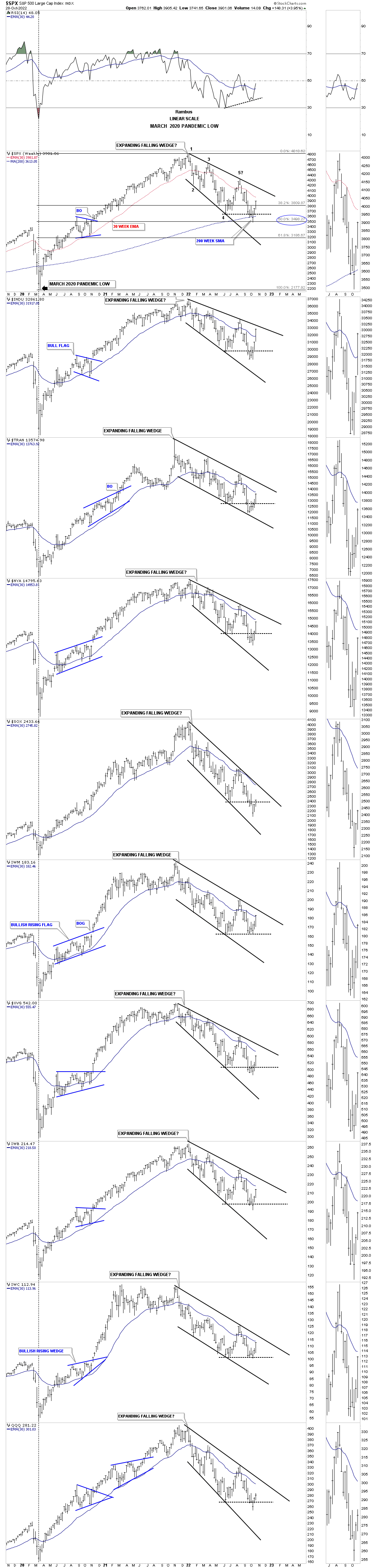

Using the BTK as a backdrop lets look at some world stock markets to see what they may be showing us. What you will see are many false breakouts above some very large trading ranges that suggests the finally thrust up was a bull trap in what had been the 2009 secular bull market. These charts to follow are pretty self explanatory. Once the price action trades back inside of the pattern the breakout is negated. Also note how the 12 month sma plays a key role as resistance.

AORD: Australia

BSE: India. This is one of the stronger stock markets in the world right now.

BVSP, Brazil

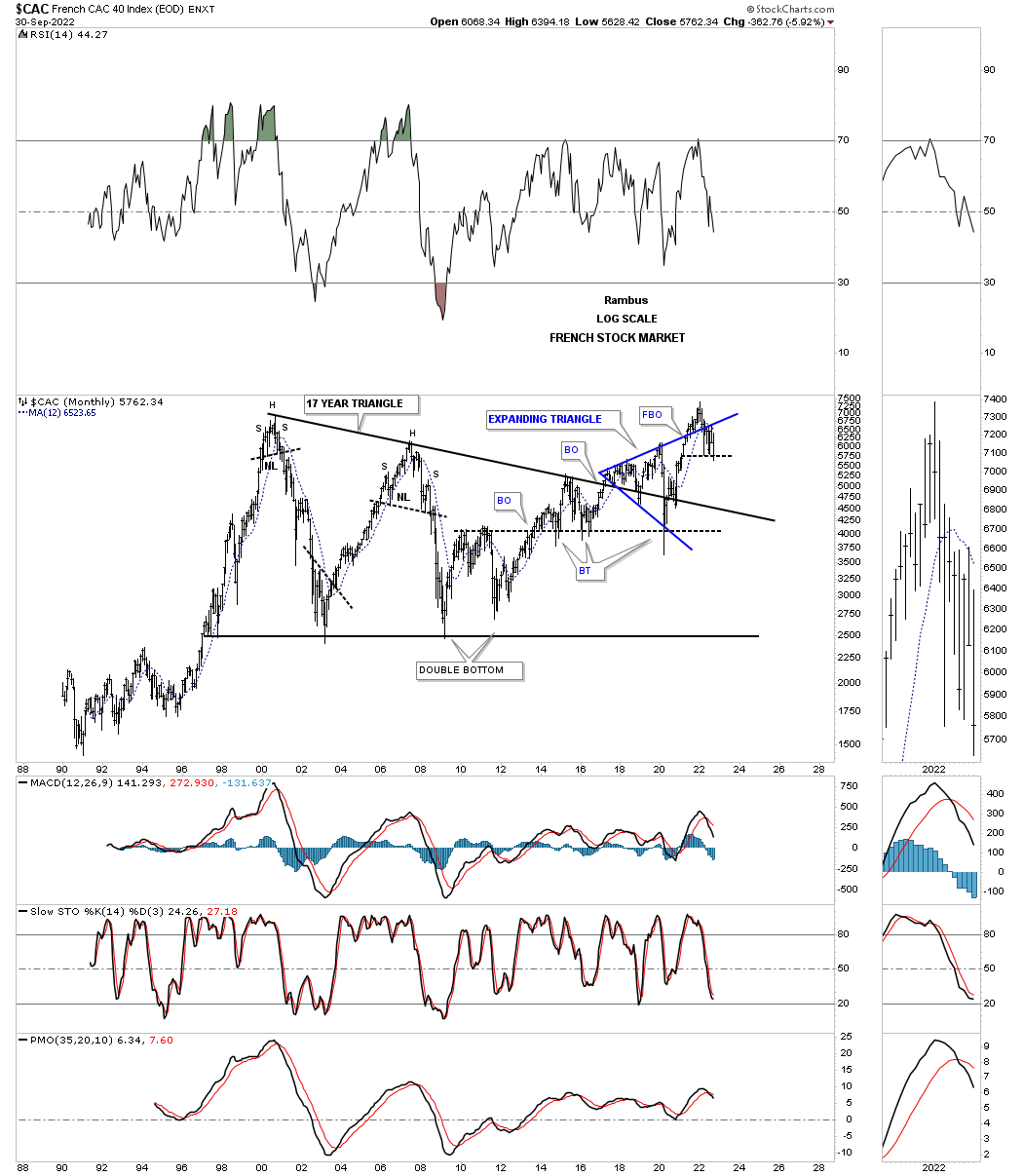

CAC: French

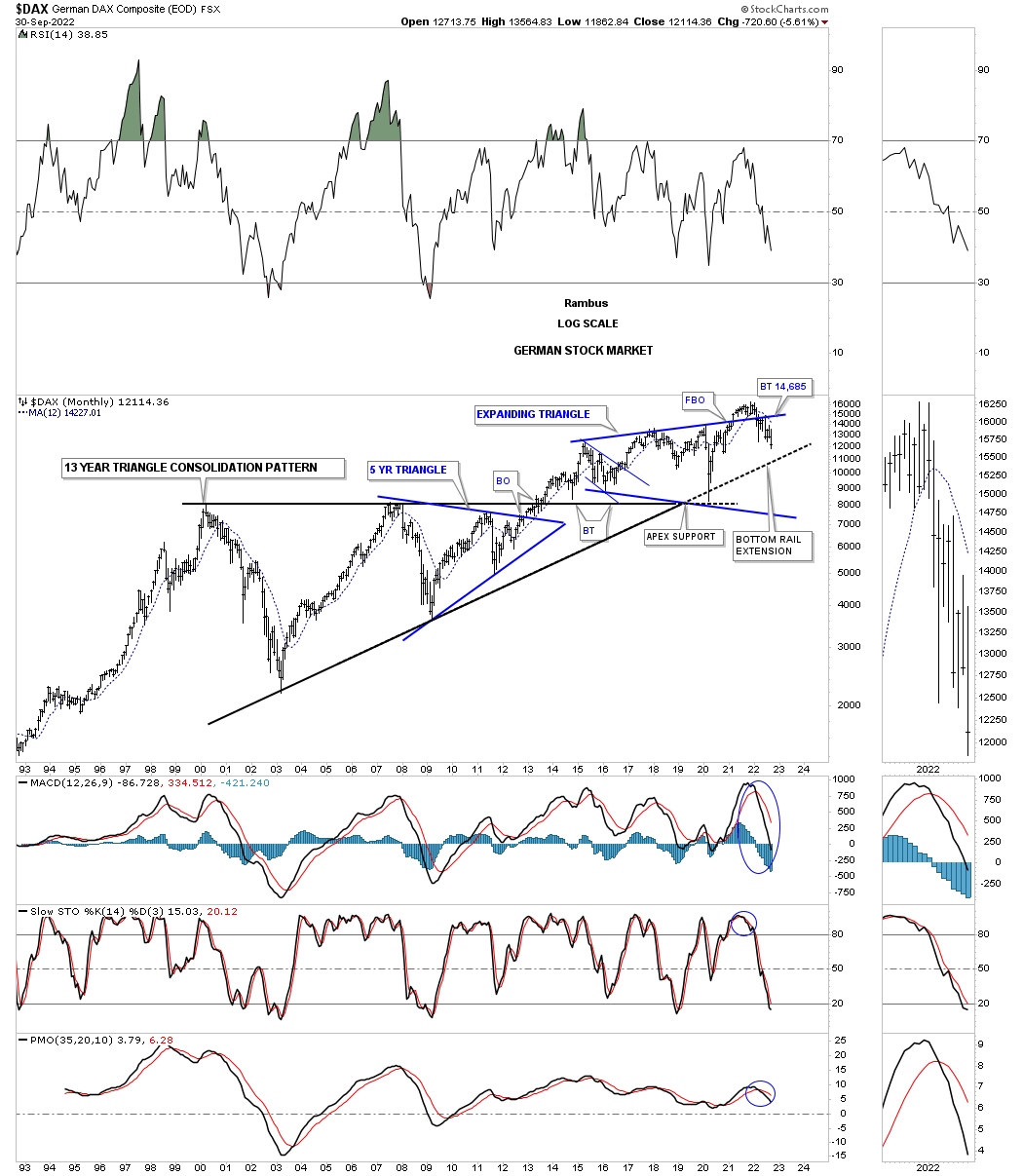

DAX: German

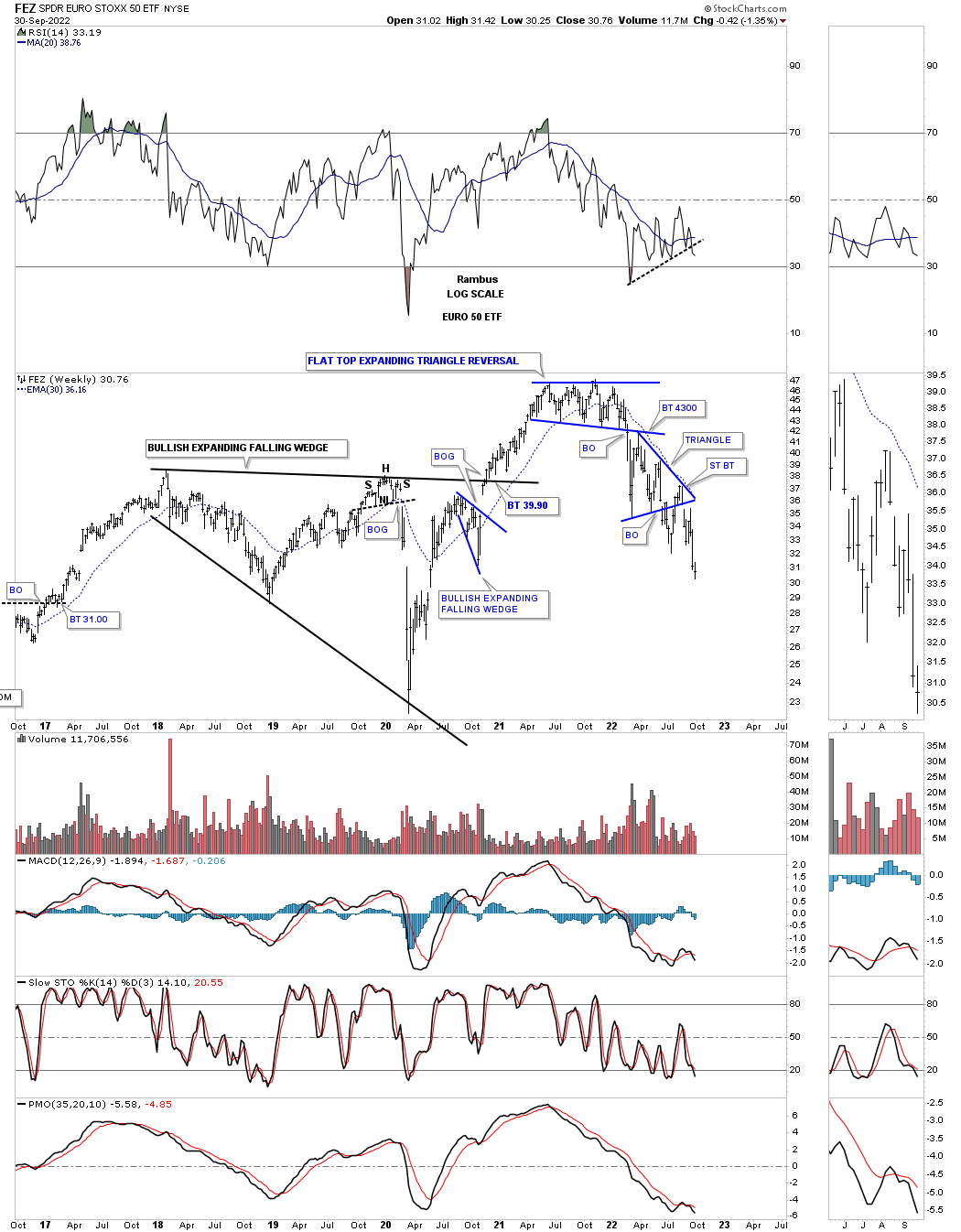

FEZ: EURO 50 one of the worst preforming areas.

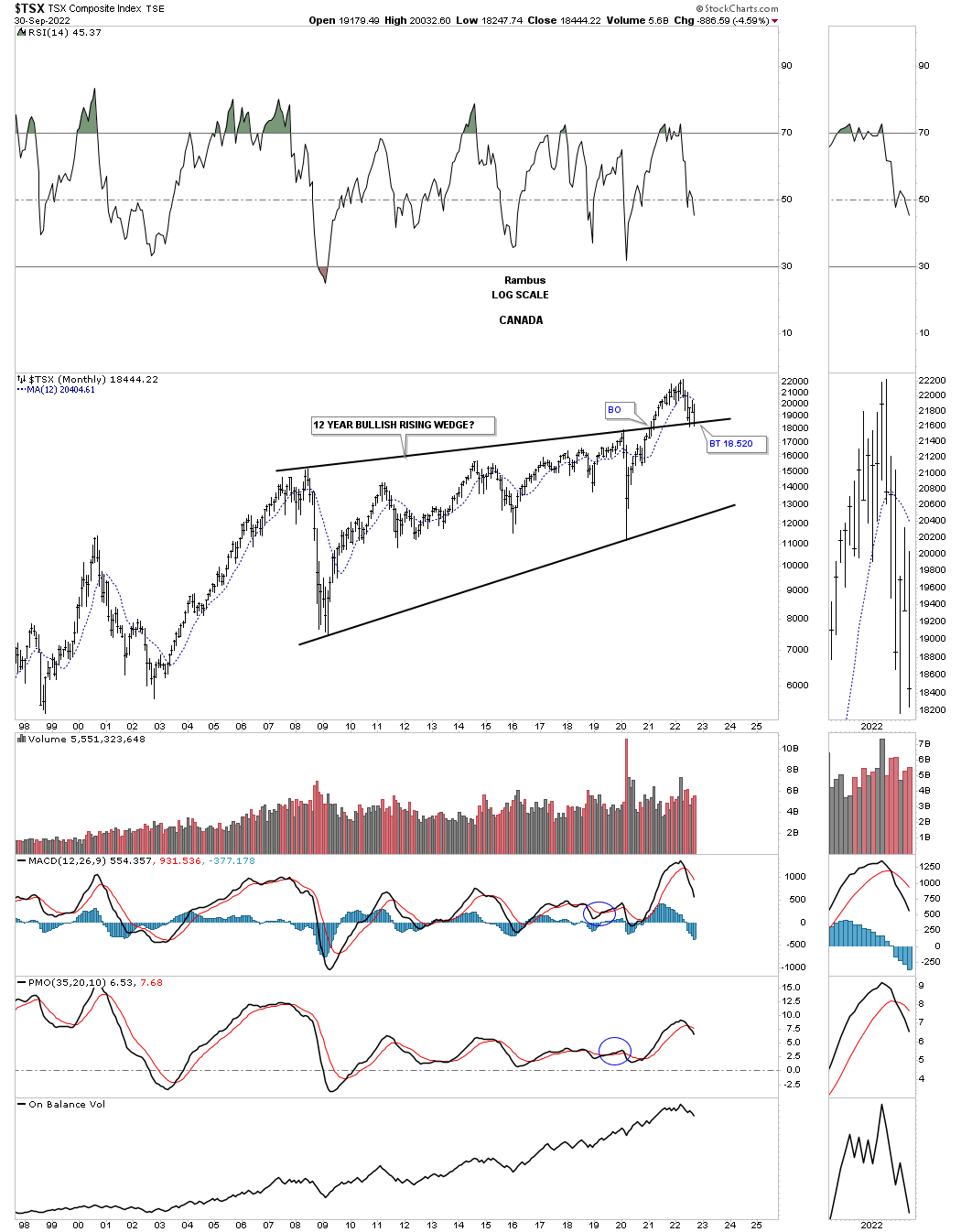

TSX: Canada. One of the few stock markets still holding the top trendline.

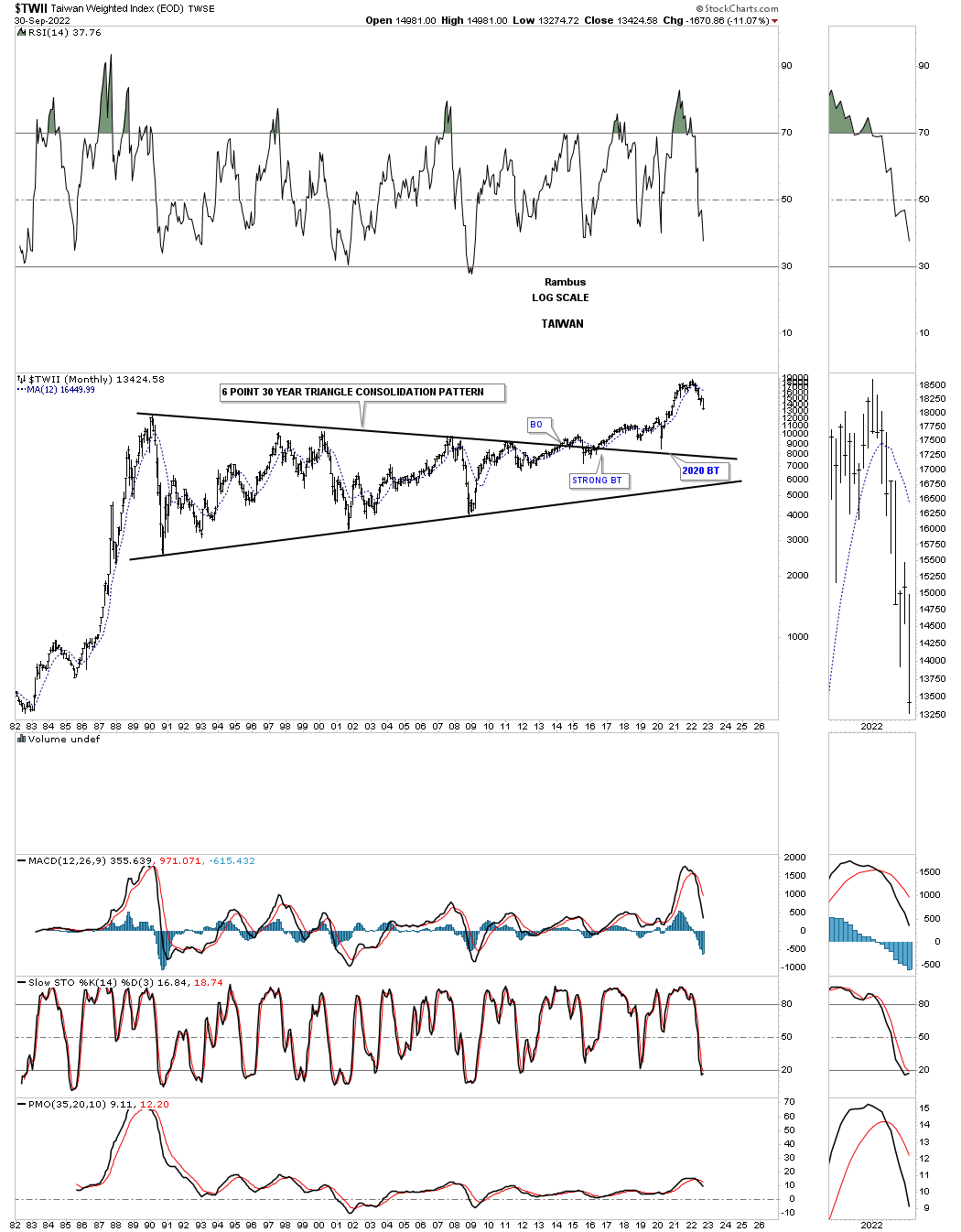

TWII: Tiawan

SSEC: China

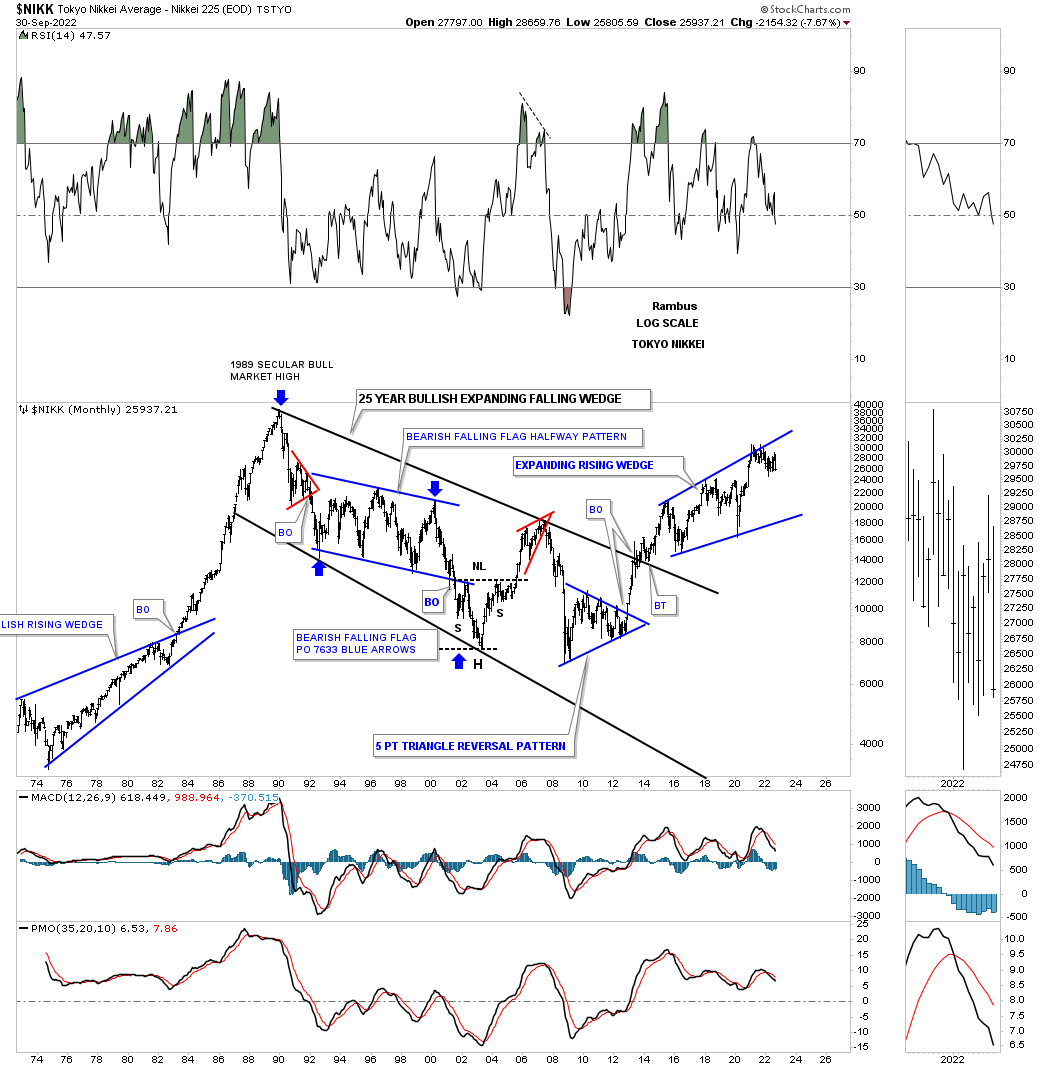

NIKK: Japan

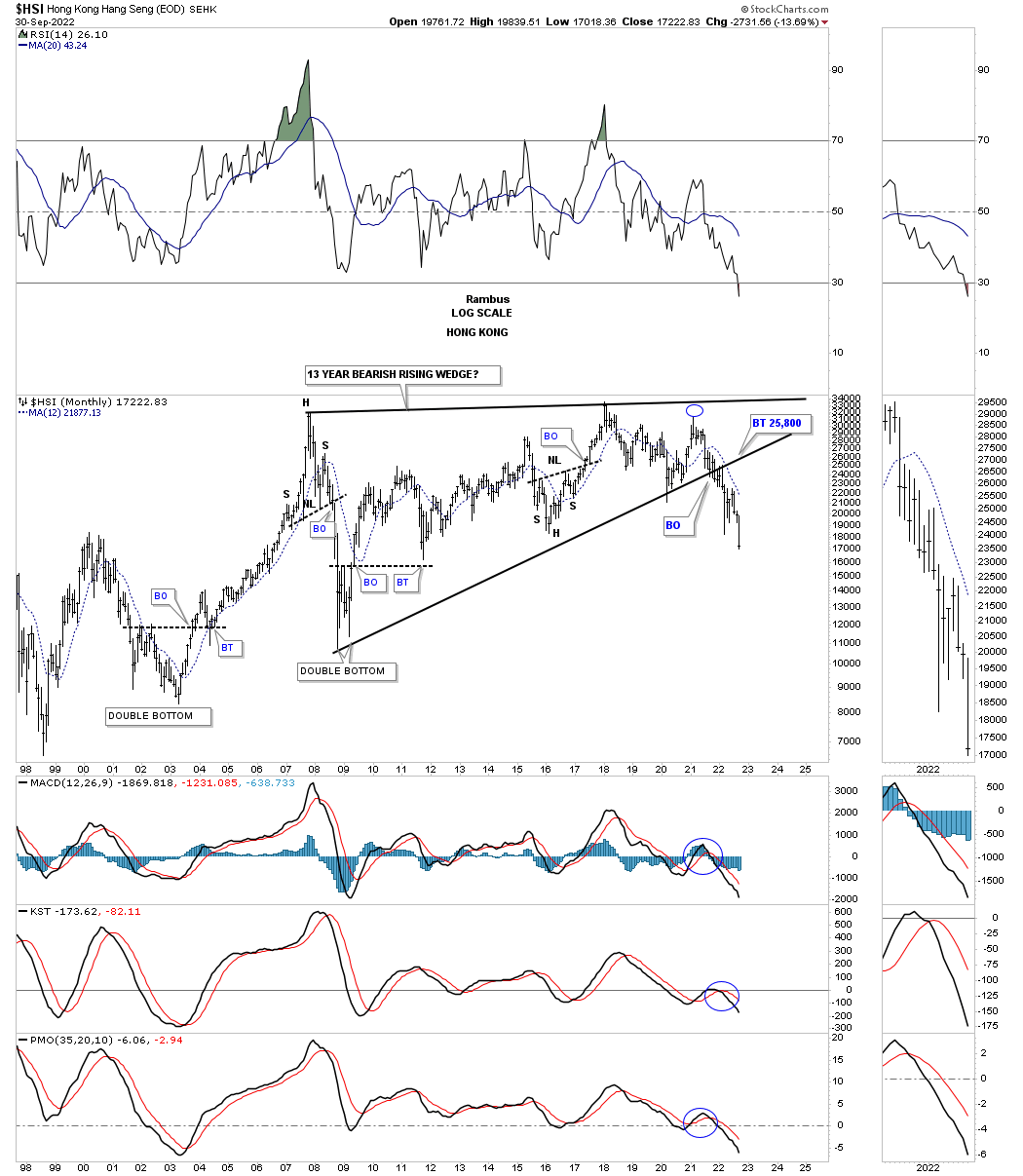

HSI: Hong Kong leading the way lower.

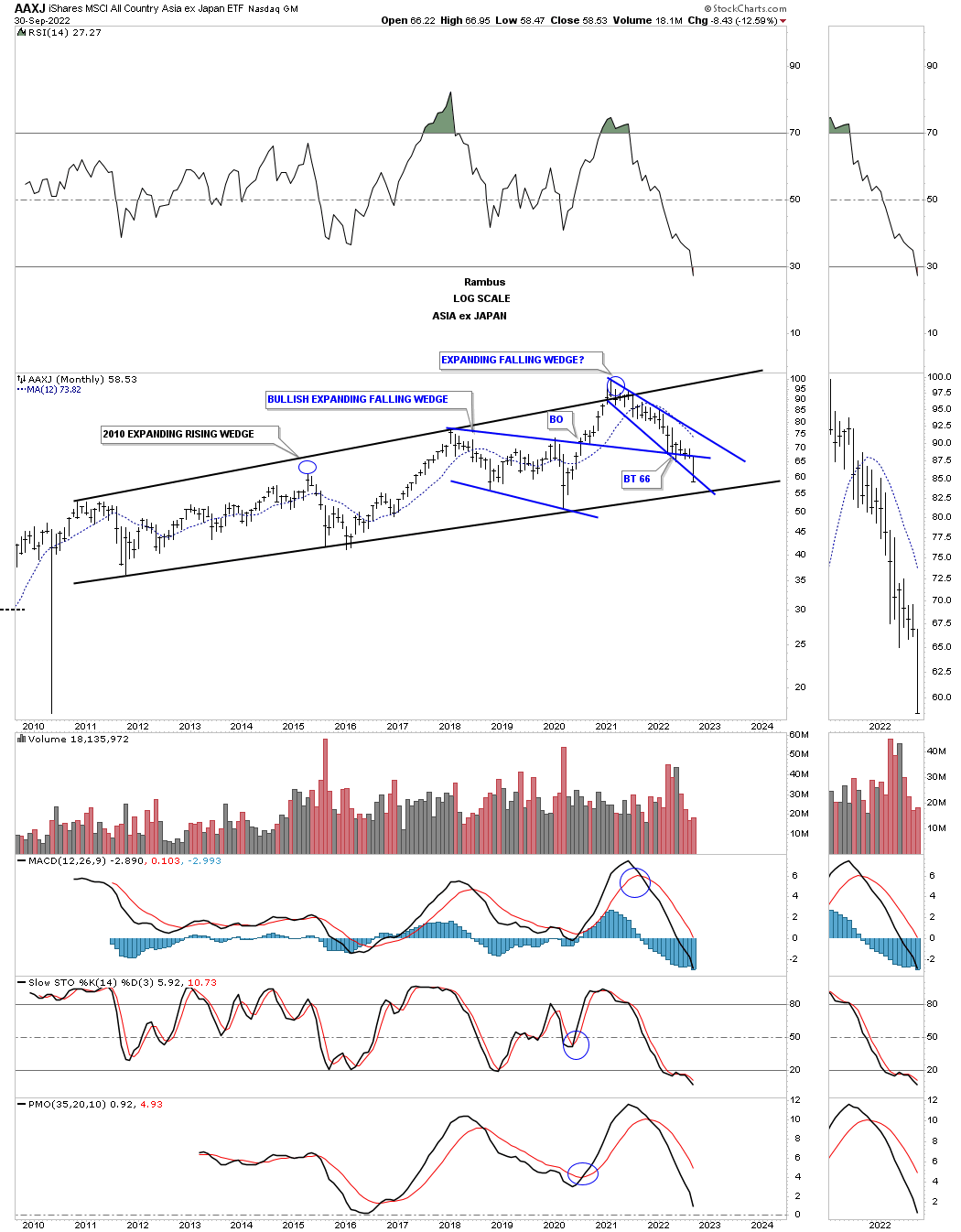

AAXJ: Asia stock markets ex Japan.

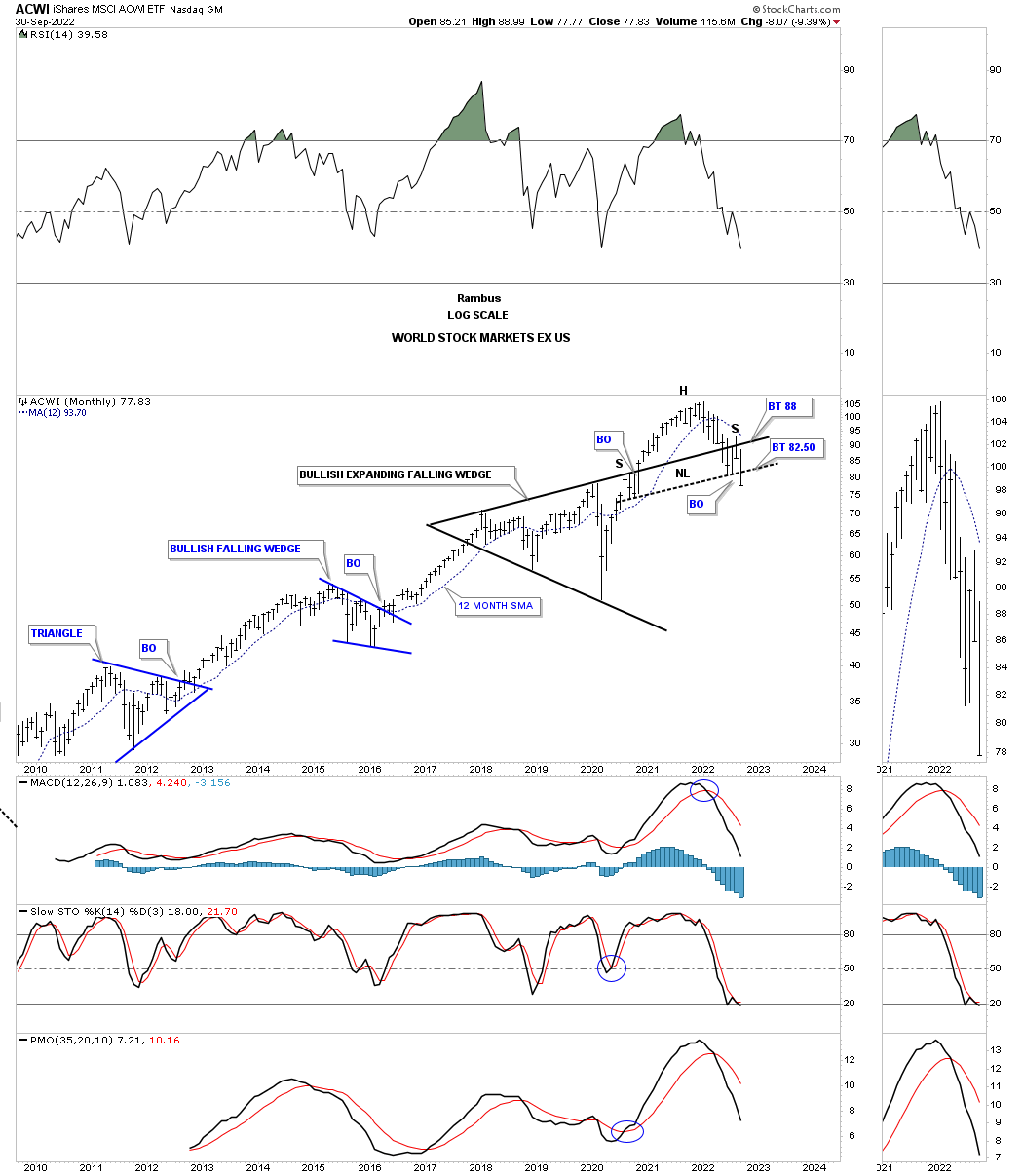

ACWI: World stock markets ex the US.

Lets move on to some of the US stock markets.

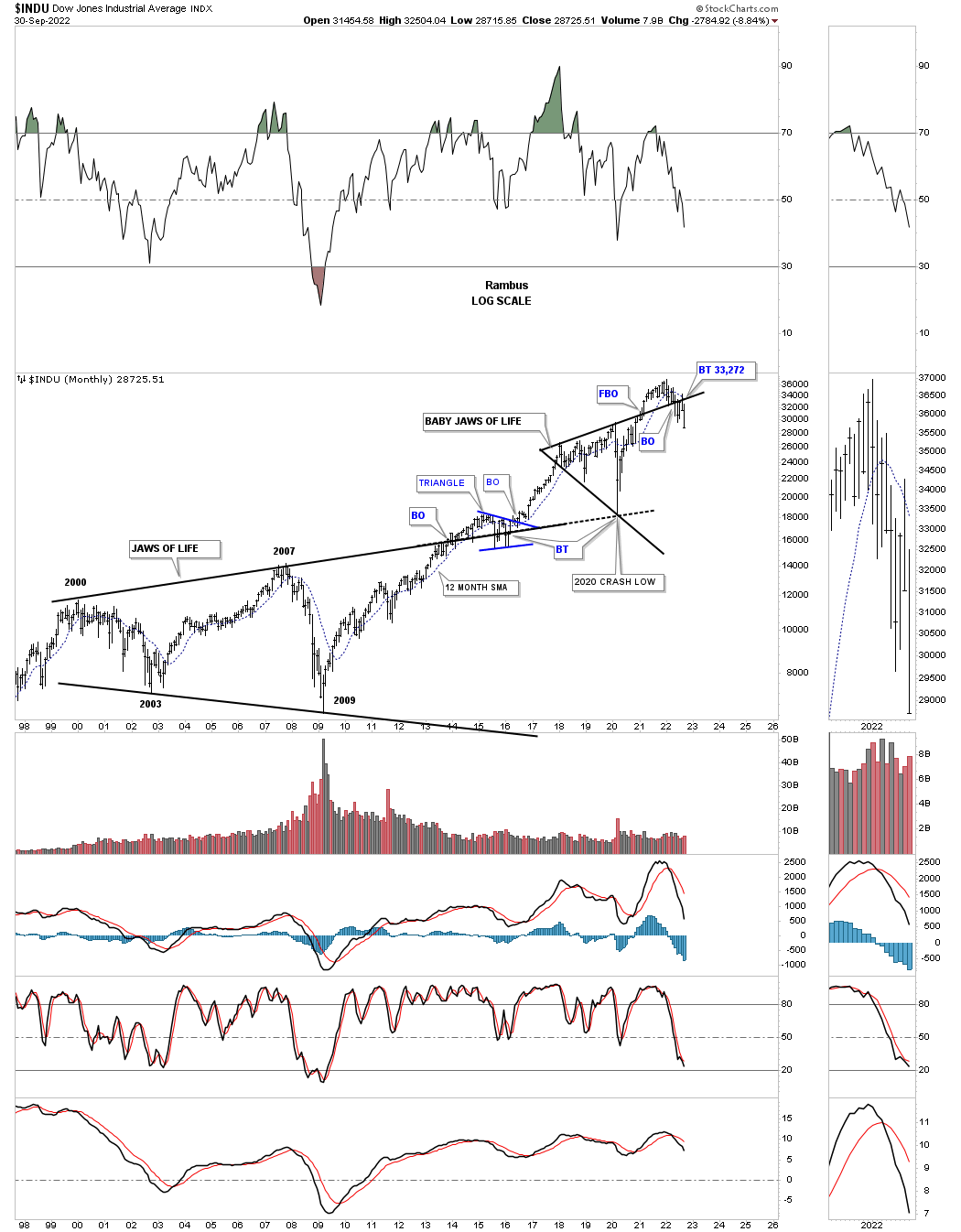

This first chart is a long term monthly chart for the INDU which shows its massive 2009 Jaws of Life. After the breakout the INDU produced a strong impulse move higher which came to an end during the 2020 pandemic crash low. That nearly two year rally into the beginning of 2022 looked very promising until the top rail gave way. You can see a backtest from below in August and now a lower low for September.

This quarterly chart shows how the secular bull market that was unfolding until the top rail of the baby Jaws of Life gave way. The first real area of support would be the top rail of the big Jaws of Life.

SPX monthly shows the breakout and backtest from the top rail of its expanding triangle. Also note where the 21 month sma is trading, below is bearish and above is bullish.

SPX quarterly chart shows how I was viewing its secular bull market until the recent close below the top rail of its expanding triangle.

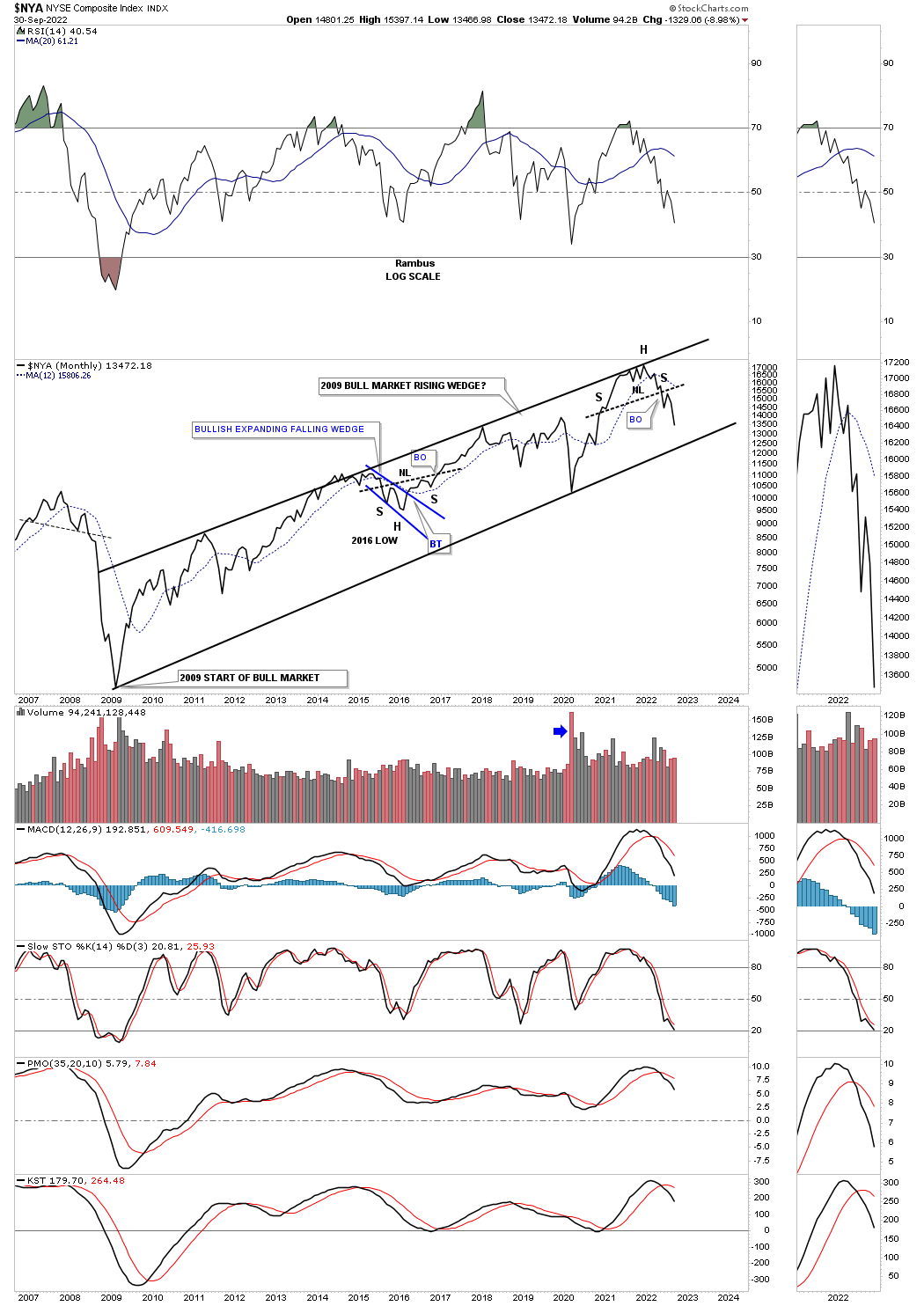

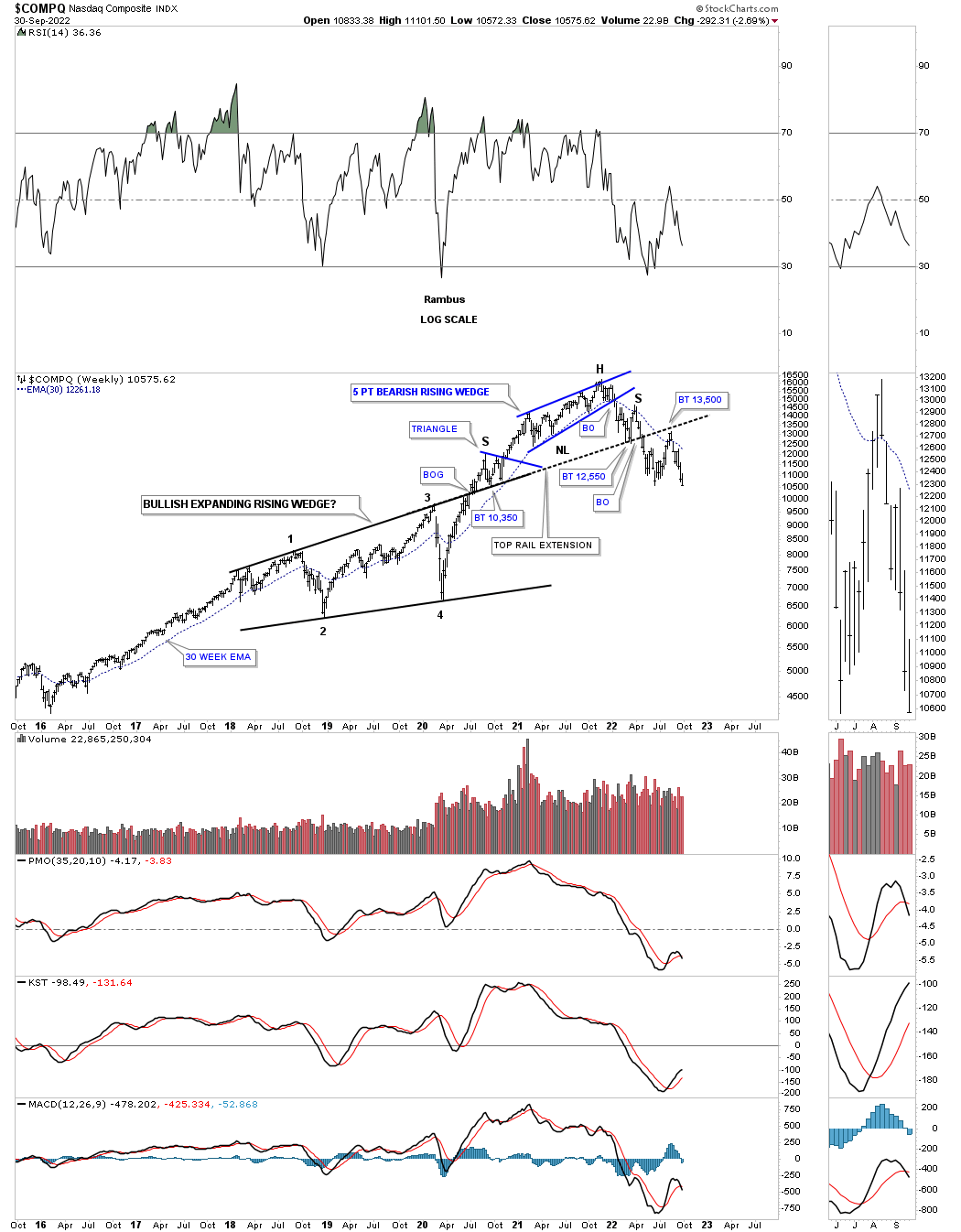

NYA long term monthly line chart showing the H&S top at the last reversal point within the 2009 rising wedge formation.

This last chart for tonight is a long term monthly chart for the COMPQ which shows some interesting Chartology. Note the 2018 black bullish expanding rising wedge with the breakout followed by the blue triangle as the backtest. The final rally built out the blue five point bearish rising wedge reversal pattern as the top. On the initial decline from the top the price action found support once again on the top rail of the black expanding rising wedge getting a decent bounce. That bounce fell way short of making a higher high which produced the right shoulder of the H&S top. Note how the top rail of the black expanding rising wedge formed the neckline and how it reversed its role to resistance on the backtest from below.

The bottom line is that until the price action can trade back above the top rail of those multi year expanding triangles and rising wedges the bears are in control. I always try to keep an open mind to any eventualities, but for the time being it is up to the bulls to do some work to negate the series of lower lows and lower highs. All the best…Rambus

Interest Rates

Interest rates seem to be on everyone’s mind right now. How high will the fed raise them, when will they pivot, how are they going to affect the markets? Right now there are more questions than answers.

Back in April of this year I wrote an in-depth, Weekend Report, on interests rates that were showing a potential massive change taking place under the surface. Interest rates had been falling since their all time high made in 1981 at 15% to the low of .50 made in early 2020.

Normally when a long term bull or bear market comes to an end there is often a parabolic move that ends the secular trend. When interest rated put in their low in the spring of 2020 there was a vertical move down which was a warning sign that the 39 year run was coming to an end.

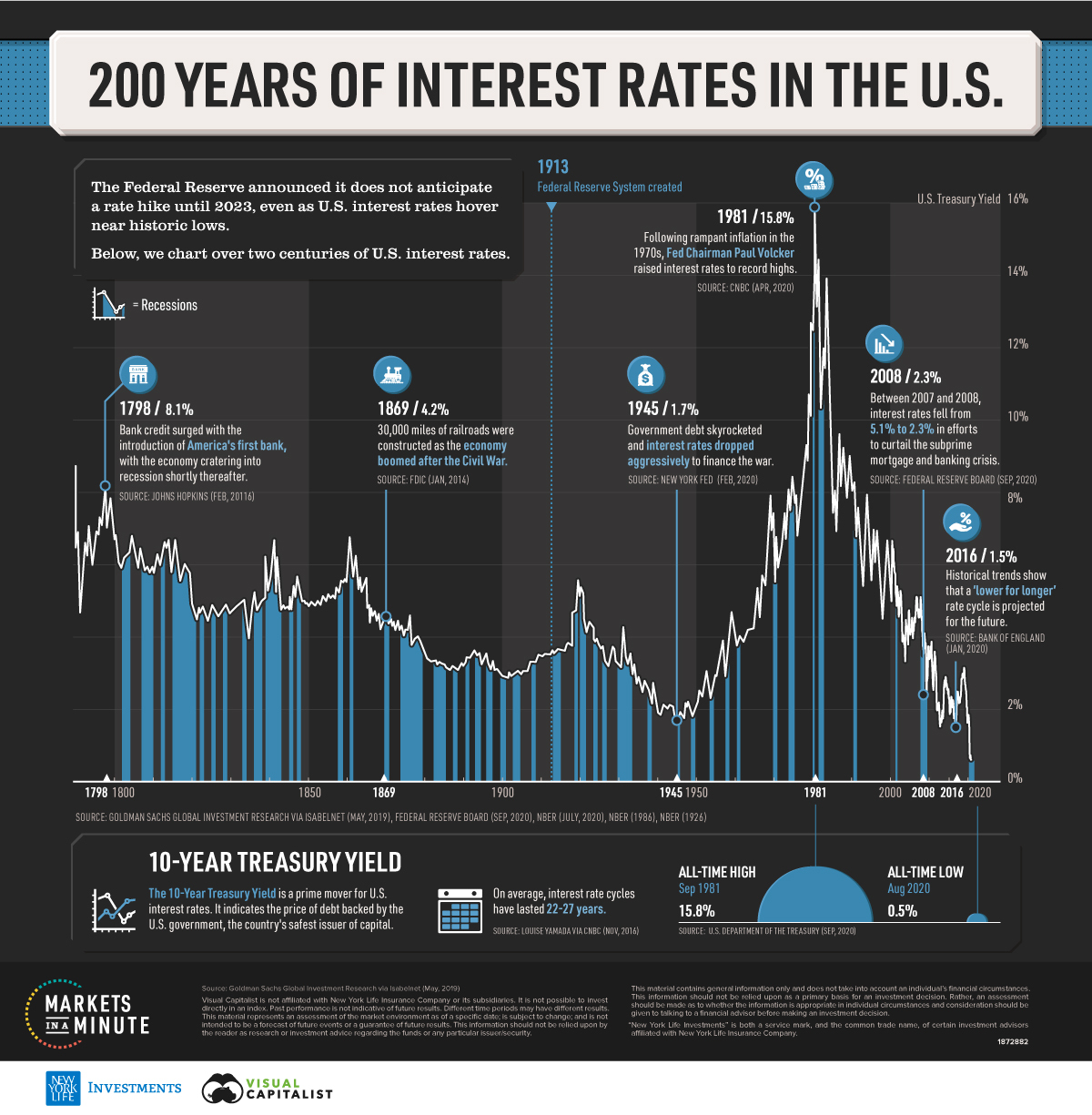

What I would like to show you in this, Weekend Report, what the charts were showing back in April and June of this year along with the current charts so you can see how the move has been unfolding in slow motion because of the long term nature of the charts. There may be a paragraph or two that repeat between the different time fames because I did a comparison between the April and June timeframes. We’ll start with the 200 year history chart for the 10 year treasure yield going all the way back to 1798.

April 4th: 200 year chart for interest rates.

The other important part of the major changes taking place that are going to affect the US and the rest of the world and is still in their infancy are interest rates. Any student of stock market history knows that interest rates can be trend bound for many years before a reversal takes place. Below is a graph I found that goes back 200 years and shows once a major trend develops, either up or down it can last many years.

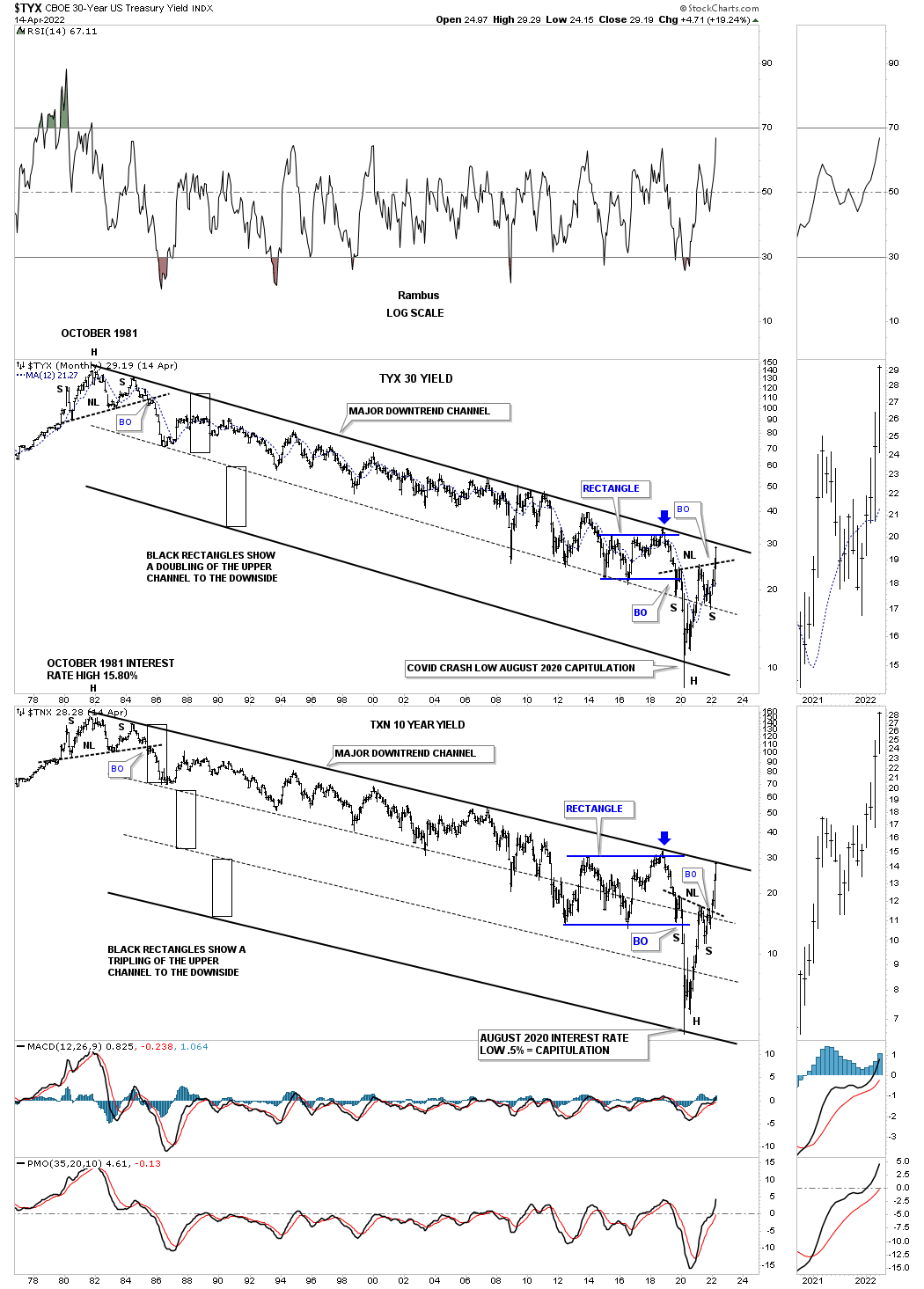

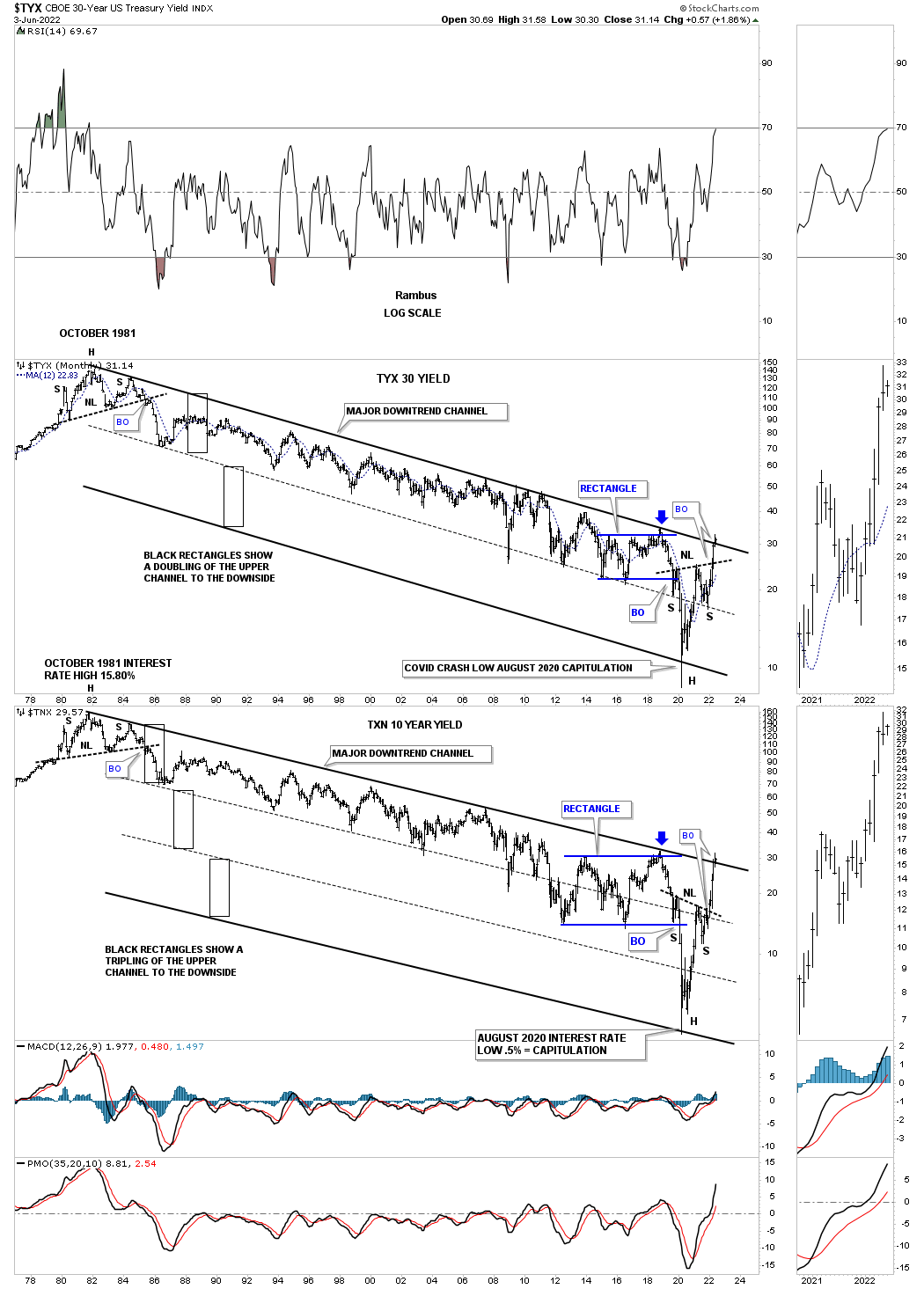

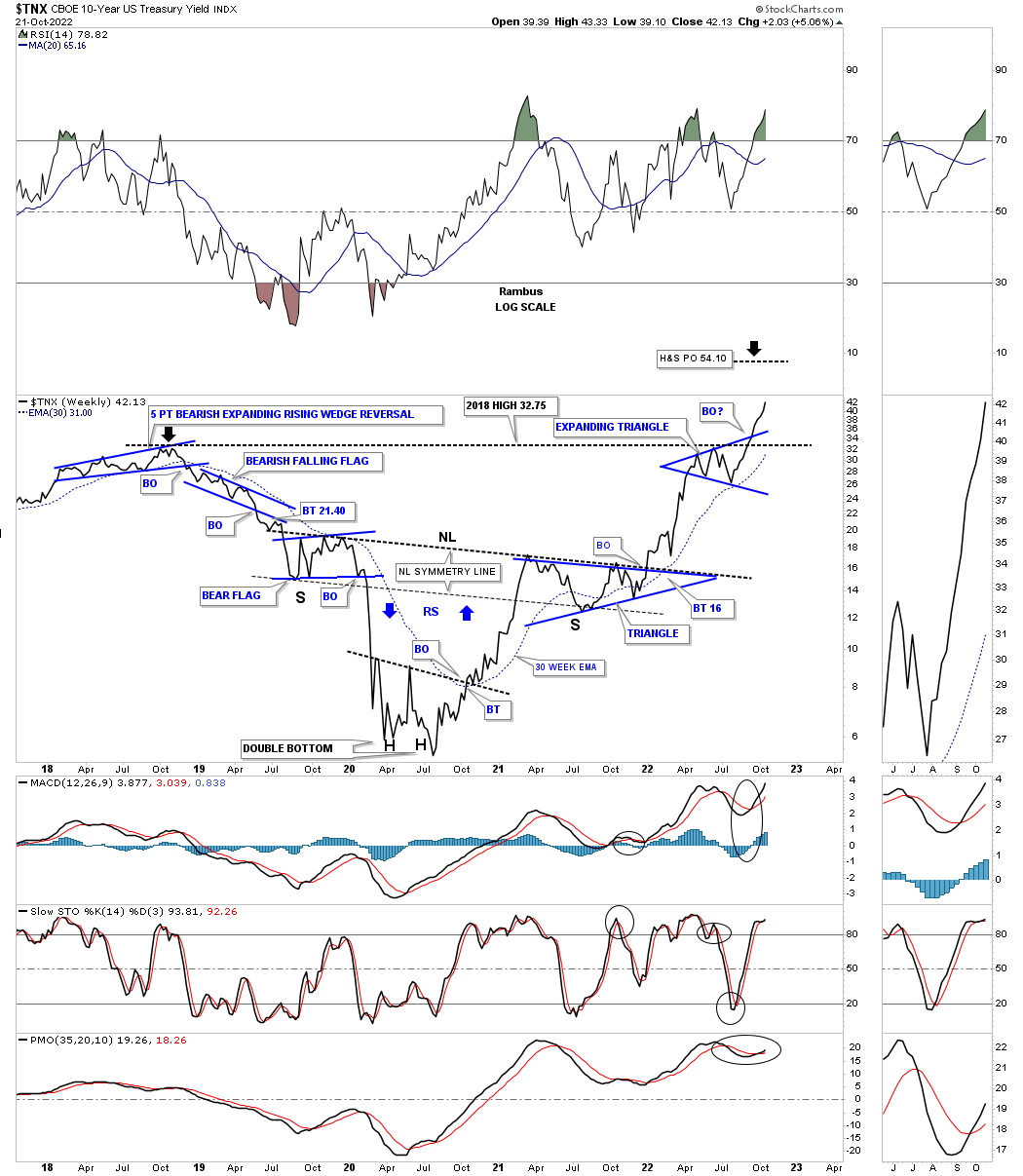

APRIL 14th: Monthly long term charts for the TYX and TNX.

Below is a long term monthly combo chart I’ve shown you through the years which shows the 30 year and ten year bond yields trapped inside of the major downtrend channel since their all time high made in October of 1981. First, notice the H&S top that formed at the end of the last cycle in interest rates in 1981.That downtrend lasted 39 years until March of 2020. The end of a major cycle often ends in a capitulation move, blue arrows, with a vertical move, in this case, to the bottom.

We’ve been following that H&S bottom on another weekly chart for the TNX well before the breakout of its neckline which ensures the 39 year downtrend in interest rates has come to a climatic end even though the top rail hasn’t been broken yet.

It took 39 years to go from 15% in 1981 to 1/2% in March of 2020. What an incredible macro event.

June 5th:

Below is a long term monthly combo chart I’ve shown you through the years which shows the 30 year and ten year bond yields trapped inside of the major downtrend channel since their all time high made in October of 1981. First, notice the H&S top that formed at the end of the last cycle in interest rates in 1981. That downtrend lasted 39 years until March of 2020. The end of a major cycle often ends in a capitulation move, blue arrows, with a vertical move, in this case, to the bottom.

So far the breakout is still in its infancy, but the inverse H&S bottom is strongly suggesting the top rail will give way. Keep in mind this is a very long term chart which show changes don’t happen overnight. How many years are interest rates going to rise in the next cycle?

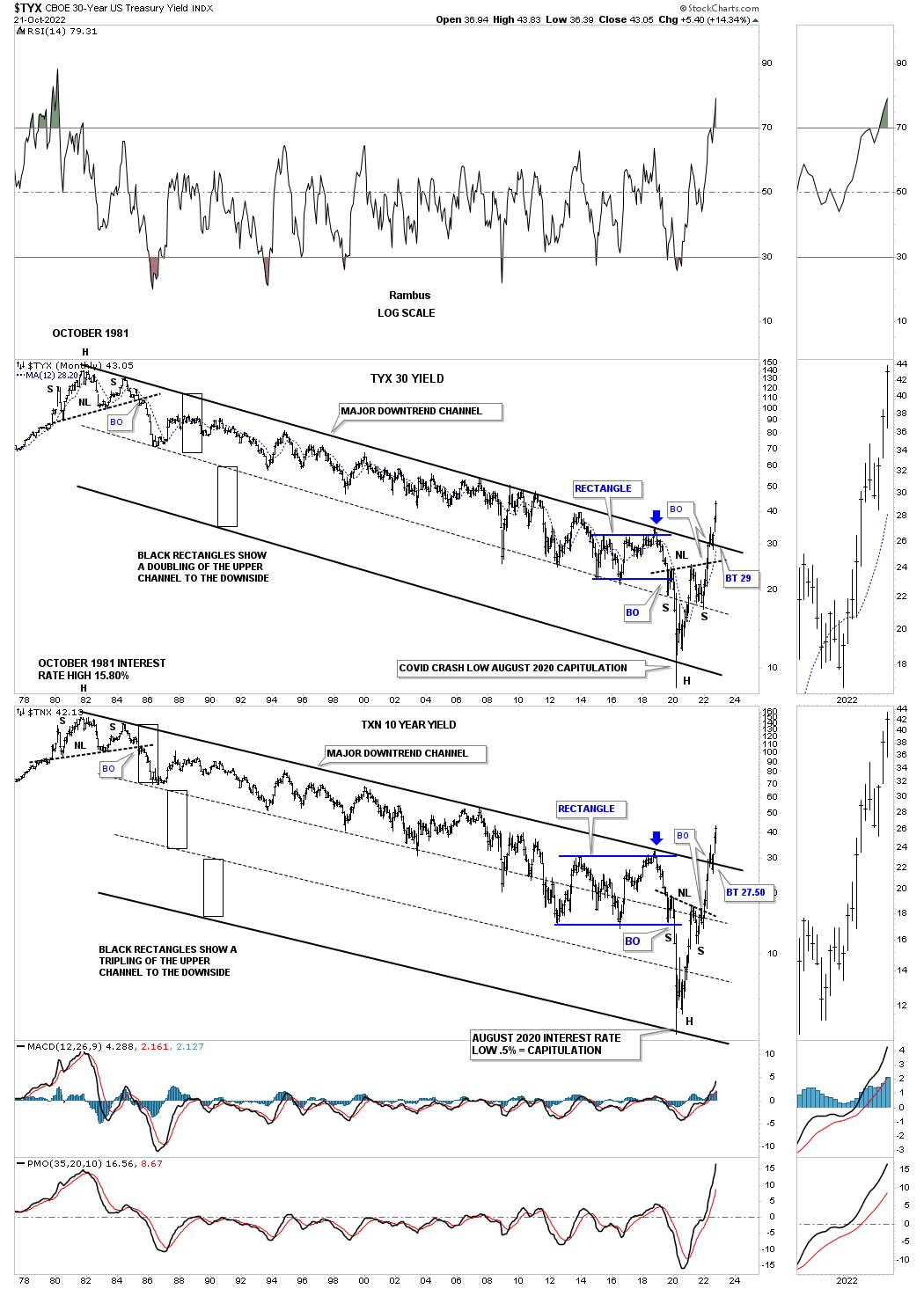

Today October 23rd:

The inverse H&S bottom strongly suggested the top rail of the 39 year downtrend channel would come to an end. You can also see the breakout and backtest to the top trendline and the current impulse move higher.

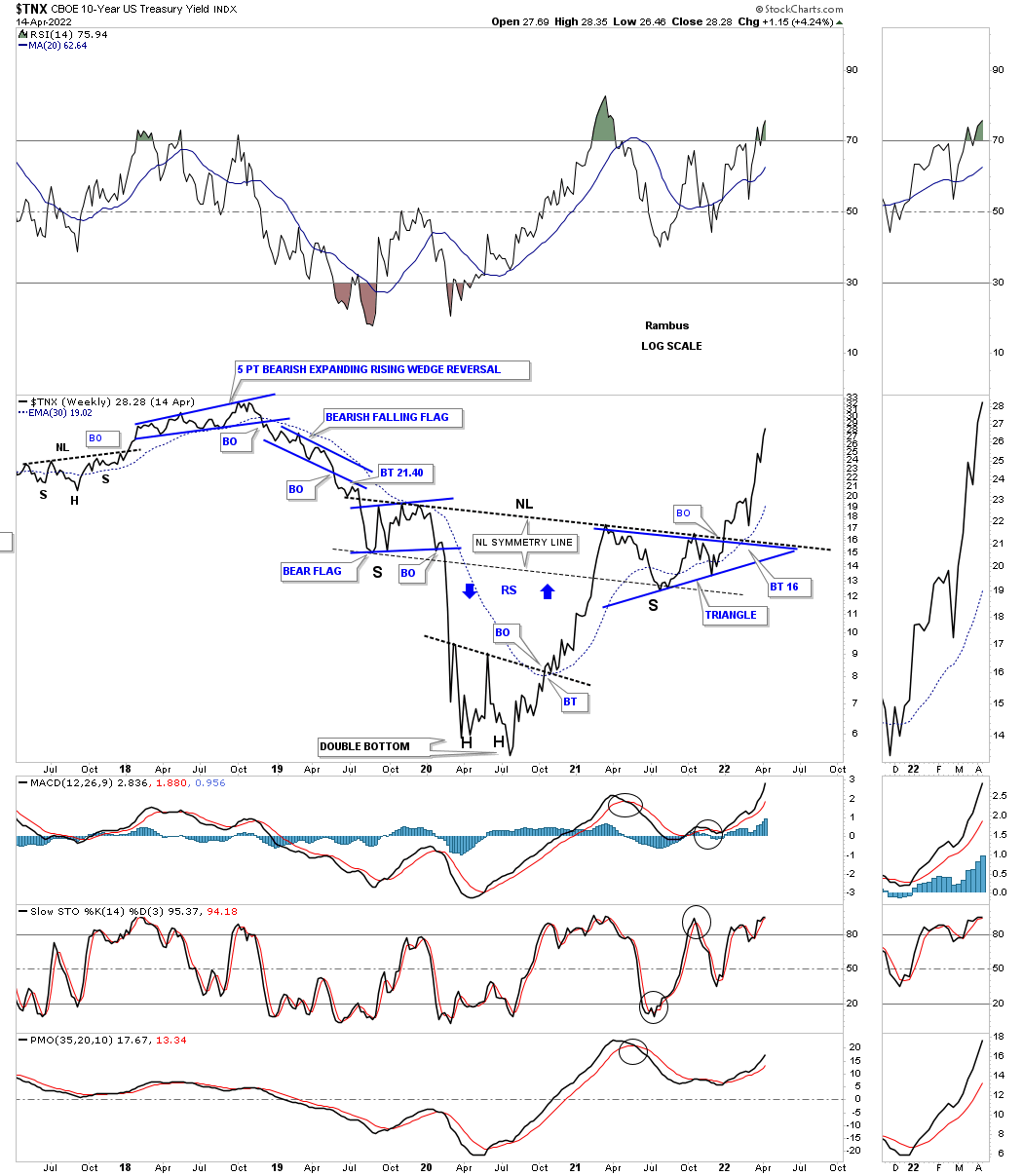

April 14th: TNX weekly line chart.

Below is the weekly line chart for the TNX I’ve shown you from time to time which shows a pretty symmetrical H&S bottom, see chart above, with the neckline symmetry line holding support for the right shoulder.

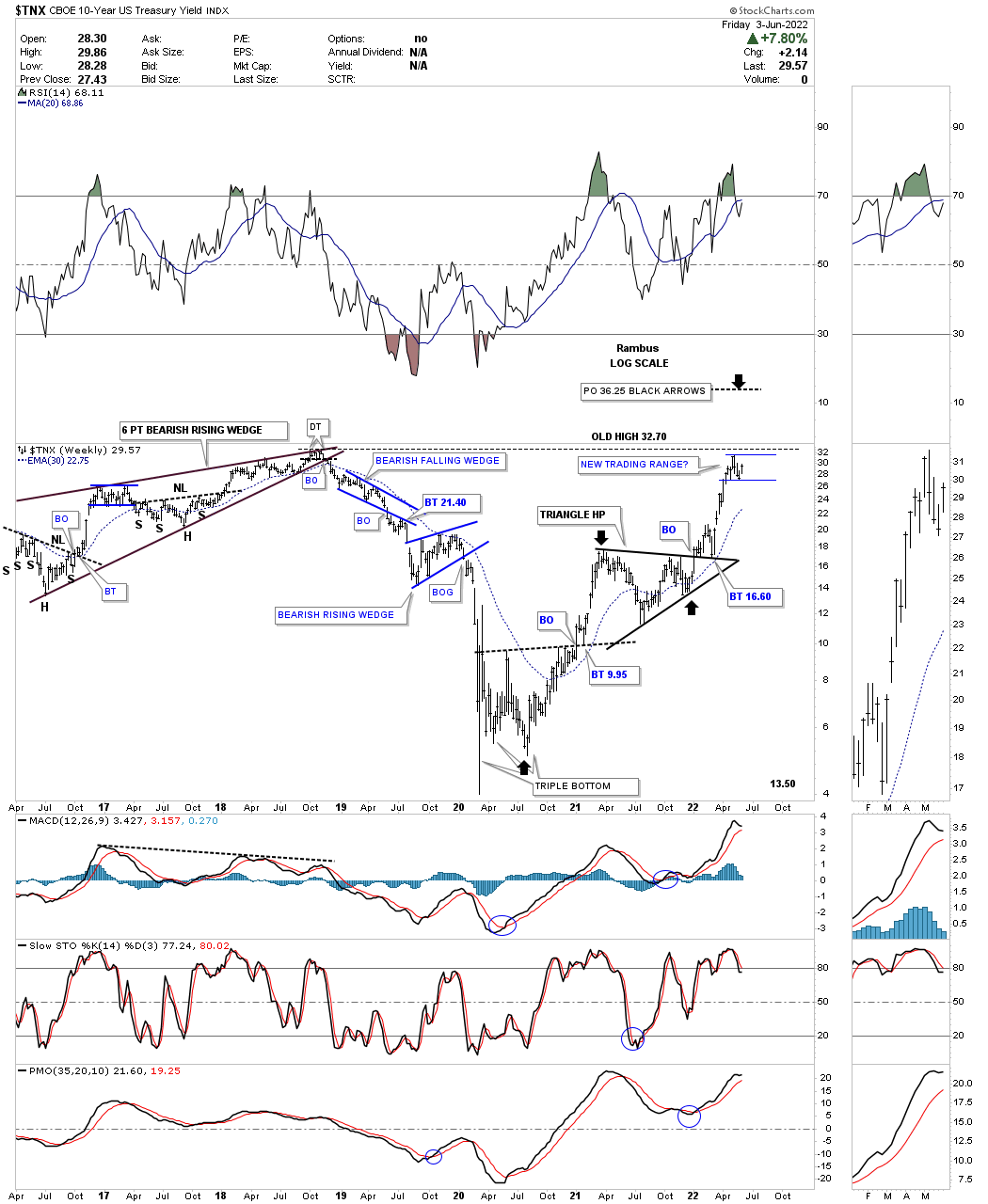

June 5th:

This shorter term weekly chart for the TNX shows the black triangle consolidation pattern with the black arrows showing its price objective. Currently the TNX is stalling out at the previous high made in 2018 which should be expected. The best case scenario would be to see a small consolation pattern form just below the old high building up the energy to takeout overhead resistance.

October 23rd:

The consolidation pattern that formed just below the TNX all time high ended up being the blue expanding triangle.

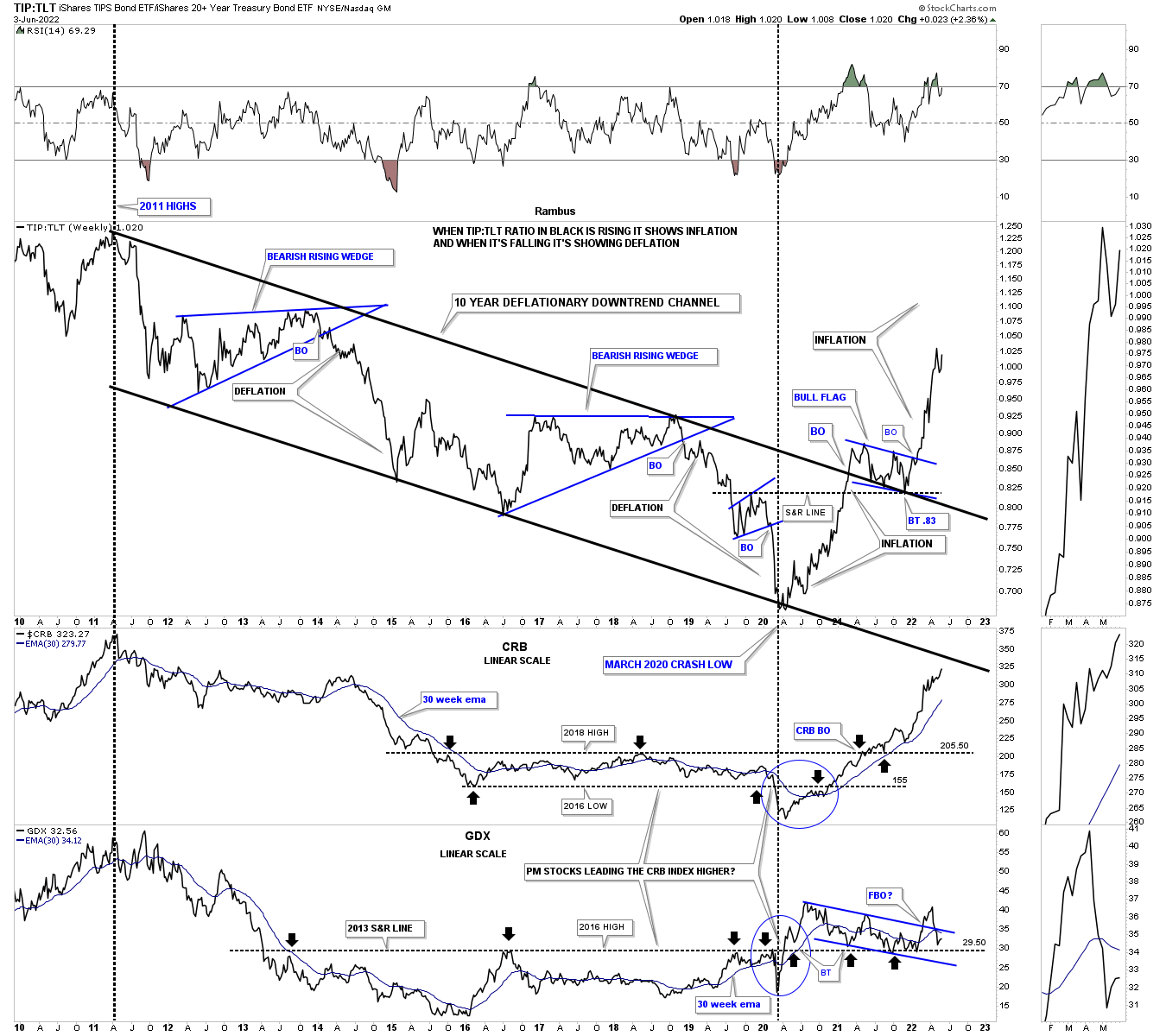

April 14th: TIP:TLT combo chart showing deflation or inflation.

Below is the exact same chart as the one above but I removed the TLT in red so you can see the TIP:TLT ratio much more clearly. The ratio has formed a perfect parallel downtrend channel starting at the 2011 high and ending at the March 2020 low. You can see the two big blue bearish rising wedge consolidation patterns that formed inside of the downtrend channel which showed bouts of deflation.

Note the classic breakout and backtest to the top rail of the 2011 downtrend channel where the ratio formed the small bull flag on top of the upper rail of the downtrend which again is classic Chartology. The last point I would like to make is that the ratio on top and the GDX on the bottom both bottomed in March of 2020 while the CRB index bottomed out one month later in April.

June 5th:

Next is the ratio combo chart that I use for showing possible inflation or deflation. The TIP:TLT ratio on top shows deflation when it is falling and inflation when it is rising. As with just about everything commodity related the bottom came in early 2020 at the pandemic crash low. Since that low you can see the first impulse move higher that broke the top rail of the 2011 parallel downtrend line and formed a small consolidation on top of the 2011 downtrend channel before moving higher in its 2nd impulse move up.

At the bottom you can see a chart for the CRB and the GDX. On a monthly closing basis you can see the CRB index is still running higher forming a possible rising wedge, if broken to the upside would be very bullish.

The big disappointment has been the GDX which had the breakout above the top rail of its 2020 trading range, but failed to hold support on the backtest. As you can see critical support still comes in around the 29.50 area as shown by the 2013 S&R line.

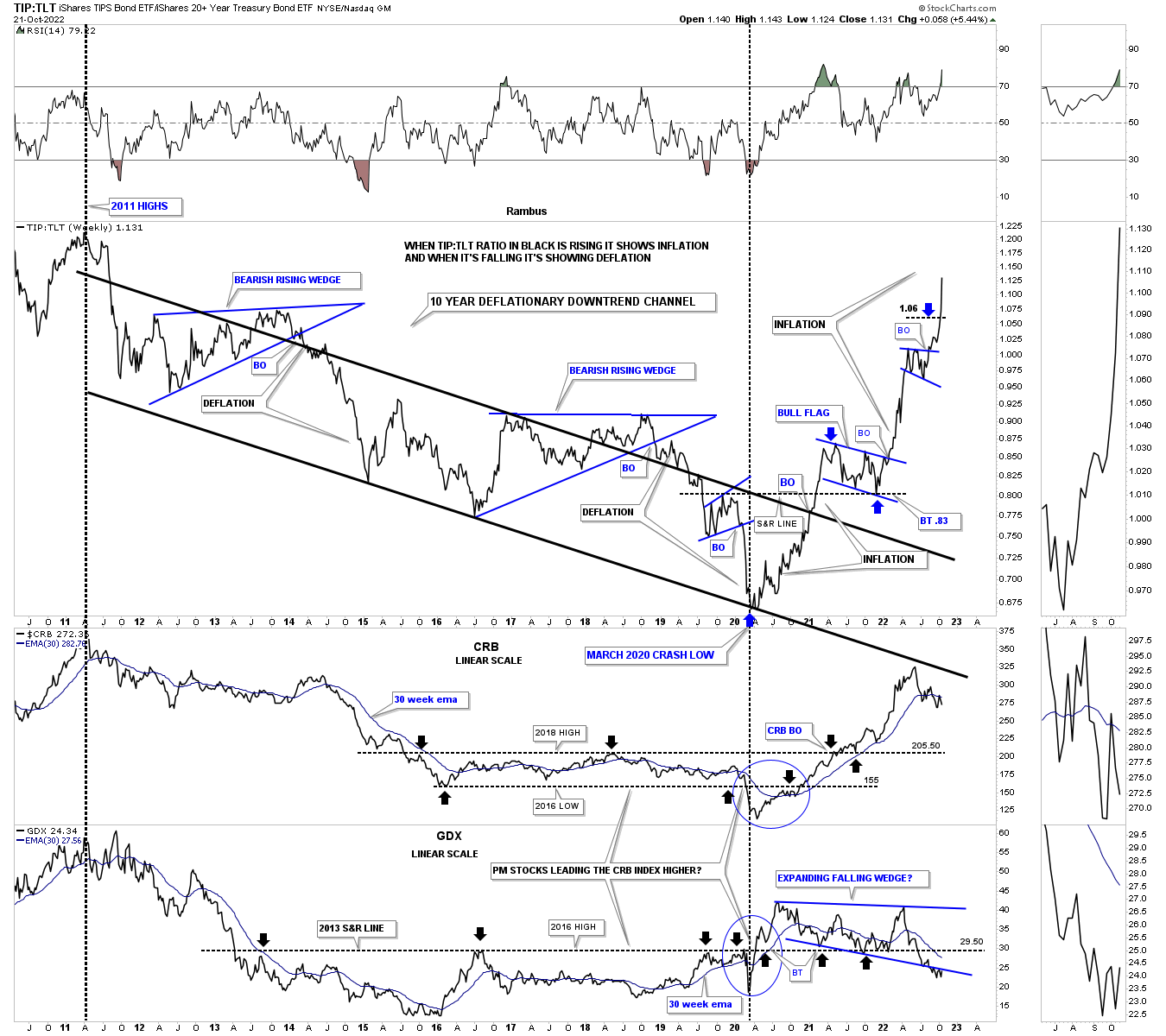

October 23rd:

The TIP:TLT ratio is still rising showing inflation, but the CRB index and the GDX have stalled out with the GDX at its lowest point since the 2020 crash low. Note where the GDX was trading on the April 14th chart above.

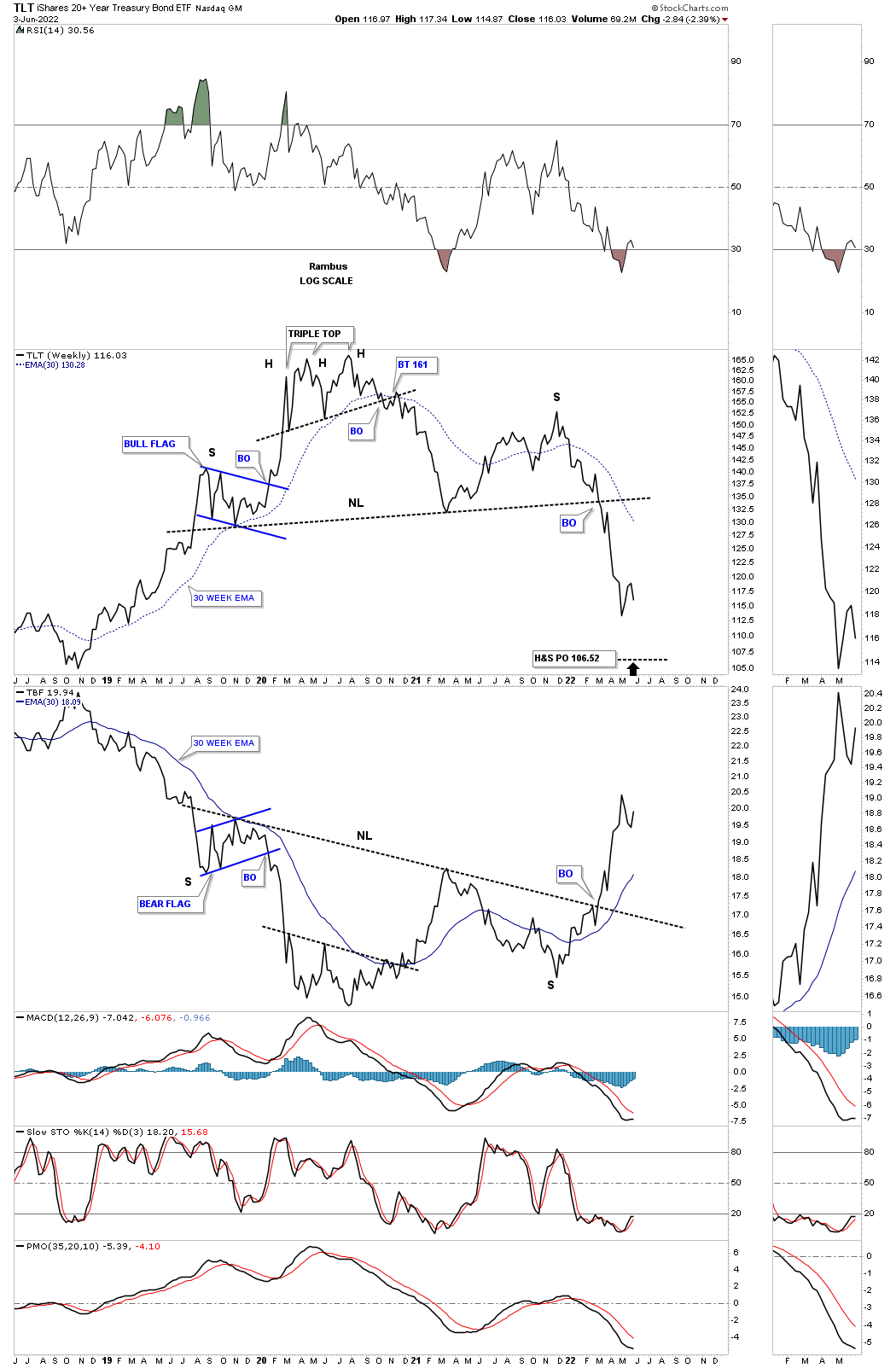

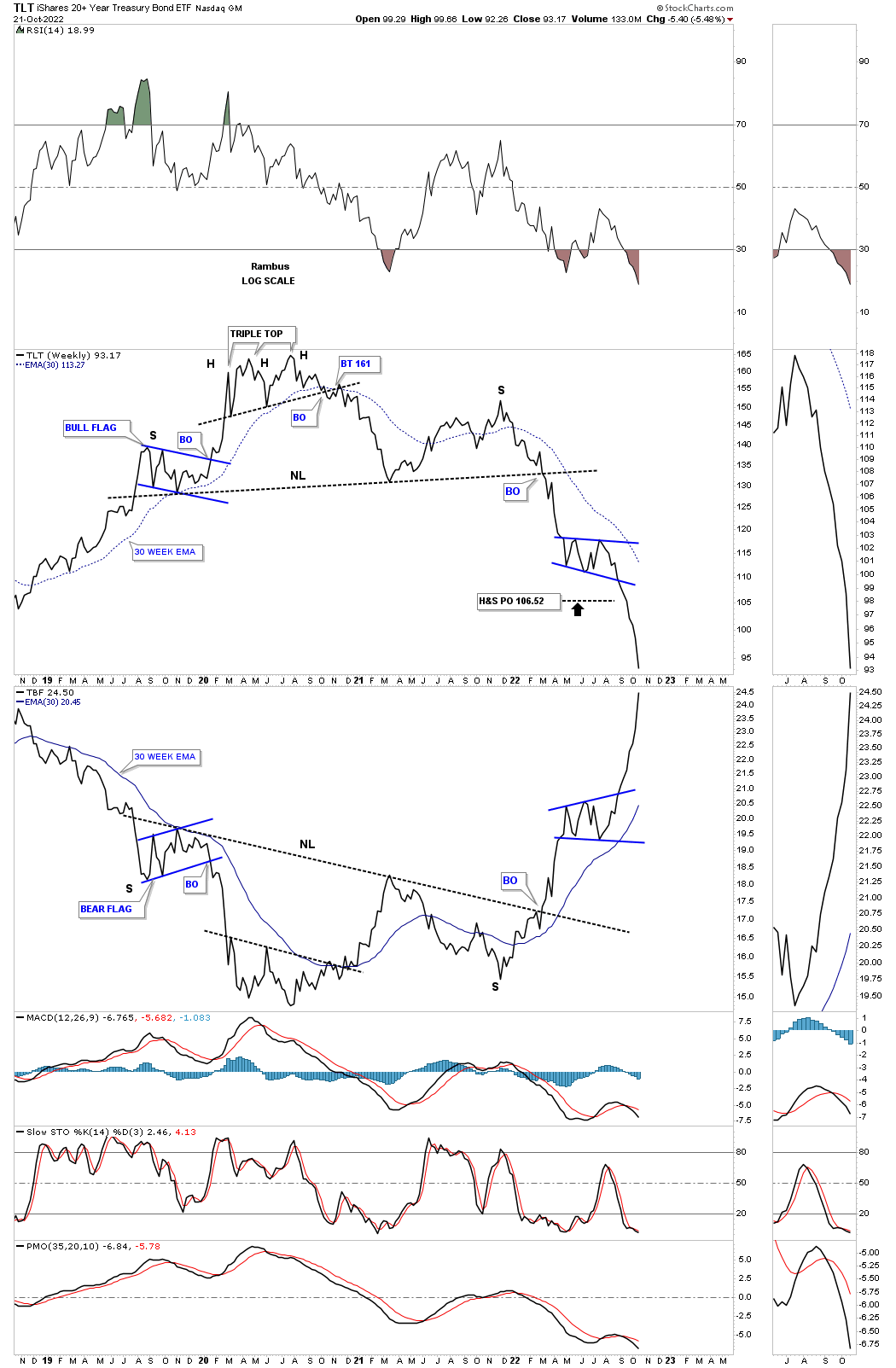

June 4th: TLT weekly H&S top.

TLT completed a large H&S top with the breakout below the neckline earlier this year. The minimum price objective would be down to the 106 area.

October 23rd:

TLT formed the blue bearish expanding falling wedge consolidation pattern.

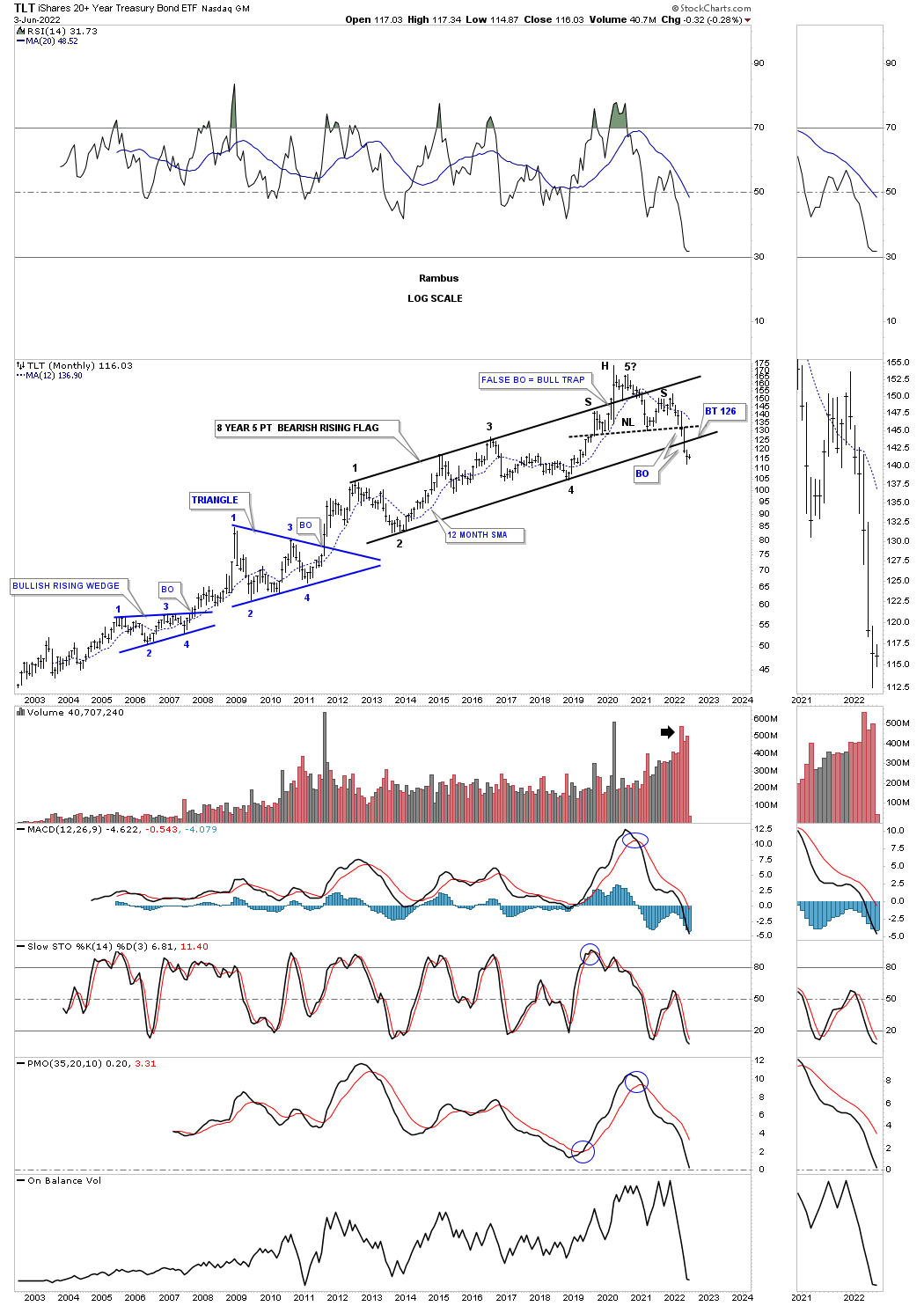

June 4th: TLT monthly:

You can see how the H&S top fits into the big picture with the bottom rail of the uptrend channel giving way a couple of months ago. Again, a backtest should be expected.

October 23rd:

The impulse move continues lower.

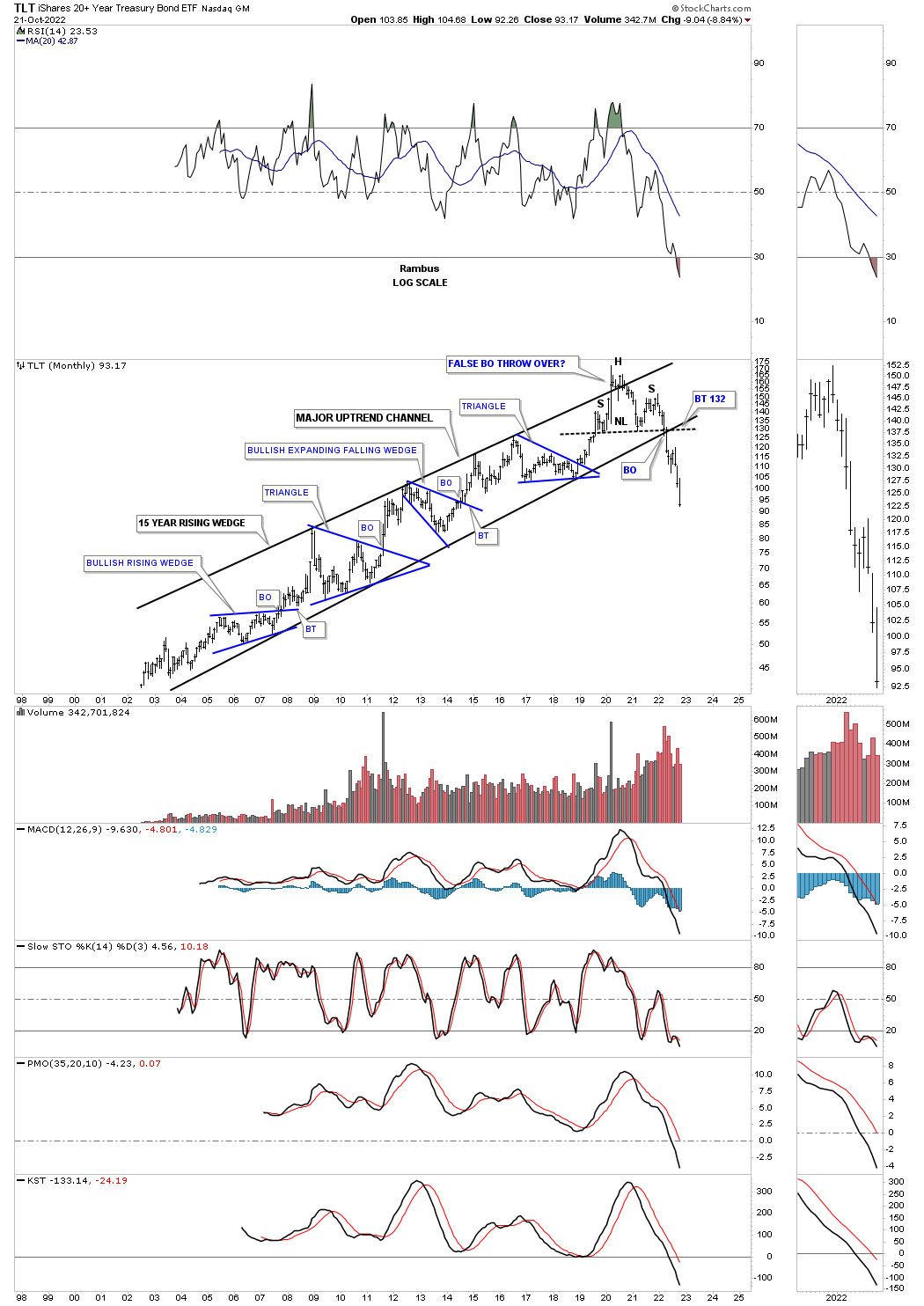

October 23rd history chart for TLT:

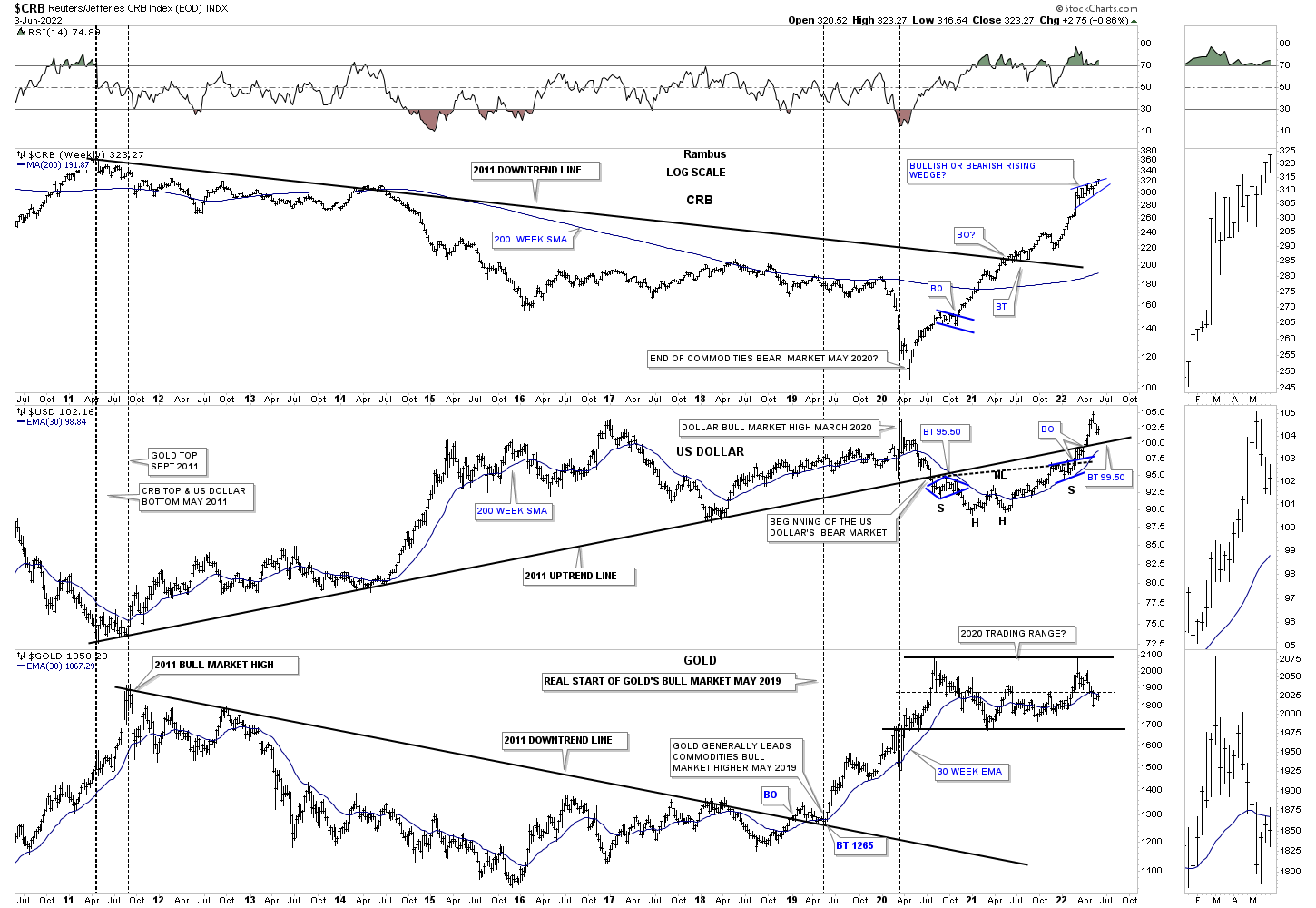

June 4th triple combo chart:

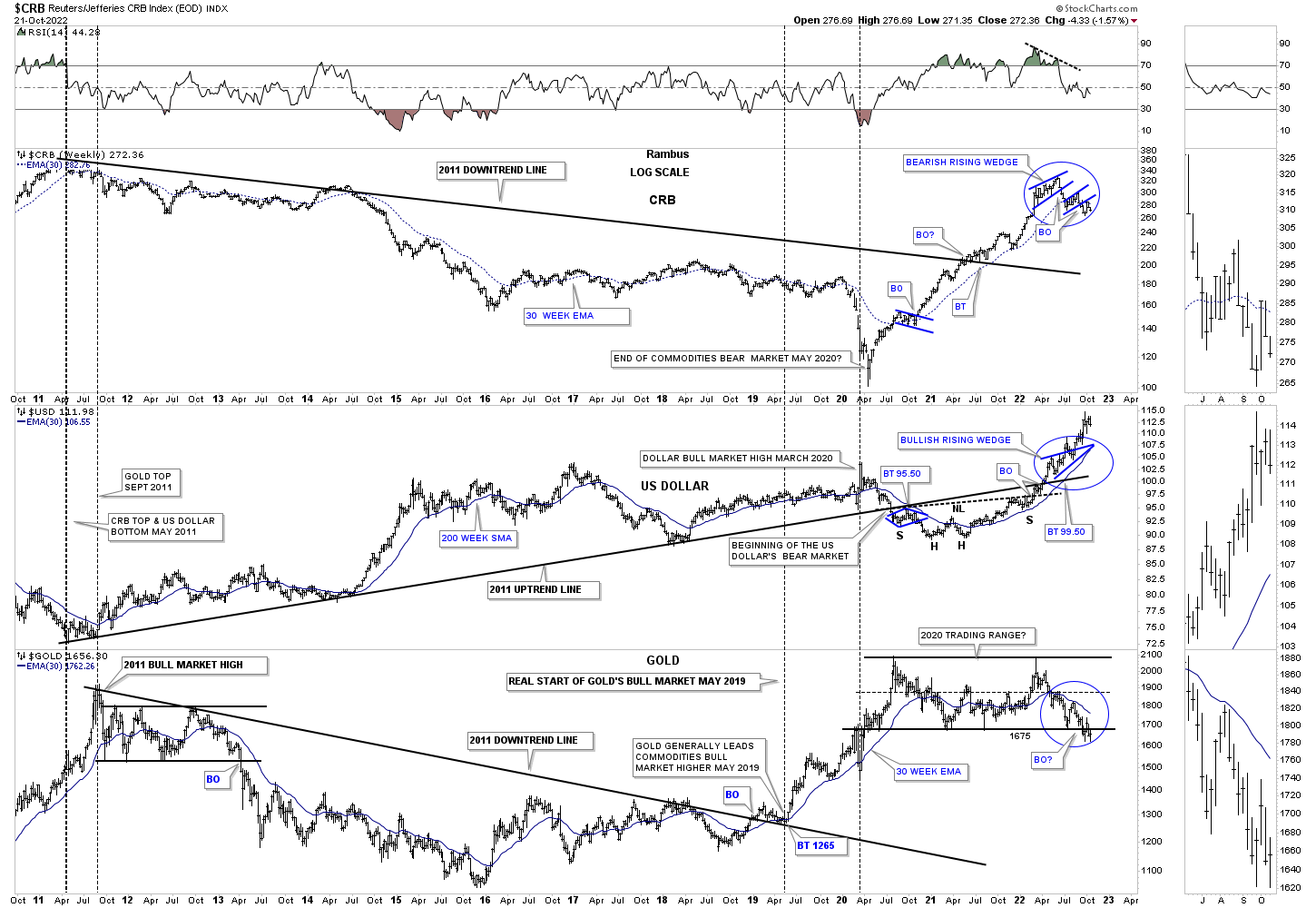

This last chart for tonight is a triple combo chart which has the CRB index on top with the US dollar in the middle and Gold on the bottom along with their 2011 trendlines. You can see the rising wedge on the CRB, which is still under construction, which could breakout either way.

The US dollar in the middle shows the bottom rail of its 2011 uptrend line which experienced a breakout to the downside in the middle of 2020 only to form a H&S bottom which took the US dollar back above the 2011 trendline. It is now attempting to backtest the bottom rail from above that would take place around the 99.50 area. And then we have Gold on the bottom which is trading dead center in the middle of its 2020 trading range.

What I find interesting about his combo chart is how the CRB index hasn’t paid any attention to the US dollar while Gold has just traded sideways. Stranger things have happened in the markets before, but the CRB index rising with the US dollar, for this length of time, is pretty unusual.

October 23rd:

The current triple combo chart with Gold testing the bottom of its 2020 trading range.

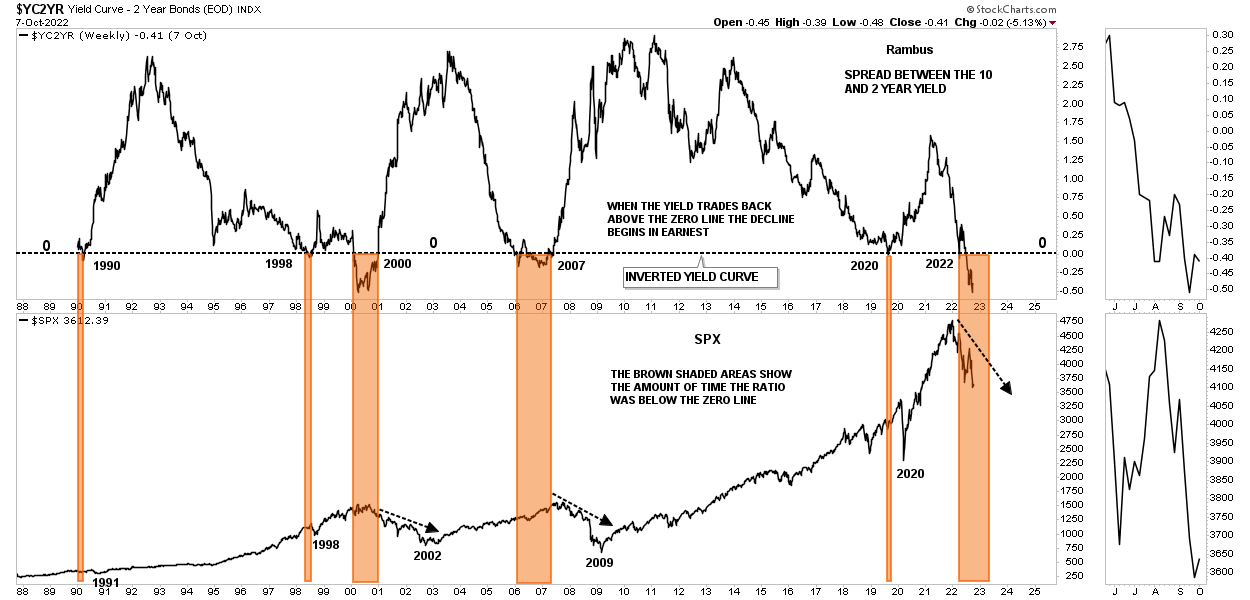

October 7th: Yield curve.

This last chart for tonight is a long term weekly chart which shows the yield between the 10 and 2 year bonds or the yield curve. Whenever the yield falls below the zero line there is an inverted yield curve which generally shows a weak market or a recession as shown by the brown shaded areas.

As you can see the yield curve is trading at the lowest point since the bull market ended at the 2000 high. What is interesting when you take a closer look is that the decline in the SPX really doesn’t pick up steam to the downside until the yield trades back above the zero line. I used the brown shaded area from the 2007 inversion and added it to the 2022 inversion until we see the yield trade back above the zero line.

I believe what all the charts above are showing us is that the US stock markets and the rest of the world are headed for a recession. How long and how deep remains to be seen yet, but something is brewing that I haven’t seen since the H&S top made in 2007.

Now you can see why I’ve changed my stance from a bull to now a bear. It is all about the charts and not what I think or what other analysts think, but the price action itself. As I mentioned earlier there are no 100% guarantees when it comes to the markets, it is all about getting the odds in your favor and taking it from there.

Keep in mind that most of the charts above are very long term and change slowly over time, but change comes as you can see from April of this year to October. No stock or market just goes straight up without consolidating their gains from time to time which is needed to keep the big trend healthy. When this current impulse move in interest rates comes to an end I will be looking for some type of consolidation pattern to form in the new uptrend the has been in place since the spring of 2020. Now the mindset should be buy weakness. All the best…Rambus

October 23rd:

The ratio is starting to hook up showing a potential double bottom. A move above the zero line should be bearish for the US stock markets, black arrows.

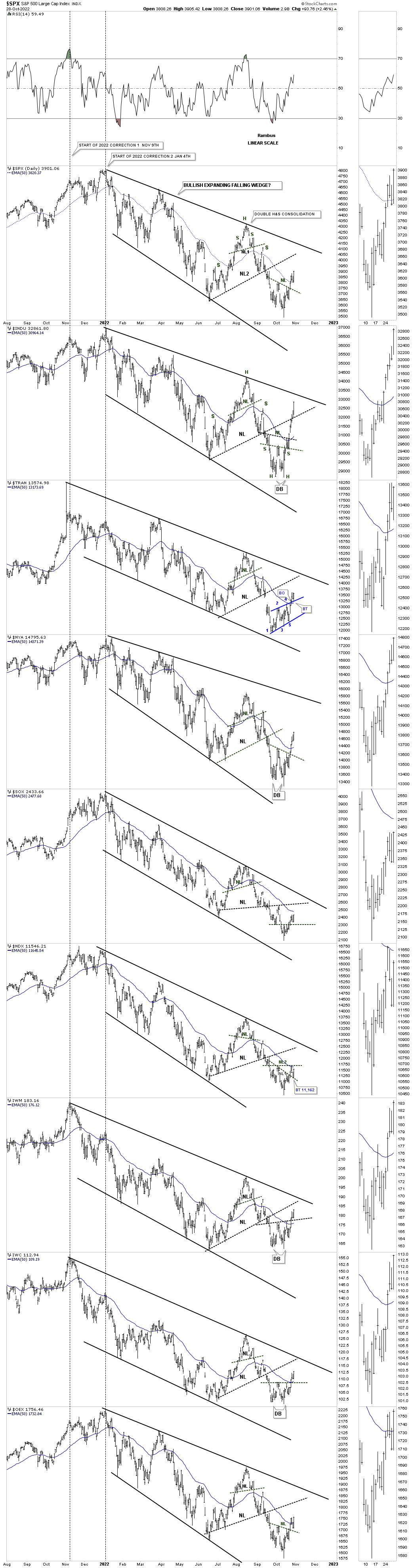

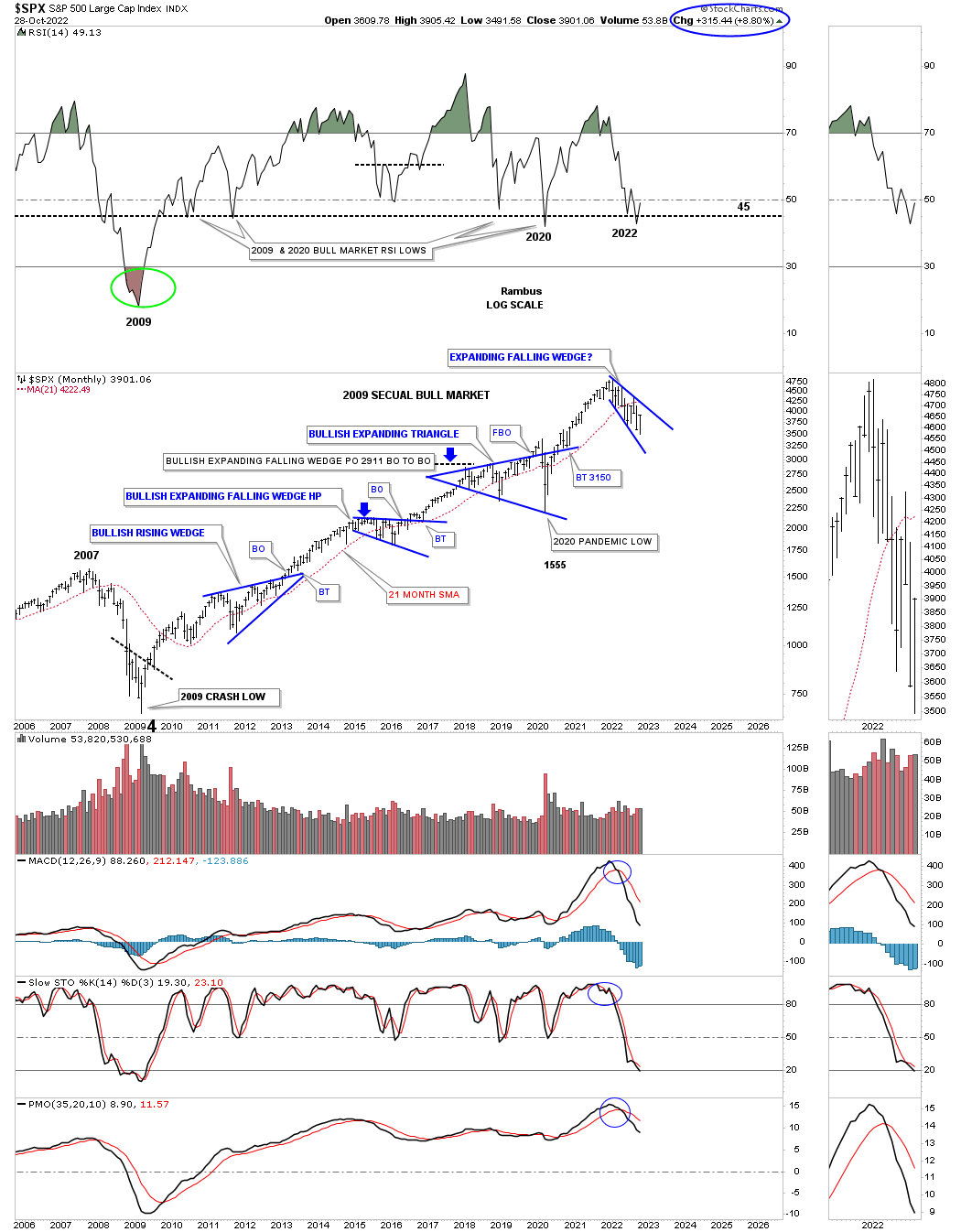

SPX Bull Market Update

I realize that most of you have just fallen off the edge of your chair after reading the title of this Weekend Report, SPX Bull Market, what bull market you may be thinking? The SPX has just completed the biggest percentage decline since the secular bull market began in March of 2009 which I know is unnerving.

During the bull market years in the PM complex I often remarked on how beautiful the bull market looked from a Chartology perspective. In a strong bull market you want to see one consolidation pattern forming on top of the previous one with a strong impulse move between each consolidation pattern. This long term monthly chart for Gold shows the eleven year bull market which formed four separate consolidation patterns.

The first one was a bullish rising wedge followed by the blue triangle. The biggest correction during the bull market was the 2008 crash low which produced the very symmetrical H&S consolidation pattern followed by another bullish rising wedge which took Gold up to its bull market high in 2011. That is what a bull market looks like.

After putting in the H&S consolidation pattern after the 2011 high you can see the 2020 trading range with the current price action sitting right on the bottom rail of the secular bull market uptrend if it can hold. And if it can hold the 2020 trading range will be the first consolidation pattern in the second leg up in Gold’s secular bull market which still remains to be seen yet, but the Chartology is there.

The psychology in the US stock markets right now is what it is supposed to feel like when an important low is being put in. You won’t know until you can look back in hindsight if what you were seeing at the time of the low was real or a figment of your imagination. Really important lows that lead to the next impulse move in a bull market are always the toughest to identify in real time, but if you can spot one the gains can be pretty amazing.

This first chart is a daily combo chart for the US stock markets which shows the 2022 expanding falling wedge we’ve been following mostly on the longer term weekly combo chart. As you can see most of the indexes have a small reversal pattern at the most recent low being either an inverse H&S or double bottom.

The Transportation Average is the exception which formed the blue 5 point bullish rising wedge reversal pattern. To be sure these small bottoming formations don’t look like much in this short term window, but they could be part of a bigger double bottom reversal pattern if we see these indexes trade above their August high. When you are at a bottom nothing looks positive.

This weekly combo chart below is the one we’ve been following during the Markets Update through the week. Again, nothing looks very positive at this point, but we do have the first index to close above its 30 week ema the INDU. You can also see a potential double bottom forming which the SPX still has a lot of work to do to trade above the August high. There is also the possibility, with the positive divergence on the RSI, the fib 50% retrace and the 200 week sma that is still holding support, that we could be seeing the potential bottom.

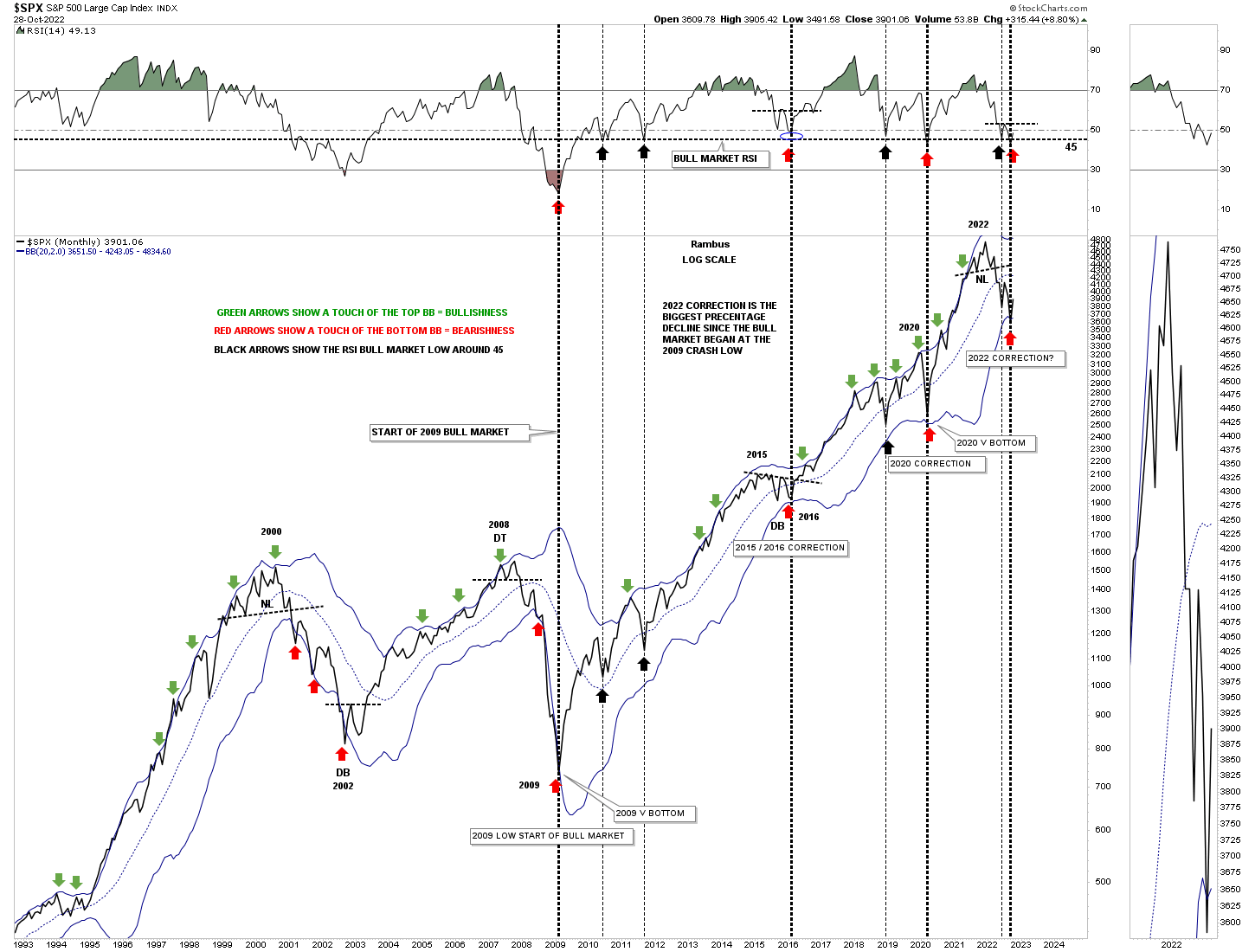

Earlier we looked at Gold’s bull market that showed four separate blue consolidation patterns with a strong impulse between each pattern. Below is the secular bull market for the SPX which shows three separate consolidation patterns with the possible fourth one still under construction. Since the bull market that began at the 2009 crash low every important low has come in at around 45 on the RSI.

One thing I find pretty amazing is that during Gold’s secular bull market all was right with the world according to the PM investors, but if the SPX builds out a similar bull market, no one wants to believe it which comes down to ones ability to have an open mind. Having an open mind doesn’t have to be about mental gymnastics, but clearing the clutter that builds up over time.

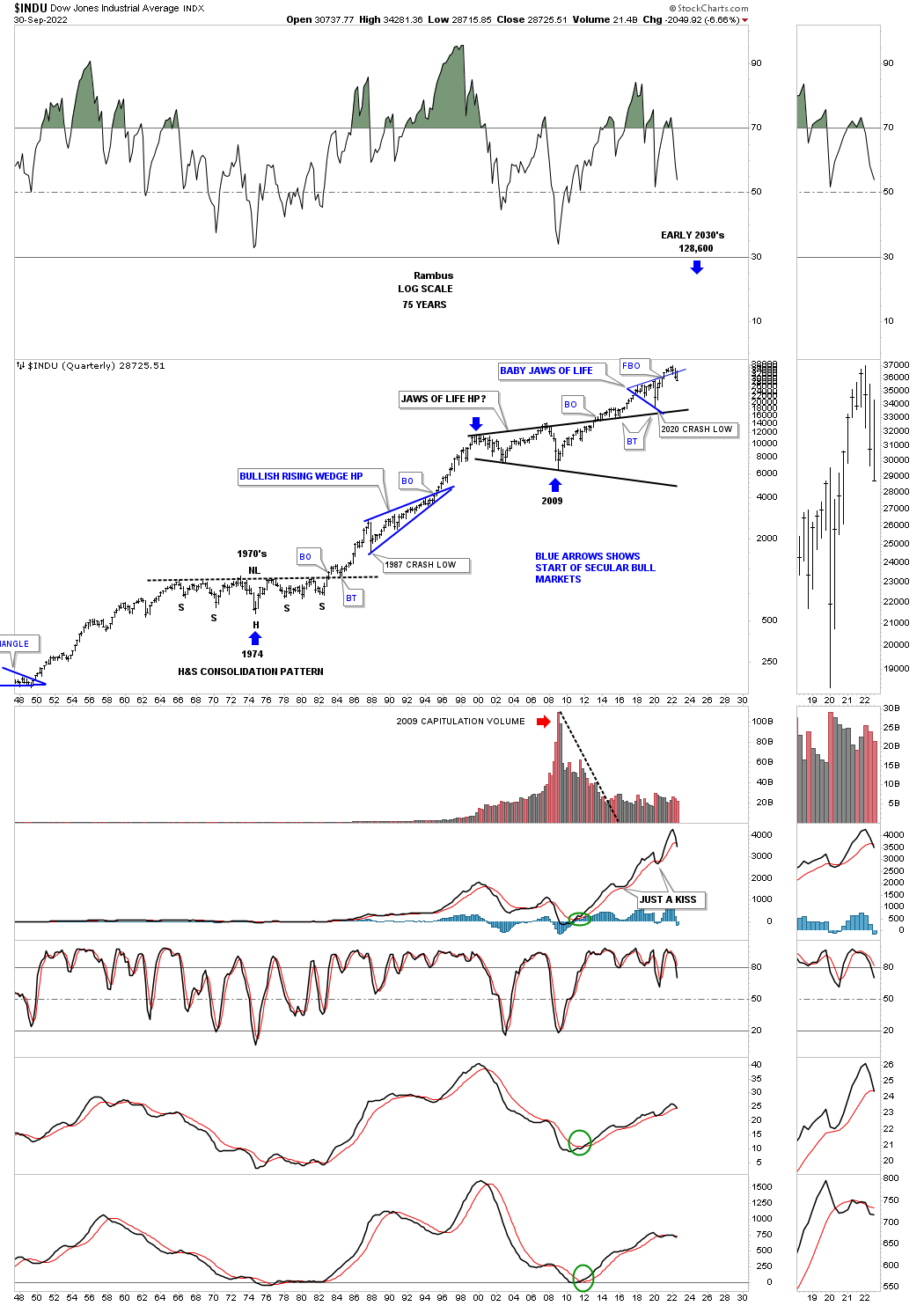

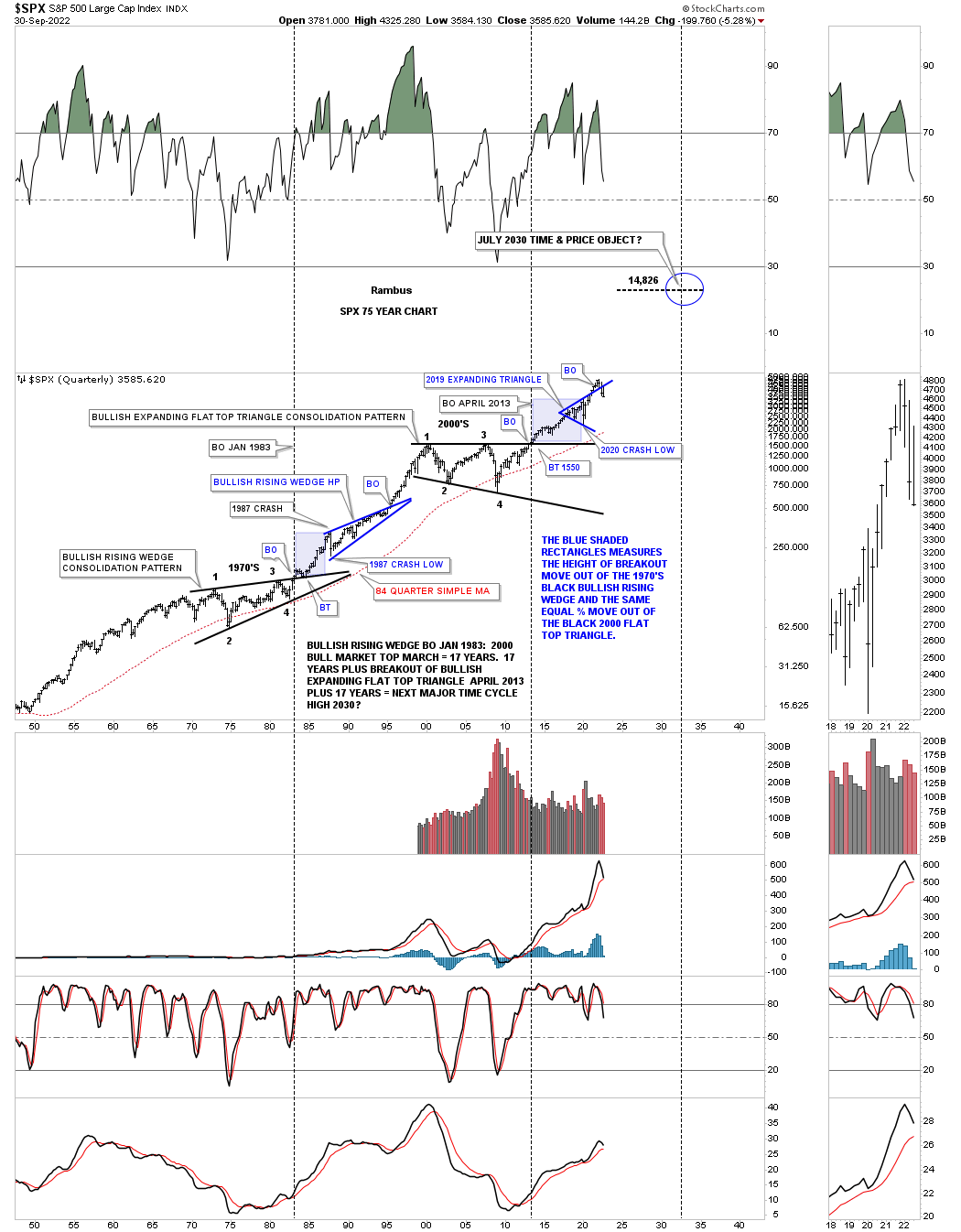

This next chart is a long term quarterly chart for the SPX which shows the secular bull market that took place at the 4th reversal point in the 1982 bullish rising wedge which ran hard into the 2000 all time high at reveal point #1 in the 13 year flat top expanding triangle. That 13 year flat top expanding triangle consolidation pattern was needed to correct the pervious secular bull market. Our current secular bull market began at the 4th reversal point at the 2009 crash low at reversal point # four.

This long term 75 year quarterly chart also shows the similarities between the 1987 crash low to the recent 2020 crash low as shown by the light blue shaded areas. Compare the 1987 crash low to the 2020 crash low which gives you an idea of where our current secular bull market is compared to the 1987 crash low and the rally that followed. The SPX rallied for another 13 years before finally topping out in 2000.

The SPX has only rallied about two years since the 2020 crash low to the 2022 high so if history is any guide, as it has been since the 2009 low, then this secular bull market still has a long ways to go yet before we see any type of significant top, correction yes, but no significant bear market.

Are we witnessing the backtest to the 2019 blue expanding triangle? Also, October is the first month in the 4th quarter. With one day to go before the end of the month the SPX is up almost 9%, believe it or not.

Its been awhile since we last looked at this long term monthly chart for the SPX which shows the Bollinger Bands in conjunction with the RSI. During a bull market it is not unusual to see the price action hit the top BB as shown by the green arrows, which shows bullishness. The opposite can be true when the bottom of the BB is hit which shows bearishness as shown by the red arrows.

Note the RSI at the top of the chart with the horizontal black dashed line which shows the 45 area, black arrows which is normally a good time to buy the SPX. During the bull market that started at the 2009 low the red arrows show when the SPX tested the bottom of the BB along with the RSI which has shown in the past has been a good place to go long. As you can see the SPX is now on a new buy signal as long as the price action stays above the lower BB.

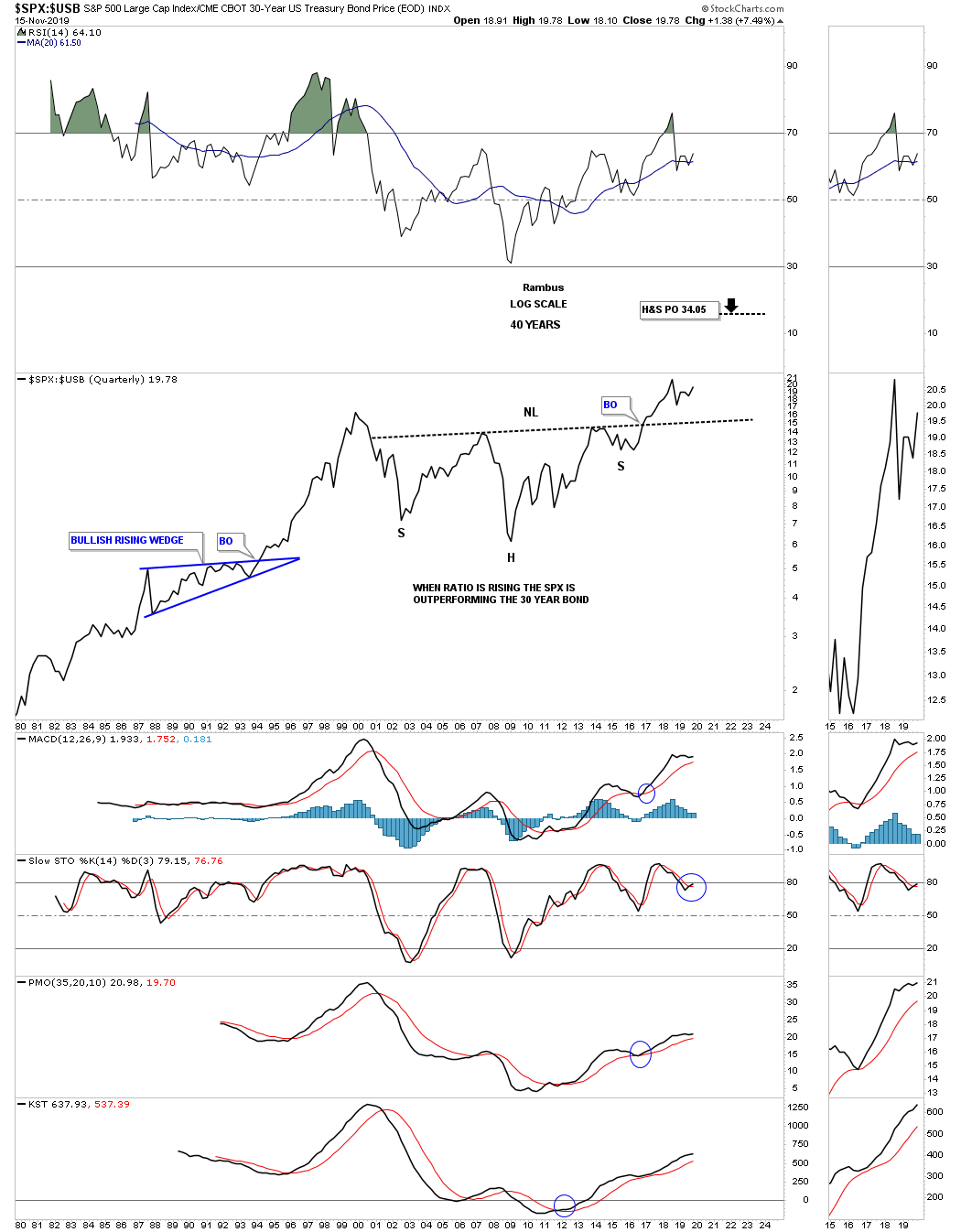

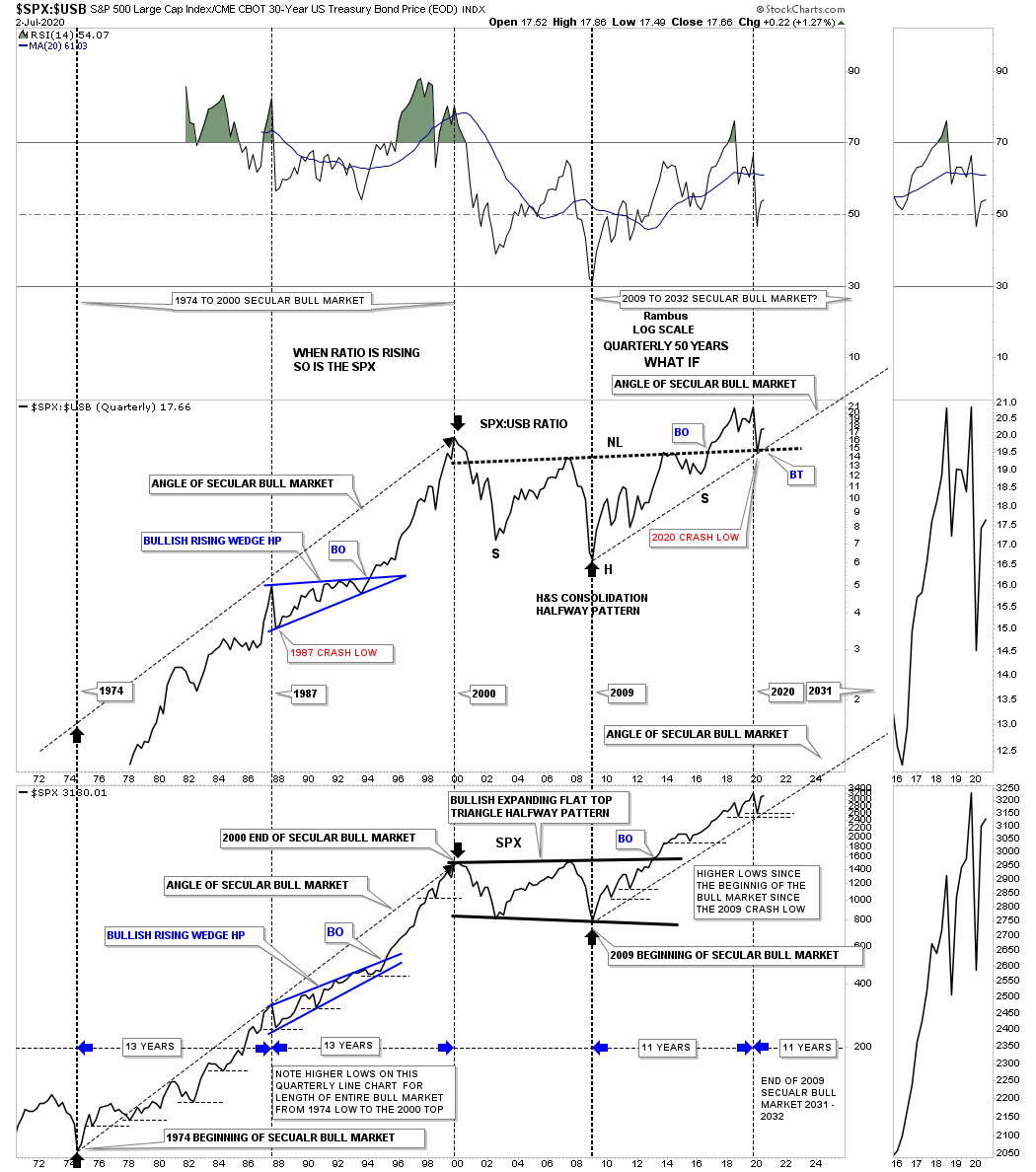

These last set of charts I’ve been showing for many years which is a ratio combo chart that compares the SPX:USB ratio on top to the SPX on the bottom except this first chart. The first chart just shows the ratio and what I wrote back in November of 2019.

November 15th 2019:

This last chart for tonight is a very long term 40 year ratio chart that compares the SPX:USB. When the SPX is outperforming the 30 year bond the price action is rising. Between 2000 and 2016 this ratio built out a massive H&S consolidation pattern which is strongly suggesting the SPX is going to rally more strongly than the 30 year bond until the price objective is reached far into the future around the 34.05 area.

There was a time in the past when it was considered unpatriotic to short the stock markets which sounds ridiculous today. I think there are some PM stock investors that think it is against their moral principal to buy the stock markets because in order for the PM complex to go up the stock markets need to crash and burn. Whatever your thoughts are on this keep an open mind and don’t be afraid to let new thoughts and ideas enter into your consciousness, you may be pleasantly surprised by the freedom it offers.

This is what I wrote on July 2nd 2020.

July 2nd 2020:

Before we move on to the shorter term charts there is one more 50 year quarterly ratio combo chart I would like to show you in regards to the secular bull market. The ratio chart on top compares the SPX to the USB, 30 year bond, with the chart on the bottom being the SPX. There is really a lot of information on this combo chart, but the main takeaway is that when the ratio chart on top is moving higher so is the SPX, they really have a pretty good correlation. On the left side of the chart you can see the secular bull market that ran from 1974 to the 2000 high in both the ratio and the SPX which began a multi year consolidation phase. Now look at the beginning of our secular bull market that began in 2009 and you can see the exact same thing happening again. Even the 2020 crash low has held support above the previous quarterly low.

The SPX formed the 2000 flat top expanding triangle as its halfway consolation pattern, but the ratio chart on top formed a large H&S consolidation pattern that I’m viewing as a halfway pattern. Note where the 2020 crash low found support, right where it needed to on the backtest to the neckline. There is other information on this chart that I don’t have the time to go into right now but there is one last thing I would like to point out to you. Starting at the very beginning of the last secular bull market that started in 1974 note how the price action never traded lower than the previous quarterly low for the entire secular bull market, as shown by the thin black dashed horizontal lines on the SPX. The same thing is true for our current secular bull market.

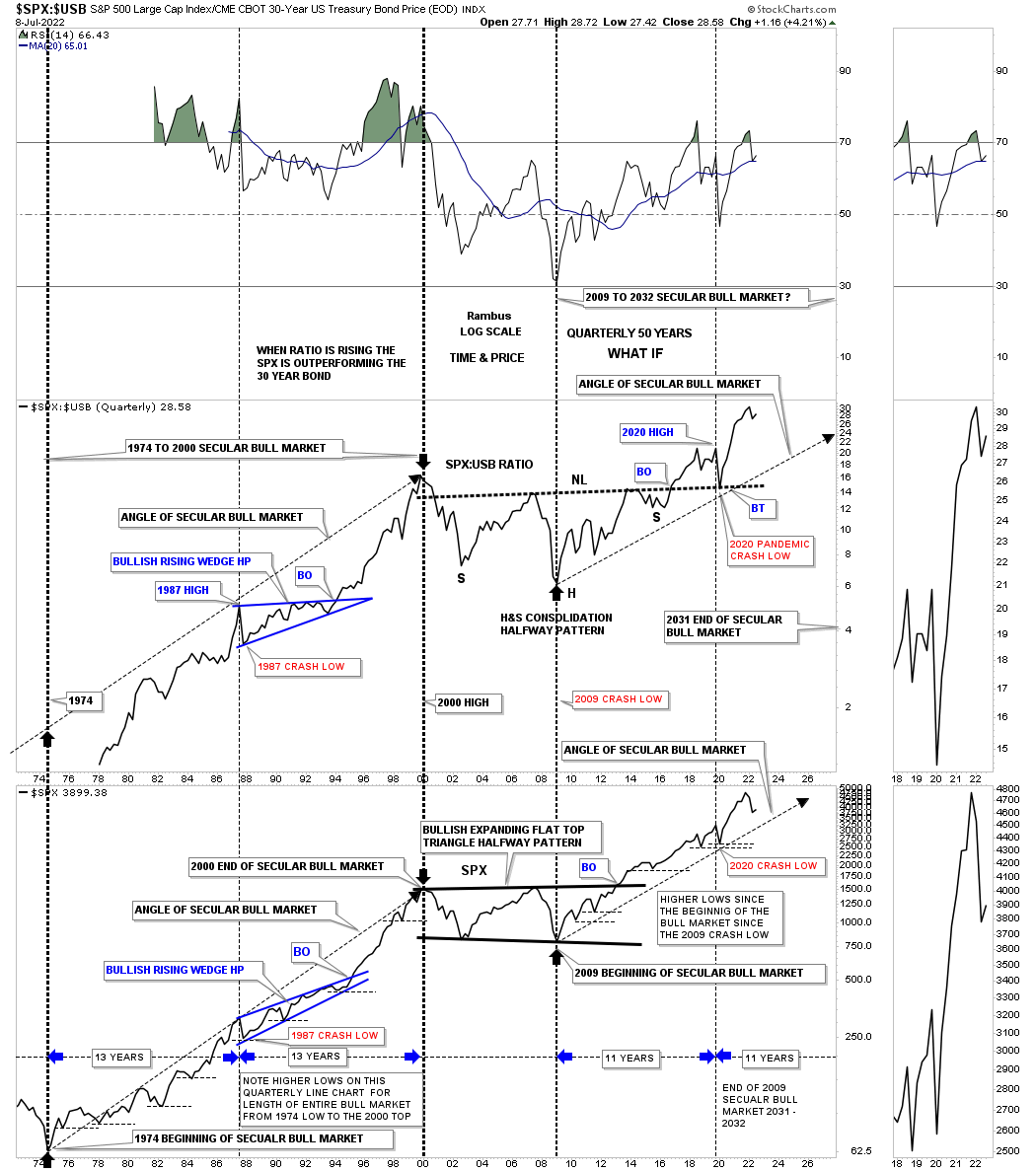

This is what I wrote one year later.

July 30th 2021:

SPX:USB / SPX ratio combo chart 1974 to 2000 secular bull market compared to the 2009 secular bull market to date showing time and price. The ratio and the SPX generally move together with important reversal points shown by the black arrows. Note how the 2020 crash low found support on the neckline on the ratio chart on top. Both are trading at new all time highs. It is what it is until it isn’t. There is also the time components which puts the secular bull market top somewhere in the 2032 area.

This is what I wrote one year later in July of 2022.

July 8th 2022:

This next chart is a long term quarterly ratio combo ratio chart which compares the $SPX:$USB ratio on top to the SPX on the bottom. As you can see the ratio chart on top is confirming the secular bull markets, the 1974 to 2000 secular bull market and our current secular bull market that began at the 2009 crash low. Note the massive H&S consolidation pattern that formed on the ratio chart which you can compare to the 2013 flat top expanding triangle on the SPX. Since the 2020 crash low both have been making new all time highs which is what you would expect if the secular bull market is alive and well. There is a lot of other important information on this ratio combo chart if you take a few minutes to study the information in more detail.

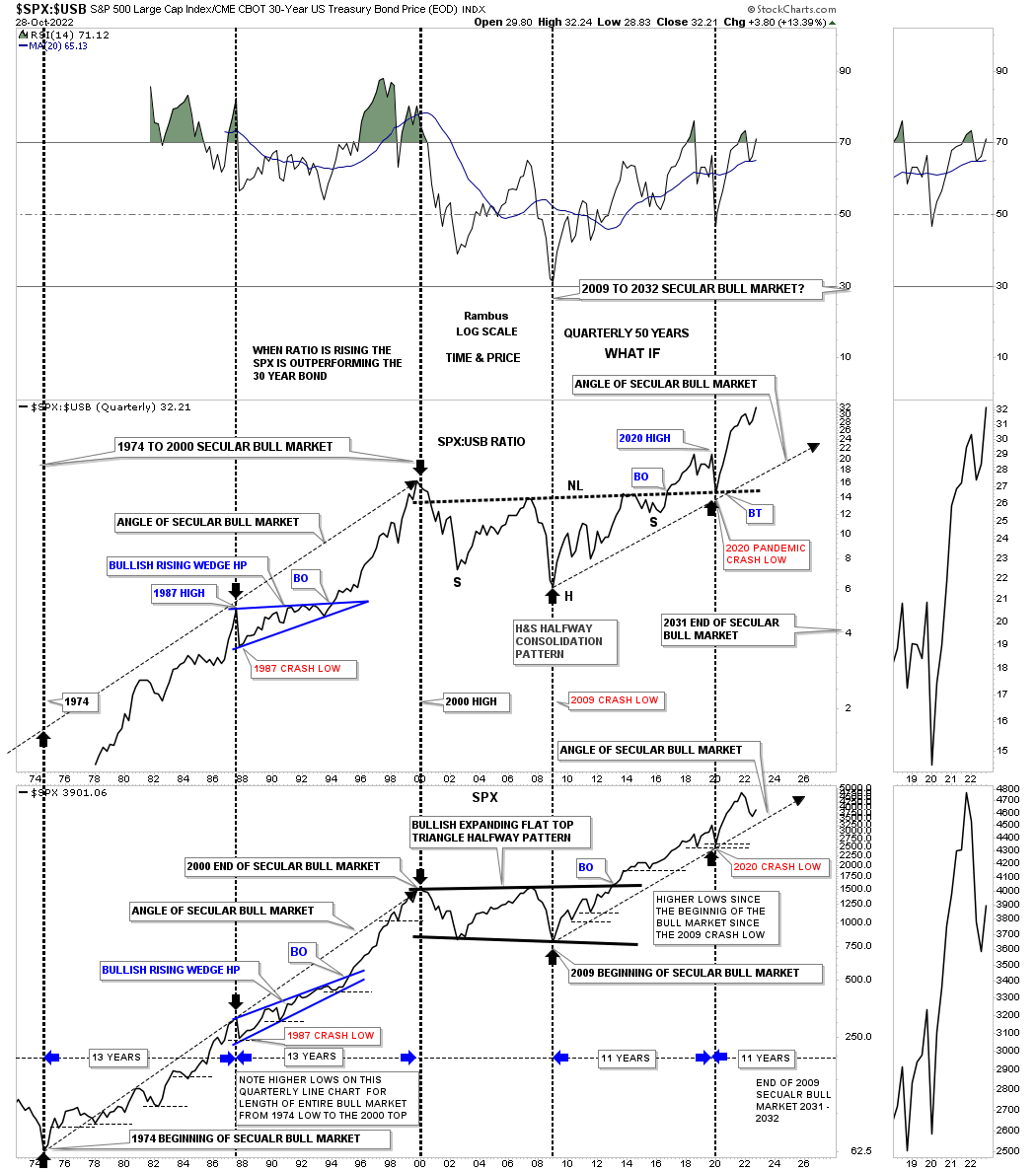

Today October 30th 2022:

To really get what this ratio combo chart is strongly suggesting it is important to follow the price action from the first ratio chart to each time frame to the present. With one more day of trading for the month of October note how the ratio on top is making a new all time high while the SPX is now starting to hook up.

This ratio combo chart has been working beautifully for years now showing support where it needed to form. Even with the rise in interest rates the SPX is still outperforming the USB, 30 year bond, by making a new all time high which is pretty amazing when you think about it.

Is the secular bull market in the US stock markets still alive and well? The only way we’ll know with 100% certainty is when we can look back in hindsight. From a fundamental point of view things couldn’t look more dire, but from a Chartology perspective the secular bull market is still alive even though it may not feel like it right now. All the best…Rambus

Related Reading:

- Rambus: Blockbuster Chartology – July, 2022

- Rambus: Blockbuster Chartology – May, 2022

- Rambus: Blockbuster Chartology – February, 2022

- Rambus: Blockbuster Chartology – October, 2021

- Rambus: Blockbuster Chartology – July, 2021

- Rambus: Blockbuster Chartology – April, 2021

- Rambus: Blockbuster Chartology – January, 2021

- Rambus: Blockbuster Chartology – October, 2020

- Rambus: Blockbuster Chartology – July, 2020

- Rambus: Blockbuster Chartology – May, 2020

- Rambus: Blockbuster Chartology – January, 2020

- Rambus: Blockbuster Chartology – October, 2019

- Rambus: Blockbuster Chartology – July, 2019

- Rambus: Blockbuster Chartology – April, 2019

- Rambus: Blockbuster Chartology – January, 2019

- Rambus: Blockbuster Chartology – October, 2018

- Rambus: Blockbuster Chartology – July, 2018

- Rambus: Blockbuster Chartology – April, 2018

- 2017 Annual Wrap Up – Does Your Pension Fund Have A Deep State Drain? – January, 2018

- 1st Quarter Wrap Up 2018 Web Presentation

- Blockbuster Chartology with Rambus – October, 2017

- Blockbuster Chartology with Rambus – July, 2017

- Blockbuster Chartology with Rambus – May, 2017

- Blockbuster Chartology with Rambus – January, 2017

- Blockbuster Chartology with Rambus – October 20, 2016

- Blockbuster Chartology with Rambus – July 21, 2016

- Blockbuster Chartology with Rambus – April 21, 2016

- Rambus: Are We in a Deflationary Spiral? – January 28, 2016

- The Dollar, Gold & the S&P 500 with Rambus – October 15, 2015